AUD/USD: the instrument is trading mixed

29 March 2018, 09:32

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 0.7676 |

| Take Profit | 0.7742, 0.7767 |

| Stop Loss | 0.7630 |

| Key Levels | 0.7530, 0.7586, 0.7638, 0.7674, 0.7711, 0.7742, 0.7767 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.7630 |

| Take Profit | 0.7586, 0.7565 |

| Stop Loss | 0.7674 |

| Key Levels | 0.7530, 0.7586, 0.7638, 0.7674, 0.7711, 0.7742, 0.7767 |

Current trend

Despite the slight upward correction, AUD is still under pressure of many factors. The main ones are the decrease in metal prices and the growth of investors’ interest in USD.

Yesterday the strong US GDP releases supported the dollar. The annualized economic growth in Q4, 2017, reached 2.9% YoY after the increase by 2.5% YoY in the previous quarter, while analysts expected the value of +2.7% YoY.

Today pair is growing due to the technical fact, that AUD is oversold and Private Sector Credit data are positive: in February the index grew by 0.4% MoM after the growth by 0.2% MoM, which is better than the analysts’ expectations of +0.3% MoM.

Support and resistance

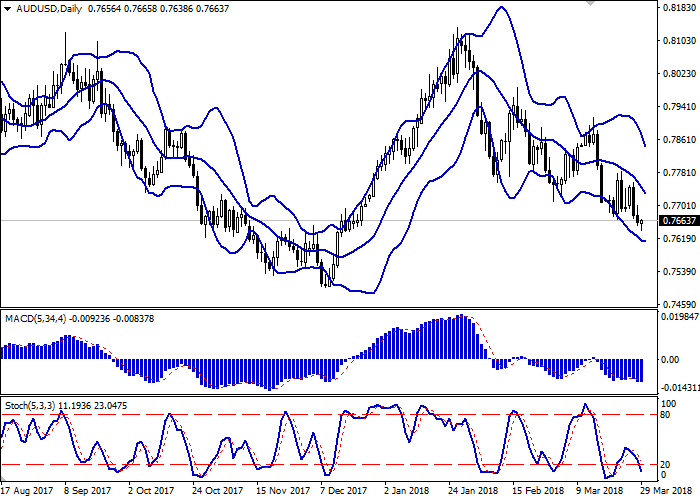

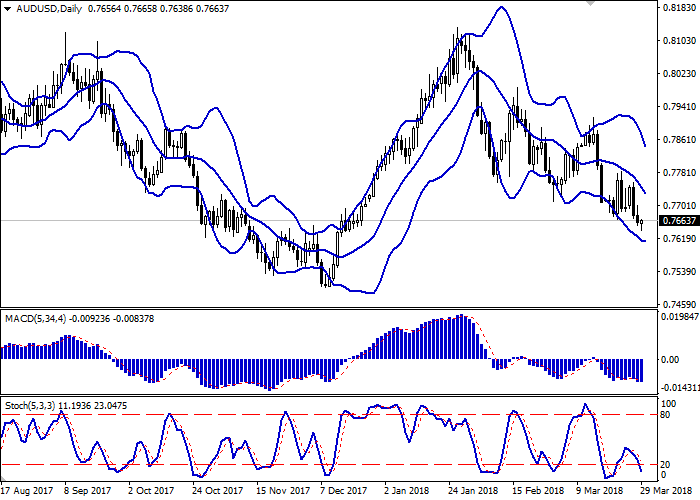

On the daily chart, Bollinger Bands are falling. The price range is narrowing, reflecting the unstable character of the “bearish” dynamics. MACD is decreasing, too, but the sell signal is too weak. Stochastic is reaching its lows, which reflects that AUD is oversold in the short term.

It is better to keep short positions for some time.

Resistance levels: 0.7674, 0.7711, 0.7742, 0.7767.

Support levels: 0.7638, 0.7586, 0.7530.

