GBP/USD: general analysis

28 March 2018, 10:17

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 1.4148 |

| Take Profit | 1.4250 |

| Stop Loss | 1.4115 |

| Key Levels | 1.4000, 1.4040, 1.4070, 1.4050, 1.4165, 1.4215, 1.4250, 1.4290 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.4060 |

| Take Profit | 1.4000 |

| Stop Loss | 1.4090 |

| Key Levels | 1.4000, 1.4040, 1.4070, 1.4050, 1.4165, 1.4215, 1.4250, 1.4290 |

Current trend

Yesterday GBP weakened against USD. The decrease peaked during the beginning of the US trading session, but by the end of the day, the instrument restored part of the losses. The volatility is high at the end of the month and a quarter, which usually is accompanied by the corrections of the positions and the increase in the money flows.

Despite the success in recent Brexit negotiations, not all the problems are solved. The Migration Advisory Committee of the UK stated in its report that the British companies were worried upon the recruitment in EU counties. According to many companies’ management, EU citizens are more reliable and work better than British. It is unclear if the companies can attract such workers and under what regulations.

Today the traders are focused on US Q4 GDP annualized release at 15:30 (GMT+2). The growth of the index can strengthen USD, a high level of volatility is expected.

Support and resistance

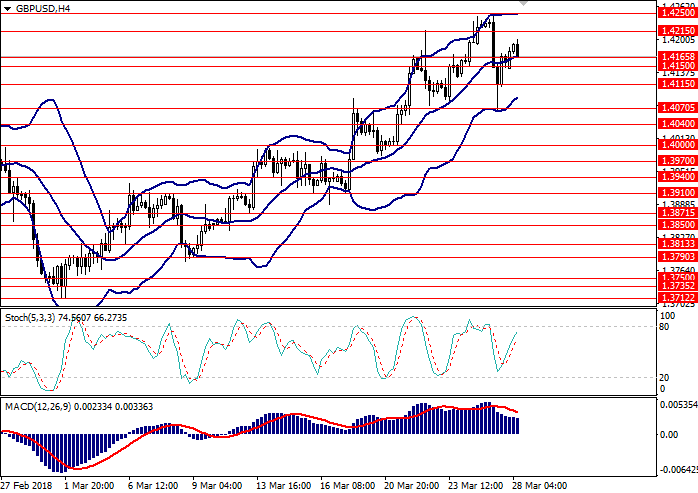

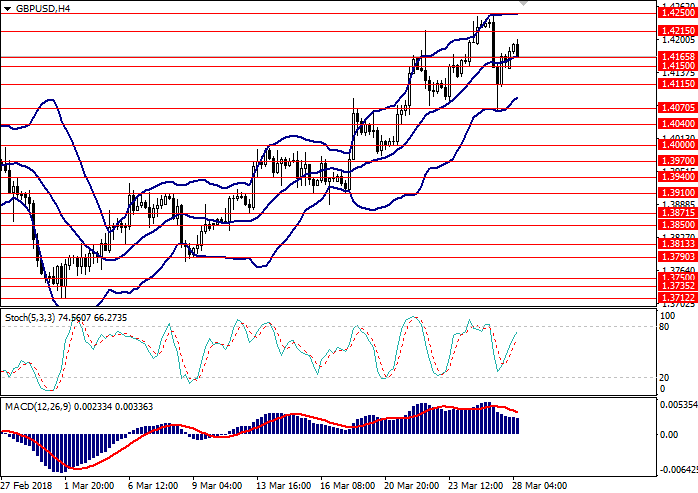

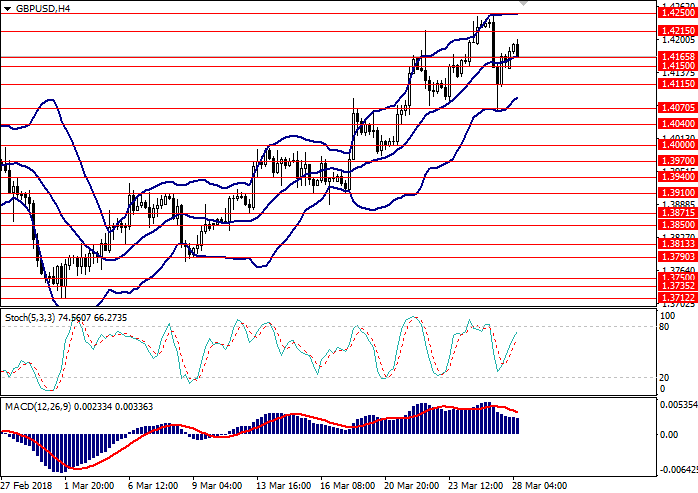

On the 4-hour chart, the pair was corrected to the middle line of Bollinger Bands. MACD histogram is in the positive zone, keeping a signal to open long positions.

Resistance levels: 1.4215, 1.4250, 1.4290.

Support levels: 1.4165, 1.4050, 1.4070, 1.4040, 1.4000.

Trading tips

Long positions can be opened at the current level with the target at 1.4250 and stop loss 1.4115. Implementation period: 1–3 days.

Short positions can be opened at the level of 1.4060 with the target at 1.4000 and stop loss 1.4090. Implementation period: 3–5 days.

Yesterday GBP weakened against USD. The decrease peaked during the beginning of the US trading session, but by the end of the day, the instrument restored part of the losses. The volatility is high at the end of the month and a quarter, which usually is accompanied by the corrections of the positions and the increase in the money flows.

Despite the success in recent Brexit negotiations, not all the problems are solved. The Migration Advisory Committee of the UK stated in its report that the British companies were worried upon the recruitment in EU counties. According to many companies’ management, EU citizens are more reliable and work better than British. It is unclear if the companies can attract such workers and under what regulations.

Today the traders are focused on US Q4 GDP annualized release at 15:30 (GMT+2). The growth of the index can strengthen USD, a high level of volatility is expected.

Support and resistance

On the 4-hour chart, the pair was corrected to the middle line of Bollinger Bands. MACD histogram is in the positive zone, keeping a signal to open long positions.

Resistance levels: 1.4215, 1.4250, 1.4290.

Support levels: 1.4165, 1.4050, 1.4070, 1.4040, 1.4000.

Trading tips

Long positions can be opened at the current level with the target at 1.4250 and stop loss 1.4115. Implementation period: 1–3 days.

Short positions can be opened at the level of 1.4060 with the target at 1.4000 and stop loss 1.4090. Implementation period: 3–5 days.

No comments:

Write comments