GBP/USD: the pound stays under pressure

30 March 2018, 09:50

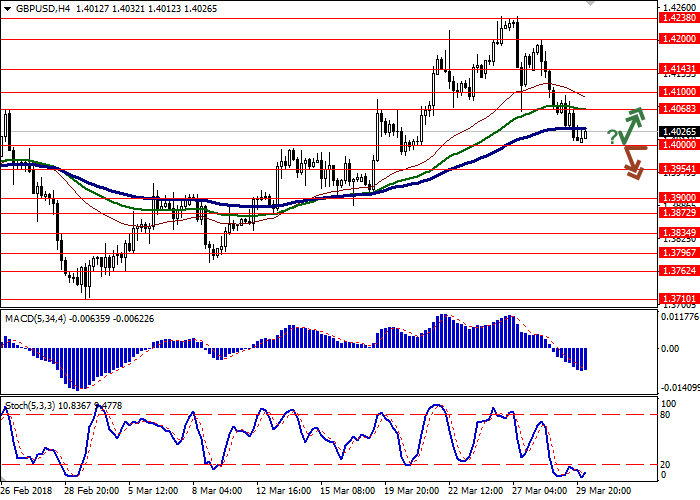

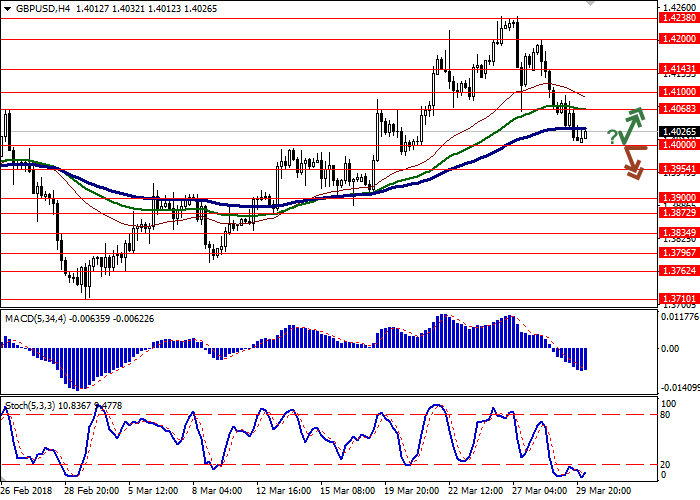

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY LIMIT |

| Entry Point | 1.4000 |

| Take Profit | 1.4100, 1.4143 |

| Stop Loss | 1.3950 |

| Key Levels | 1.3872, 1.3900, 1.3954, 1.4000, 1.4068, 1.4100, 1.4143, 1.4200 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.3990 |

| Take Profit | 1.3900 |

| Stop Loss | 1.4060 |

| Key Levels | 1.3872, 1.3900, 1.3954, 1.4000, 1.4068, 1.4100, 1.4143, 1.4200 |

Current trend

Yesterday GBP fell against USD and renewed the lows since March 21. UK data supported the pound moderately, but the investors are interested in the dollar.

On Thursday, a number of important economic releases were published in the UK. GDP for Q4 2017 remained on the same level: on the YoY basis, it made up 1.4% and on monthly basis 0.4%. The trade deficit decreased from 19.173 to 18.443 billion pounds. In addition, the pound was supported by the British Foreign Trade Minister Liam Fox, who said he hopes to sign 40 trade agreements with 70 countries by the end of the Brexit transition period in 2020.

Today the pair is in the correction, stepping off the local lows. At the end of the trading week, economic activity will noticeably decrease on the occasion of Good Friday.

