AUD/USD: American dollar is growing

04 April 2018, 14:37

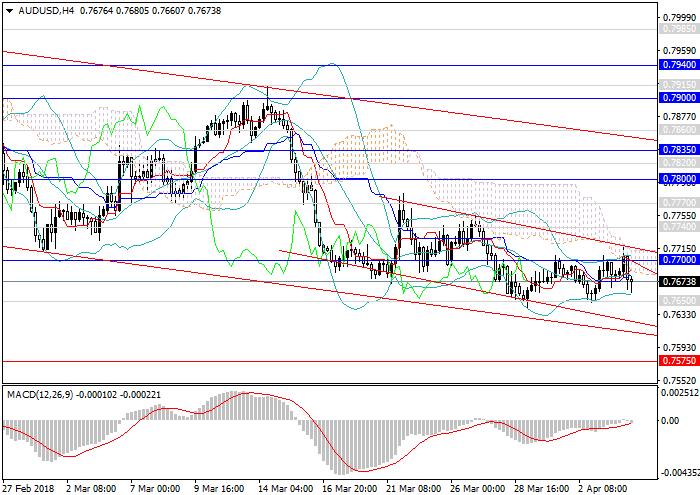

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL |

| Entry Point | 0.7683 |

| Take Profit | 0.7575, 0.7480 |

| Stop Loss | 0.7760 |

| Key Levels | 0.7400, 0.7435, 0.7450, 0.7480, 0.7530, 0.7575, 0.7650, 0.7700, 0.7740, 0.7770, 0.7800, 0.7820, 0.7860, 0.7900, 0.7940 |

Current trend

AUD is decreasing against USD due to the growth of its investment attractiveness.

The pair stays within the wide downward trend but during the last trading week, it has been consolidating within the sideways range. The decrease of volatility is due to the lack of key macroeconomic releases in the USA. The main issues (Nonfarm Payrolls, Unemployment Level, and Initial Jobless Claims) will be published at the end of the trading week. Today February Factory Orders and ADP Employment Change data will be released.

The commentaries of Fed’s representatives about the tightening of the monetary policy and the high possibility of the interest rate increase in the second quarter support USD significantly. On the contrary, RBA has been keeping the monetary policy unchanged for a long time. AUD is under additional pressure of the commentaries about the risks for the country’s economy, brought by the high rate of the national currency.

Support and resistance

At the end of the trading week, the fall to the local minimum 0.7640 and the movement to the levels of 0.7600, 0.7575 are expected. In the middle term, the downward momentum will maintain, the pair will tend to the levels of 0.7480, 0.7400 and 0.7335.

Technical indicators confirm the further decrease, MACD short positions’ volumes are high, and Bollinger Bands are pointed downwards.

Resistance levels: 0.7700, 0.7740, 0.7770, 0.7800, 0.7820, 0.7860, 0.7900, 0.7940.

Support levels: 0.7650, 0.7575, 0.7530, 0.7480, 0.7450, 0.7435, 0.7400.

Trading tips

It is better to increase the volumes of short positions at the current level with the targets at 0.7575, 0.7480 and stop loss 0.7760.

AUD is decreasing against USD due to the growth of its investment attractiveness.

The pair stays within the wide downward trend but during the last trading week, it has been consolidating within the sideways range. The decrease of volatility is due to the lack of key macroeconomic releases in the USA. The main issues (Nonfarm Payrolls, Unemployment Level, and Initial Jobless Claims) will be published at the end of the trading week. Today February Factory Orders and ADP Employment Change data will be released.

The commentaries of Fed’s representatives about the tightening of the monetary policy and the high possibility of the interest rate increase in the second quarter support USD significantly. On the contrary, RBA has been keeping the monetary policy unchanged for a long time. AUD is under additional pressure of the commentaries about the risks for the country’s economy, brought by the high rate of the national currency.

Support and resistance

At the end of the trading week, the fall to the local minimum 0.7640 and the movement to the levels of 0.7600, 0.7575 are expected. In the middle term, the downward momentum will maintain, the pair will tend to the levels of 0.7480, 0.7400 and 0.7335.

Technical indicators confirm the further decrease, MACD short positions’ volumes are high, and Bollinger Bands are pointed downwards.

Resistance levels: 0.7700, 0.7740, 0.7770, 0.7800, 0.7820, 0.7860, 0.7900, 0.7940.

Support levels: 0.7650, 0.7575, 0.7530, 0.7480, 0.7450, 0.7435, 0.7400.

Trading tips

It is better to increase the volumes of short positions at the current level with the targets at 0.7575, 0.7480 and stop loss 0.7760.

No comments:

Write comments