USD/JPY: general analysis

29 March 2018, 15:38

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 106.20 |

| Take Profit | 105.85, 105.47 |

| Stop Loss | 107.30 |

| Key Levels | 105.47, 105.85, 106.25, 107.00, 107.81 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 107.10 |

| Take Profit | 107.81 |

| Stop Loss | 106.70 |

| Key Levels | 105.47, 105.85, 106.25, 107.00, 107.81 |

Current trend

The Japanese currency is weakening due to the news about North Korean leader Kim Jong-un to China. The experts consider is as an attempt to enlist the support and mediation of Beijing in order to dialogue with world society and the USA. Also, the yen is under pressure of poor Retail Sales, which grew by 1.6% YoY in February, being below the forecast of 1.7%.

Today the growth can restore in case of positive US Personal Spending data publication. However, according to the forecast, the indices will stay at the levels of 0.2% YoY and 0.4% MoM.

Support and resistance

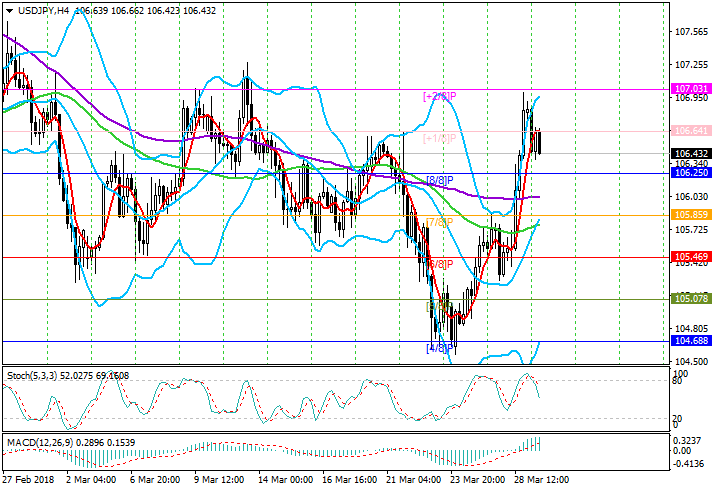

On the 4-hour chart, the price progressed beyond the main trading Murray range and is trading near the level of 106.64 (Murray [+1/8]). The key “bullish” level is 107.00 ([+2/8]), in case of breakout the instrument can grow to the level of 107.81 (Murray [5/8], D1). However, the indicators reflect the significant possibility of the downward correction to the levels of 105.85 (Murray [7/8]) and 105.47 (Murray [6/8]). Stochastic has left the overbought area, MACD histogram is stable after the growth in the positive zone.

Resistance levels: 107.00, 107.81.

Support levels: 106.25, 105.85, 105.47.

Trading tips

Short positions can be opened below the level of 106.25 with the targets at 105.85, 105.47 and stop loss 107.30.

Long positions can be opened after the breakout of the level 107.00 with the target at 107.81 and stop loss 106.70.

The Japanese currency is weakening due to the news about North Korean leader Kim Jong-un to China. The experts consider is as an attempt to enlist the support and mediation of Beijing in order to dialogue with world society and the USA. Also, the yen is under pressure of poor Retail Sales, which grew by 1.6% YoY in February, being below the forecast of 1.7%.

Today the growth can restore in case of positive US Personal Spending data publication. However, according to the forecast, the indices will stay at the levels of 0.2% YoY and 0.4% MoM.

Support and resistance

On the 4-hour chart, the price progressed beyond the main trading Murray range and is trading near the level of 106.64 (Murray [+1/8]). The key “bullish” level is 107.00 ([+2/8]), in case of breakout the instrument can grow to the level of 107.81 (Murray [5/8], D1). However, the indicators reflect the significant possibility of the downward correction to the levels of 105.85 (Murray [7/8]) and 105.47 (Murray [6/8]). Stochastic has left the overbought area, MACD histogram is stable after the growth in the positive zone.

Resistance levels: 107.00, 107.81.

Support levels: 106.25, 105.85, 105.47.

Trading tips

Short positions can be opened below the level of 106.25 with the targets at 105.85, 105.47 and stop loss 107.30.

Long positions can be opened after the breakout of the level 107.00 with the target at 107.81 and stop loss 106.70.

No comments:

Write comments