Brent Crude Oil: general review

09 April 2018, 15:38

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 67.77 |

| Take Profit | 68.45, 68.75 |

| Stop Loss | 67.20 |

| Key Levels | 65.62, 66.40, 67.18, 68.45, 68.75 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 67.10 |

| Take Profit | 66.40, 65.62 |

| Stop Loss | 67.45 |

| Key Levels | 65.62, 66.40, 67.18, 68.45, 68.75 |

Current trend

Currently, the main drivers for the price movement are news about the US-China trade confrontation. On Friday, quotes of Brent Crude oil fell to the area of 66.60 after the news that the US administration is working on the possibility to impose another import duties on a number of Chinese goods totaling USD 100 billion. The additional pressure on the instrument was provided by the data of Baker Hughes, according to which the number of oil rigs in the United States began to rise and amounted to 808 units.

Today, quotes are trying to correct in view of President Trump statements, which expressed confidence that China will make concessions, a deal on intellectual property issues will be concluded, and both countries "await an excellent future". In addition, prices are supported by the worsening tensions in the Middle East, related to Israeli air strikes against targets in Syria.

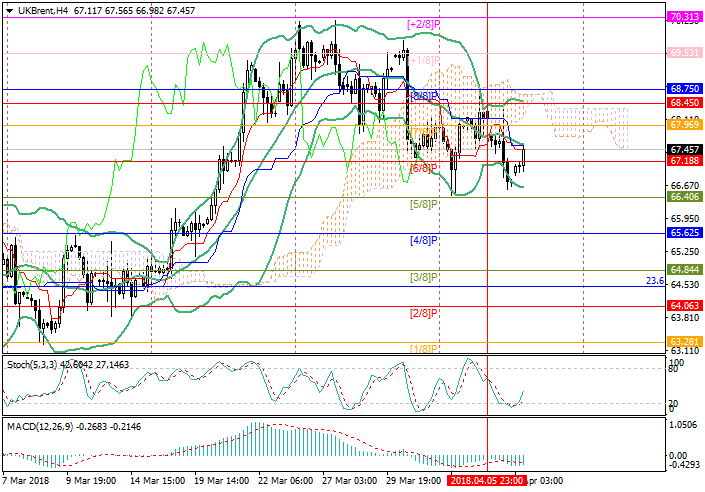

Support and resistance

Technically, the price rose above the level of 67.18 (Murray [6/8]). However, sell positions will become relevant only if the instrument is consolidated above the midline of Bollinger Bands. At the same time, quotes may rise to the area of 68.45-68.75. Possible growth is confirmed by Stochastic, which reversed upwards, and MACD histogram, which decreases in the negative zone. If the instrument consolidates below the 67.18 mark, it may lead to a drop to levels of 66.40 (Murray [5/8]) and 65.62 (Murray [4/8]).

Support levels: 67.18, 66.40, 65.62.

Resistance levels: 68.45, 68.75.

Trading tips

Long positions may be opened above the level of 67.50 with targets at 68.45, 68.75 and stop-loss at 67.20.

Short positions will become relevant below 67.18 mark with targets at 66.40, 65.62 and stop-loss at 67.45.

Currently, the main drivers for the price movement are news about the US-China trade confrontation. On Friday, quotes of Brent Crude oil fell to the area of 66.60 after the news that the US administration is working on the possibility to impose another import duties on a number of Chinese goods totaling USD 100 billion. The additional pressure on the instrument was provided by the data of Baker Hughes, according to which the number of oil rigs in the United States began to rise and amounted to 808 units.

Today, quotes are trying to correct in view of President Trump statements, which expressed confidence that China will make concessions, a deal on intellectual property issues will be concluded, and both countries "await an excellent future". In addition, prices are supported by the worsening tensions in the Middle East, related to Israeli air strikes against targets in Syria.

Support and resistance

Technically, the price rose above the level of 67.18 (Murray [6/8]). However, sell positions will become relevant only if the instrument is consolidated above the midline of Bollinger Bands. At the same time, quotes may rise to the area of 68.45-68.75. Possible growth is confirmed by Stochastic, which reversed upwards, and MACD histogram, which decreases in the negative zone. If the instrument consolidates below the 67.18 mark, it may lead to a drop to levels of 66.40 (Murray [5/8]) and 65.62 (Murray [4/8]).

Support levels: 67.18, 66.40, 65.62.

Resistance levels: 68.45, 68.75.

Trading tips

Long positions may be opened above the level of 67.50 with targets at 68.45, 68.75 and stop-loss at 67.20.

Short positions will become relevant below 67.18 mark with targets at 66.40, 65.62 and stop-loss at 67.45.

No comments:

Write comments