Support and resistance

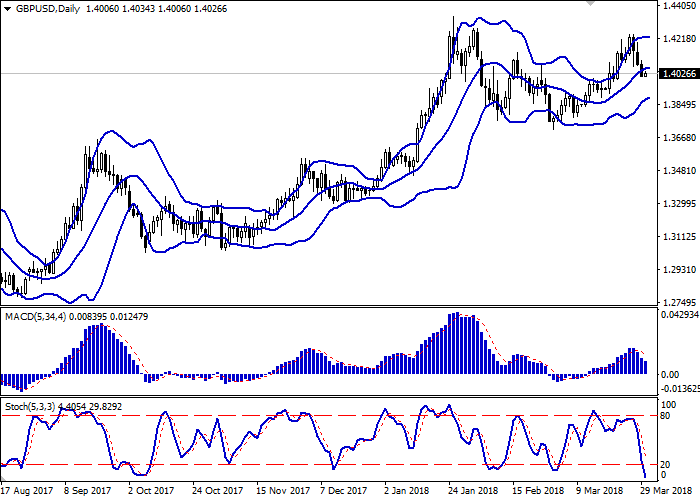

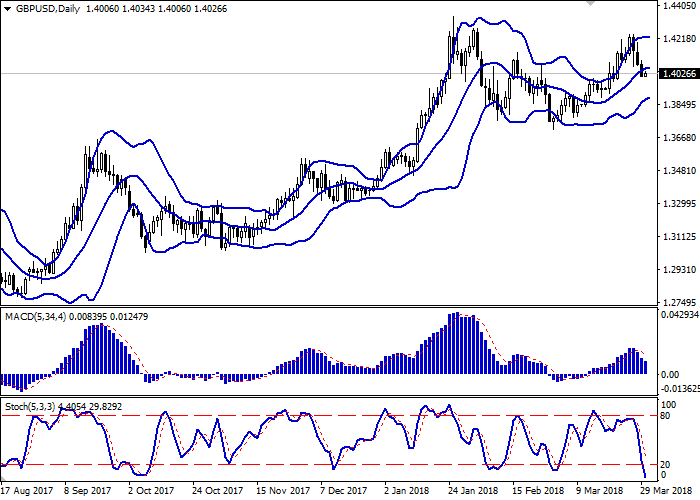

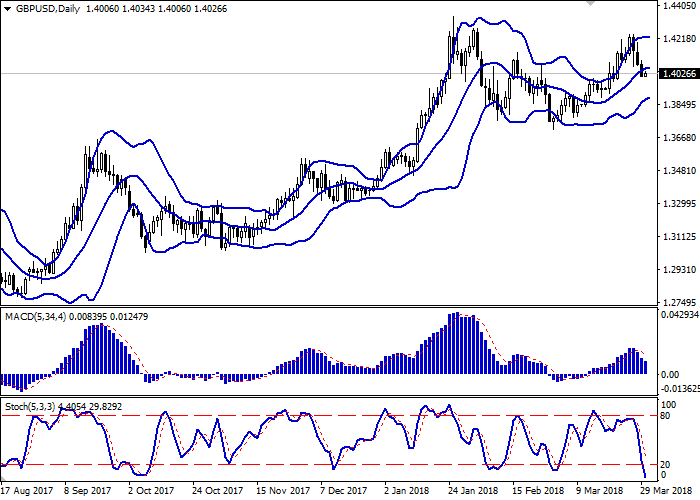

On the daily chart, Bollinger Bands are reversing horizontally. The price range is slightly narrowing from below.

MACD has reversed downwards; it keeps a quite strong sell signal (the histogram is below the signal line).

Stochastic is directed downwards but is near its lows, which reflects that GBP is overbought in the short or very short term.

The technical indicators’ readings reflect the possibility of the downward trend development in the short term. However, at the end of the trading week, the upward correction is possible.

Resistance levels: 1.4068, 1.4100, 1.4143, 1.4200.

Support levels: 1.4000, 1.3954, 1.3900, 1.3872.

Trading tips

Long positions can be opened after the rebound at the level of 1.4000 with the targets at 1.4100–1.4143 and stop loss 1.3950.

Short positions can be opened after the strong breakdown of the level 1.4000 with the target at 1.3900 and stop loss 1.4060.

Implementation period: 2–3 days.

Yesterday GBP fell against USD and renewed the lows since March 21. UK data supported the pound moderately, but the investors are interested in the dollar.

On Thursday, a number of important economic releases were published in the UK. GDP for Q4 2017 remained on the same level: on the YoY basis, it made up 1.4% and on monthly basis 0.4%. The trade deficit decreased from 19.173 to 18.443 billion pounds. In addition, the pound was supported by the British Foreign Trade Minister Liam Fox, who said he hopes to sign 40 trade agreements with 70 countries by the end of the Brexit transition period in 2020.

Today the pair is in the correction, stepping off the local lows. At the end of the trading week, economic activity will noticeably decrease on the occasion of Good Friday.

Support and resistance

On the daily chart, Bollinger Bands are reversing horizontally. The price range is slightly narrowing from below.

MACD has reversed downwards; it keeps a quite strong sell signal (the histogram is below the signal line).

Stochastic is directed downwards but is near its lows, which reflects that GBP is overbought in the short or very short term.

The technical indicators’ readings reflect the possibility of the downward trend development in the short term. However, at the end of the trading week, the upward correction is possible.

Resistance levels: 1.4068, 1.4100, 1.4143, 1.4200.

Support levels: 1.4000, 1.3954, 1.3900, 1.3872.

Trading tips

Long positions can be opened after the rebound at the level of 1.4000 with the targets at 1.4100–1.4143 and stop loss 1.3950.

Short positions can be opened after the strong breakdown of the level 1.4000 with the target at 1.3900 and stop loss 1.4060.

Implementation period: 2–3 days.

No comments:

Write comments