NZD/USD: dynamics will remain

29 March 2018, 13:38

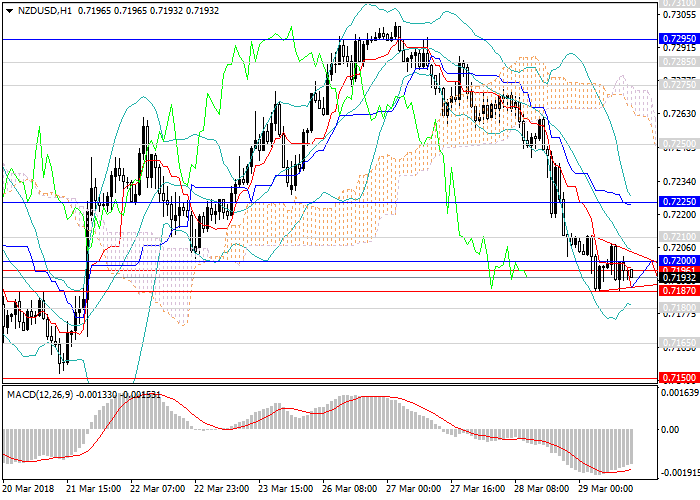

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL |

| Entry Point | 0.7193 |

| Take Profit | 0.7150, 0.7130, 0.7110 |

| Stop Loss | 0.7235 |

| Key Levels | 0.6970, 0.7010, 0.7050, 0.7110, 0.7130, 0.7150, 0.7180, 0.7187, 0.7200, 0.7225, 0.7250, 0.7275, 0.7285, 0.7295, 0.7310 |

Current trend

NZD remains in a rapid downward trend amid rising demand for USD and negative fundamental statistics from New Zealand.

In a couple of trading days, the pair lost over 100 points and reached the strong support level of 0.7187. Later, the instrument moved to the stage of side consolidation and is now traded in a narrow lateral channel with a width of no more than 25 points. It is worth noting that, despite favorable statistics on the construction sector of New Zealand, at the beginning of the trading day the pair broke down the key support level of 0.7200. This indicates the recent drop in the investment attractiveness of NZD.

Today, there are data on the labor market and the main indices of the United States, which can give additional support to USD. Tomorrow the foreign exchange market is expected not to be volatile due to Good Friday.

Support and resistance

Today the current momentum is expected to strengthen, breaking down 0.7187 mark followed by the decline with the target of 0.7150, after which the pair will again move into lateral consolidation. Comments on the possible further tightening of monetary policy by the Fed support USD. Comments by RBNZ representatives, on the contrary, are aimed at the further decline of New Zealand currency. All these factors give a clear signal to further sales of NZD.

Technical indicators fully reflect the situation, MACD indicates the preservation of a high volume of short positions, and Bollinger Bands are directed downward.

Support levels: 0.7187, 0.7180, 0.7150, 0.7130, 0.7110, 0.7050, 0.7010, 0.6970.

Resistance levels: 0.7200, 0.7225, 0.7250, 0.7275, 0.7285, 0.7295, 0.7310.

Trading tips

In this situation, short positions may be opened from the current level with short-term targets at 0.7150, 0.7130, 0.7110 and stop-loss at 0.7235.

NZD remains in a rapid downward trend amid rising demand for USD and negative fundamental statistics from New Zealand.

In a couple of trading days, the pair lost over 100 points and reached the strong support level of 0.7187. Later, the instrument moved to the stage of side consolidation and is now traded in a narrow lateral channel with a width of no more than 25 points. It is worth noting that, despite favorable statistics on the construction sector of New Zealand, at the beginning of the trading day the pair broke down the key support level of 0.7200. This indicates the recent drop in the investment attractiveness of NZD.

Today, there are data on the labor market and the main indices of the United States, which can give additional support to USD. Tomorrow the foreign exchange market is expected not to be volatile due to Good Friday.

Support and resistance

Today the current momentum is expected to strengthen, breaking down 0.7187 mark followed by the decline with the target of 0.7150, after which the pair will again move into lateral consolidation. Comments on the possible further tightening of monetary policy by the Fed support USD. Comments by RBNZ representatives, on the contrary, are aimed at the further decline of New Zealand currency. All these factors give a clear signal to further sales of NZD.

Technical indicators fully reflect the situation, MACD indicates the preservation of a high volume of short positions, and Bollinger Bands are directed downward.

Support levels: 0.7187, 0.7180, 0.7150, 0.7130, 0.7110, 0.7050, 0.7010, 0.6970.

Resistance levels: 0.7200, 0.7225, 0.7250, 0.7275, 0.7285, 0.7295, 0.7310.

Trading tips

In this situation, short positions may be opened from the current level with short-term targets at 0.7150, 0.7130, 0.7110 and stop-loss at 0.7235.

No comments:

Write comments