AUD/USD: general review

30 March 2018, 09:39

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL |

| Entry Point | 0.7693 |

| Take Profit | 0.7610 |

| Stop Loss | 0.7715 |

| Key Levels | 0.7574, 0.7608, 0.7642, 0.7664, 0.7684, 0.7711, 0.7736, 0.7753, 0.7791 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 0.7720 |

| Take Profit | 0.7760 |

| Stop Loss | 0.7680 |

| Key Levels | 0.7574, 0.7608, 0.7642, 0.7664, 0.7684, 0.7711, 0.7736, 0.7753, 0.7791 |

Current trend

The pair AUD/USD is trading near the minimum value for the last three months.

The cautious position of the RBA and the fall in commodity prices have generated strong pressure on AUD. In addition, the negative impact on Australian economy is provided by the US introduction of import duties on Chinese goods.

Yesterday, the pair reached its local minimum, but failed to break through the support level of 0.7640 and demonstrated insignificant growth. The pair ignored the positive data on the US labor market and personal expenditure, which means that the instrument is dependent on the US and the PRC relations.

No important macroeconomic publications are planned today. Market participants expect low volatility, and the volume of trading is likely to be minimal due to Good Friday. At the same time, the clarification in the process of negotiations between the US and China will serve as a driver for the AUD/USD pair. In this situation, it is necessary to be cautious expecting significant data on the trade war during the weekend.

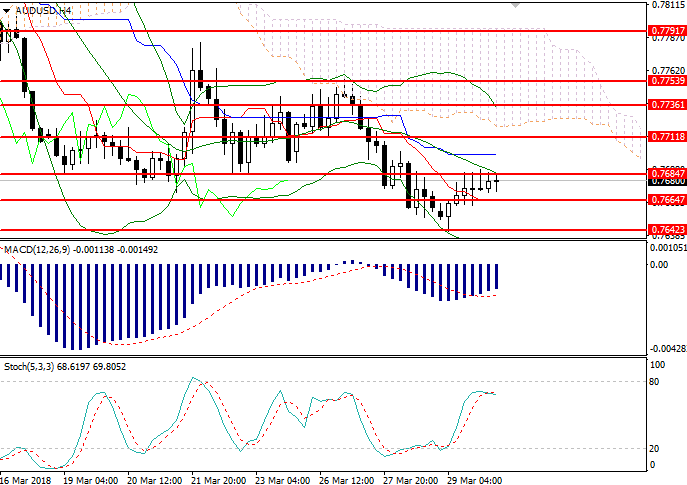

Support and resistance

On the H4 chart the instrument is testing the moving average of Bollinger Bands. The indicator reversed downwards and the price range is narrowing down which serves as a basis for the change of the uptrend to downtrend. MACD histogram is in the negative zone keeping the sale signal. Stochastic is approaching the oversold area, the signal for opening positions is not formed.

Support levels: 0.7574, 0.7608, 0.7642, 0.7664.

Resistance levels: 0.7684, 0.7711, 0.7736, 0.7753, 0.7791.

Trading tips

Short positions may be opened from the current level with target at 0.7610 and stop-loss at 0.7715. Implementation period: 1-2 days.

Long positions may be opened above the level of 0.7715 with target at 0.7760 and stop-loss at 0.7680. Implementation period: 1-2 days.

The pair AUD/USD is trading near the minimum value for the last three months.

The cautious position of the RBA and the fall in commodity prices have generated strong pressure on AUD. In addition, the negative impact on Australian economy is provided by the US introduction of import duties on Chinese goods.

Yesterday, the pair reached its local minimum, but failed to break through the support level of 0.7640 and demonstrated insignificant growth. The pair ignored the positive data on the US labor market and personal expenditure, which means that the instrument is dependent on the US and the PRC relations.

No important macroeconomic publications are planned today. Market participants expect low volatility, and the volume of trading is likely to be minimal due to Good Friday. At the same time, the clarification in the process of negotiations between the US and China will serve as a driver for the AUD/USD pair. In this situation, it is necessary to be cautious expecting significant data on the trade war during the weekend.

Support and resistance

On the H4 chart the instrument is testing the moving average of Bollinger Bands. The indicator reversed downwards and the price range is narrowing down which serves as a basis for the change of the uptrend to downtrend. MACD histogram is in the negative zone keeping the sale signal. Stochastic is approaching the oversold area, the signal for opening positions is not formed.

Support levels: 0.7574, 0.7608, 0.7642, 0.7664.

Resistance levels: 0.7684, 0.7711, 0.7736, 0.7753, 0.7791.

Trading tips

Short positions may be opened from the current level with target at 0.7610 and stop-loss at 0.7715. Implementation period: 1-2 days.

Long positions may be opened above the level of 0.7715 with target at 0.7760 and stop-loss at 0.7680. Implementation period: 1-2 days.

No comments:

Write comments