EUR/USD: general review

04 April 2018, 14:20

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 1.2330 |

| Take Profit | 1.2451 |

| Stop Loss | 1.2300 |

| Key Levels | 1.2150, 1.2207, 1.2268, 1.2329, 1.2390, 1.2451 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY LIMIT |

| Entry Point | 1.2207 |

| Take Profit | 1.2330, 1.2390 |

| Stop Loss | 1.2170 |

| Key Levels | 1.2150, 1.2207, 1.2268, 1.2329, 1.2390, 1.2451 |

Current trend

Today, the pair is influenced by the publication of preliminary data on inflation in the Eurozone in March and the aggravation of the US-China trade war.

The consumer price index in the EU increased from 1.1% to 1.4% (for the first time since November). The basic consumer price index remained at the same level of 1.0% (since January).

The aggravation of US-China trade disputes worries investors. It became known that China's retaliatory measures will not be limited to 128 US goods worth USD 3 billion. The same duties will be imposed on another 106 types of products from the US, including cars, airplanes, beef, wheat, corn, soybeans, products of the chemical and tobacco industries. The total value of goods under tariffs can reach USD 50 billion. Thus, parity will be achieved with the total amount of Chinese goods levied with duties in the US.

Investors did not expect such harsh actions, because it will affect products that are very important for China, namely, soybeans. China is the largest importer of soy from the US: last year, the amount of import was about USD 14 billion.

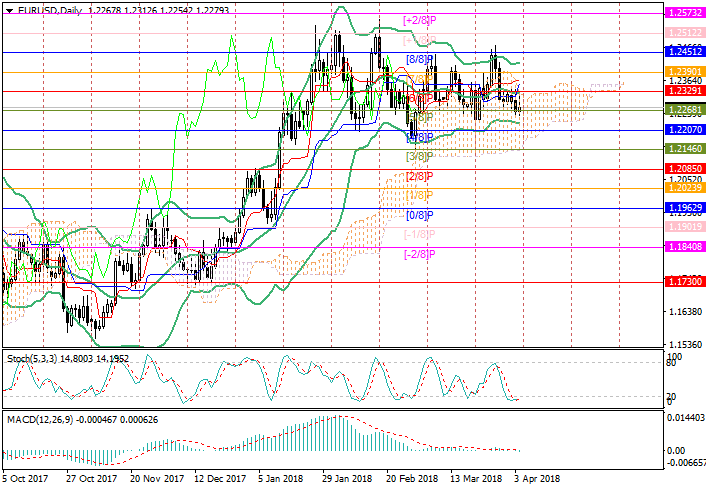

Support and resistance

Now the instrument is at the level of 1.2268 (Murray [5/8]) and at its breakdown can reach the level of 1.2207 (Murray [4/8]). However, Stochastic is still in the oversold zone, which indicates an early reversal and a possible rise to the levels of 1.2390 (Murray [7/8]) and 1.2451 (Murray [8/8]).

Support levels: 1.2268, 1.2207, 1.2150.

Resistance levels: 1.2329, 1.2390, 1.2451.

Trading tips

Long positions may be opened from the level of 1.2330 with the target at 1.2451 and stop-loss at 1.2300. In case of a reverse at the level of 1.2207, long positions will also be relevant with targets at 1.2330, 1.2390 and stop-loss at 1.2170.

Today, the pair is influenced by the publication of preliminary data on inflation in the Eurozone in March and the aggravation of the US-China trade war.

The consumer price index in the EU increased from 1.1% to 1.4% (for the first time since November). The basic consumer price index remained at the same level of 1.0% (since January).

The aggravation of US-China trade disputes worries investors. It became known that China's retaliatory measures will not be limited to 128 US goods worth USD 3 billion. The same duties will be imposed on another 106 types of products from the US, including cars, airplanes, beef, wheat, corn, soybeans, products of the chemical and tobacco industries. The total value of goods under tariffs can reach USD 50 billion. Thus, parity will be achieved with the total amount of Chinese goods levied with duties in the US.

Investors did not expect such harsh actions, because it will affect products that are very important for China, namely, soybeans. China is the largest importer of soy from the US: last year, the amount of import was about USD 14 billion.

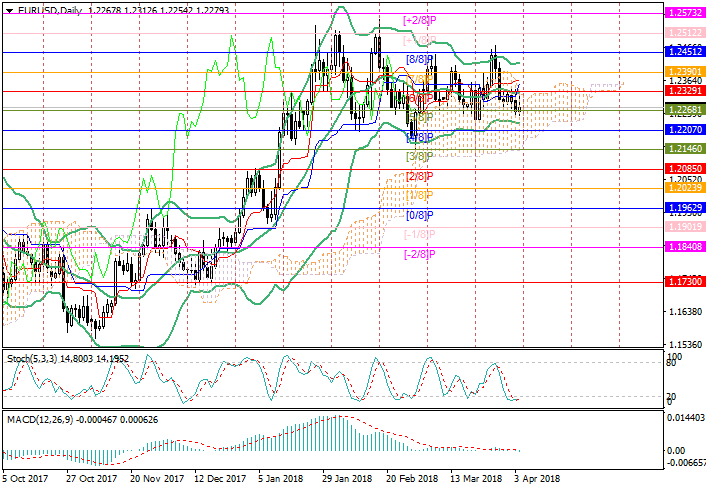

Support and resistance

Now the instrument is at the level of 1.2268 (Murray [5/8]) and at its breakdown can reach the level of 1.2207 (Murray [4/8]). However, Stochastic is still in the oversold zone, which indicates an early reversal and a possible rise to the levels of 1.2390 (Murray [7/8]) and 1.2451 (Murray [8/8]).

Support levels: 1.2268, 1.2207, 1.2150.

Resistance levels: 1.2329, 1.2390, 1.2451.

Trading tips

Long positions may be opened from the level of 1.2330 with the target at 1.2451 and stop-loss at 1.2300. In case of a reverse at the level of 1.2207, long positions will also be relevant with targets at 1.2330, 1.2390 and stop-loss at 1.2170.

No comments:

Write comments