USD/CAD: general analysis

29 March 2018, 13:15

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 1.2911 |

| Take Profit | 1.3000 |

| Stop Loss | 1.2880 |

| Key Levels | 1.2785, 1.2820, 1.2860, 1.2880, 1.2900, 1.2930, 1.2950, 1.3000, 1.3050, 1.3070, 1.3100, 1.3130 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.2860 |

| Take Profit | 1.2800 |

| Stop Loss | 1.2915 |

| Key Levels | 1.2785, 1.2820, 1.2860, 1.2880, 1.2900, 1.2930, 1.2950, 1.3000, 1.3050, 1.3070, 1.3100, 1.3130 |

Current trend

Yesterday, USD strengthened against CAD due to the release of strong US GDP data, which exceeded the investors’ expectations and grew from 2.5% to 2.9%. The visit of the leader of North Korea Kim Jong-un to China supports the US currency, too. The experts consider it as an intention of DPRK to start the dialogue with the world society and with USA via Beijing, in particular. The trade negotiations between the USA and China continue. Trump’s Administration is now reviewing the possibility to restrict Chinese investments in enterprises and technologies, sensitive to the national safety. As a result, the decrease of the US stock market slowed, which, after the rapid fall on Tuesday, affected the dollar positively.

CAD is under additional pressure of the decrease in oil prices and some disagreements of Canada and US relating to NAFTA. The market is waiting for Canadian GDP release at 14:30 (GMT+2), the possibility of the growth of the index restricts the further growth of the pair.

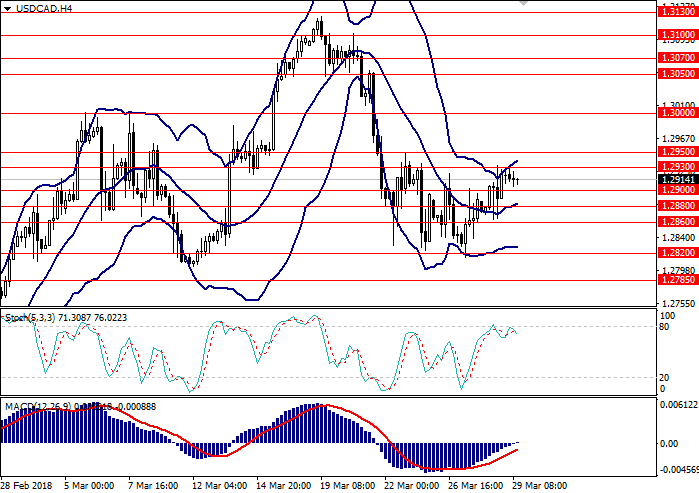

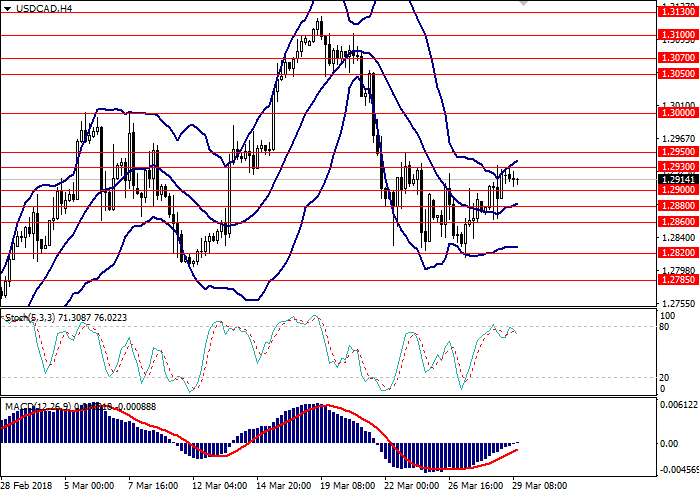

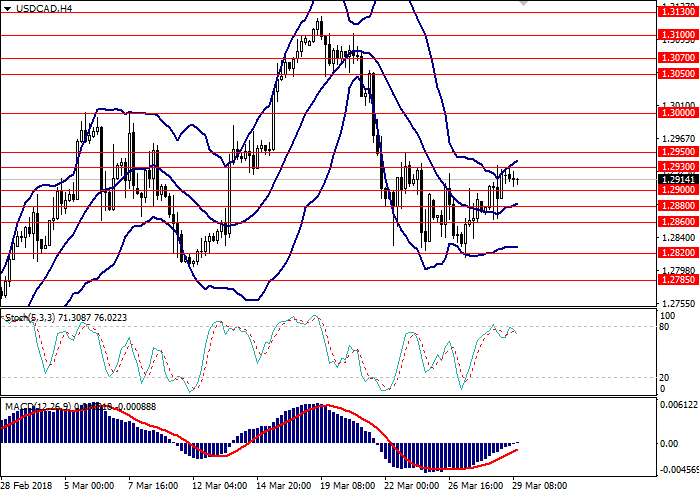

Support and resistance

On the 4-hour chart, the instrument is trading within the upper border and the middle line of Bollinger Bands, the price range is widened, which reflects the possible development of the upward movement. MACD histogram is around the zero line, its volumes are minimal, and the signal line is directed upwards.

Resistance levels: 1.2930, 1.2950, 1.3000, 1.3050, 1.3070, 1.3100, 1.3130.

Support levels: 1.2900, 1.2880, 1.2860, 1.2820, 1.2785.

Trading tips

Long positions can be opened at the current level with the target at 1.3000 and stop loss 1.2880. Implementation period: 1–3 days.

Short positions can be opened at the level of 1.2860 with the target at 1.2800 and stop loss 1.2915. Implementation period: 3–5 days.

Yesterday, USD strengthened against CAD due to the release of strong US GDP data, which exceeded the investors’ expectations and grew from 2.5% to 2.9%. The visit of the leader of North Korea Kim Jong-un to China supports the US currency, too. The experts consider it as an intention of DPRK to start the dialogue with the world society and with USA via Beijing, in particular. The trade negotiations between the USA and China continue. Trump’s Administration is now reviewing the possibility to restrict Chinese investments in enterprises and technologies, sensitive to the national safety. As a result, the decrease of the US stock market slowed, which, after the rapid fall on Tuesday, affected the dollar positively.

CAD is under additional pressure of the decrease in oil prices and some disagreements of Canada and US relating to NAFTA. The market is waiting for Canadian GDP release at 14:30 (GMT+2), the possibility of the growth of the index restricts the further growth of the pair.

Support and resistance

On the 4-hour chart, the instrument is trading within the upper border and the middle line of Bollinger Bands, the price range is widened, which reflects the possible development of the upward movement. MACD histogram is around the zero line, its volumes are minimal, and the signal line is directed upwards.

Resistance levels: 1.2930, 1.2950, 1.3000, 1.3050, 1.3070, 1.3100, 1.3130.

Support levels: 1.2900, 1.2880, 1.2860, 1.2820, 1.2785.

Trading tips

Long positions can be opened at the current level with the target at 1.3000 and stop loss 1.2880. Implementation period: 1–3 days.

Short positions can be opened at the level of 1.2860 with the target at 1.2800 and stop loss 1.2915. Implementation period: 3–5 days.

No comments:

Write comments