YM: general analysis

29 March 2018, 14:09

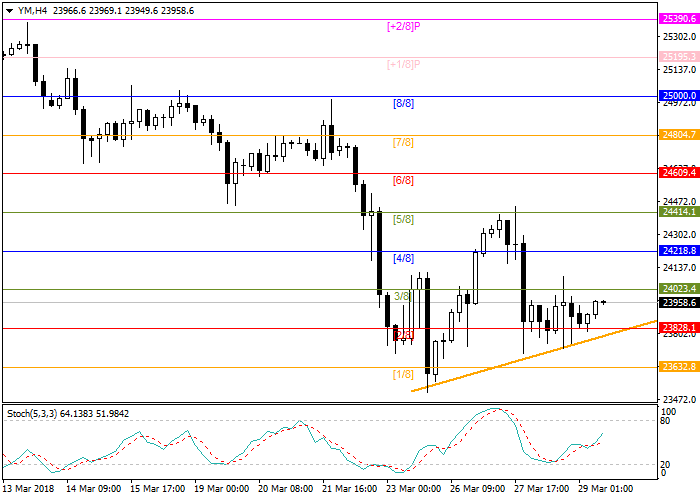

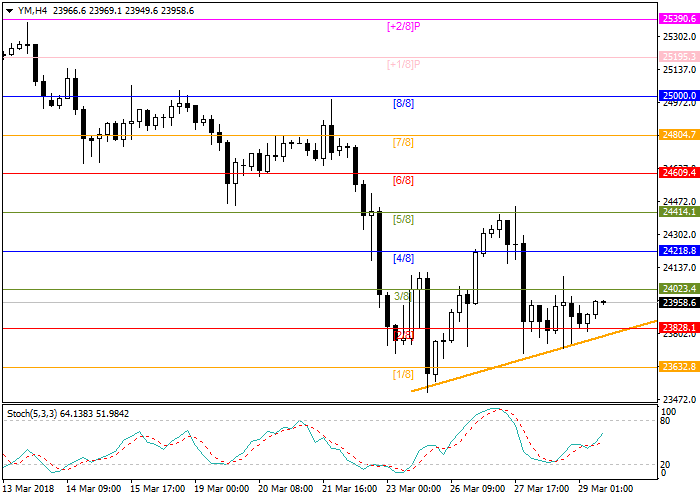

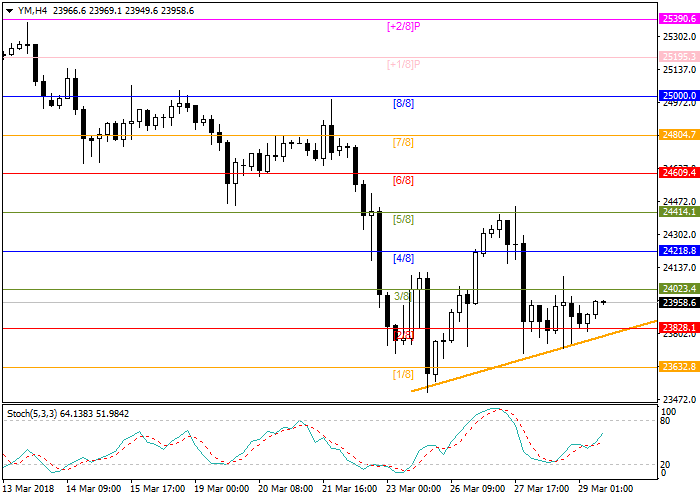

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 23952.5 |

| Take Profit | 24177.0 |

| Stop Loss | 23753.0 |

| Key Levels | 23632.8, 23753.0, 24023.4, 24177.0 |

Current trend

Dow Jones index is slightly restoring its loss and is now trading at the level of 23961.6.

The growth is due to the positive US economic data: yesterday’s GDP index exceeded the expectations of the market and reached 2.9%. The second positive factor is the visit of North Korean leader to China. It is possible that together USA can meet an agreement with DPRK leader without military interventions. As for trade policy, Donald Trump’s Administration reviews the possibility to restring Chinese investments into sectors and technologies, sensitive for the national safety. The market reacts positively to any improvement in the countries’ relations, which supports the instrument. The decrease of debt bond’s yield, which has reached 2.75%, also supports US stock markets.

Today the traders are focused on US Personal Spending, Michigan Consumer Sentiment Index, and FOMC Member Harker Speech publications.

Support and resistance

Stochastic is at the level of 64 points and does not give a signal to open positions.

Resistance levels: 24023.4, 24177.0.

Support levels: 23753.0, 23632.8.

Trading tips

Long positions can be opened at the current level with the target at 24177.0 and stop loss 23753.0.

Dow Jones index is slightly restoring its loss and is now trading at the level of 23961.6.

The growth is due to the positive US economic data: yesterday’s GDP index exceeded the expectations of the market and reached 2.9%. The second positive factor is the visit of North Korean leader to China. It is possible that together USA can meet an agreement with DPRK leader without military interventions. As for trade policy, Donald Trump’s Administration reviews the possibility to restring Chinese investments into sectors and technologies, sensitive for the national safety. The market reacts positively to any improvement in the countries’ relations, which supports the instrument. The decrease of debt bond’s yield, which has reached 2.75%, also supports US stock markets.

Today the traders are focused on US Personal Spending, Michigan Consumer Sentiment Index, and FOMC Member Harker Speech publications.

Support and resistance

Stochastic is at the level of 64 points and does not give a signal to open positions.

Resistance levels: 24023.4, 24177.0.

Support levels: 23753.0, 23632.8.

Trading tips

Long positions can be opened at the current level with the target at 24177.0 and stop loss 23753.0.

No comments:

Write comments