Trading tips

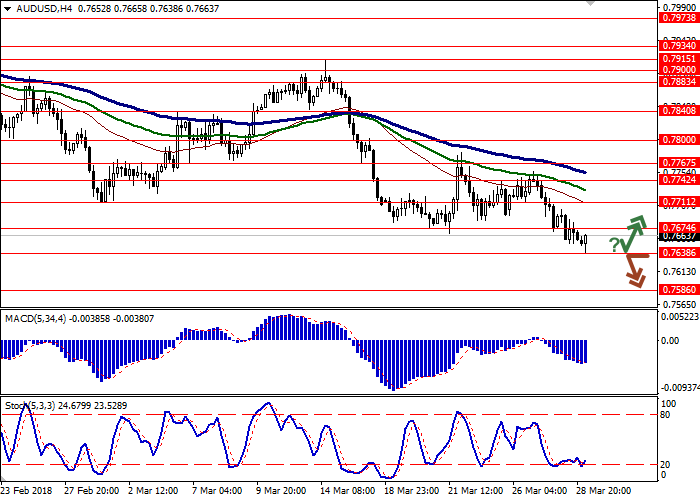

Long positions can be opened after the rebound at the level of 0.7638 and the breakout of the level 0.7674 with the targets at 0.7742–0.7767 and stop loss 0.7630.

Short positions can be opened after the breakdown of the level 0.7638 with the target at 0.7586–0.7565 and stop loss 0.7674.

Implementation period: 2–3 days.

Despite the slight upward correction, AUD is still under pressure of many factors. The main ones are the decrease in metal prices and the growth of investors’ interest in USD.

Yesterday the strong US GDP releases supported the dollar. The annualized economic growth in Q4, 2017, reached 2.9% YoY after the increase by 2.5% YoY in the previous quarter, while analysts expected the value of +2.7% YoY.

Today pair is growing due to the technical fact, that AUD is oversold and Private Sector Credit data are positive: in February the index grew by 0.4% MoM after the growth by 0.2% MoM, which is better than the analysts’ expectations of +0.3% MoM.

Support and resistance

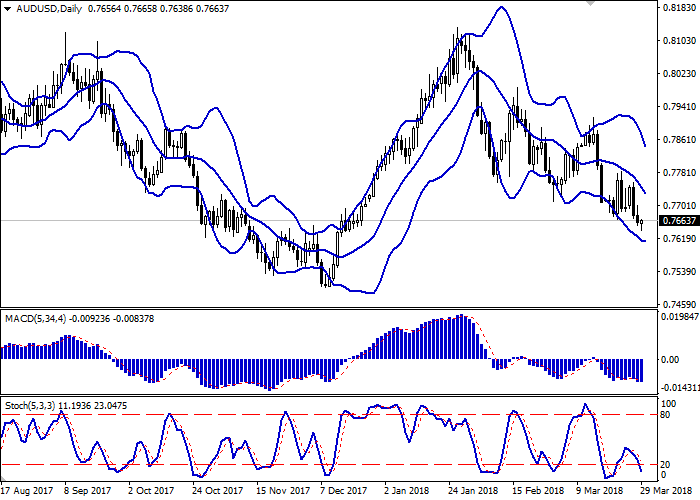

On the daily chart, Bollinger Bands are falling. The price range is narrowing, reflecting the unstable character of the “bearish” dynamics. MACD is decreasing, too, but the sell signal is too weak. Stochastic is reaching its lows, which reflects that AUD is oversold in the short term.

It is better to keep short positions for some time.

Resistance levels: 0.7674, 0.7711, 0.7742, 0.7767.

Support levels: 0.7638, 0.7586, 0.7530.

Trading tips

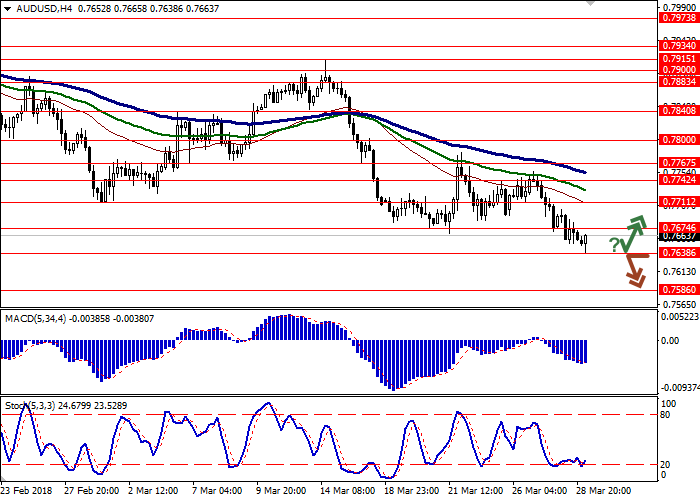

Long positions can be opened after the rebound at the level of 0.7638 and the breakout of the level 0.7674 with the targets at 0.7742–0.7767 and stop loss 0.7630.

Short positions can be opened after the breakdown of the level 0.7638 with the target at 0.7586–0.7565 and stop loss 0.7674.

Implementation period: 2–3 days.

No comments:

Write comments