YM: general review

21 September 2017, 08:54

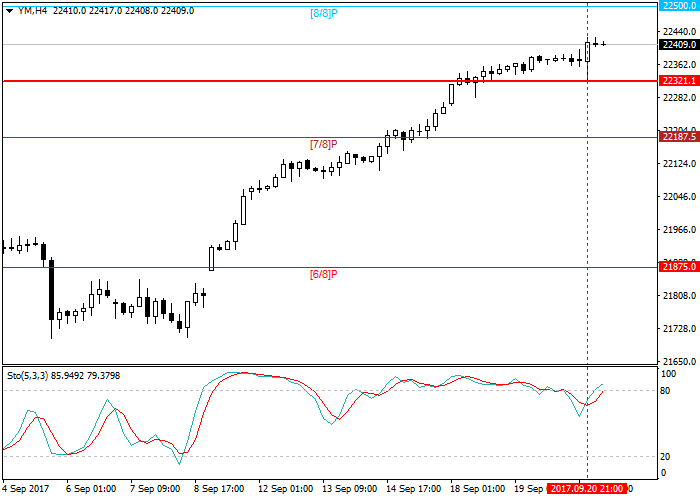

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 22321.1 |

| Take Profit | 22187.5 |

| Stop Loss | 22410.0 |

| Key Levels | 22321.1, 22500.0 |

Current trend

Dow Jones index continues to trade around its maximum values at 22412.0. American indexes showed almost no reaction to yesterday's Fed's meeting. According to its minutes, the regulator pointed out that economic activity continued to strengthen, and risks remained balanced, therefore one more increase of the interest rate before the end of the year was possible. The growth of bank loans prices or the refinancing rate will stop the inflow of cheap money into the US companies leading to correction in the financial markets.

Another interesting statement of Fed was the decision to start balance reduction in October. According to the initial plan, the regulator will reduce it by about $10 bln each month increasing the sum on a quarterly basis until it reached $50 bln. Therefore within the first year the balance may be reduced by about $300 bln.

Support and resistance

Stochastic is trading at the level of 80 points and indicates possible correction of the index. Short positions may be opened after the breakthrough of the previous minimum or the level of 22321.1.

Resistance levels: 22500.0.

Support levels: 22321.1.

Trading tips

Short positions may be opened from the level of 22321.1 with target at 22187.5 and stop-loss at 22410.0.

Dow Jones index continues to trade around its maximum values at 22412.0. American indexes showed almost no reaction to yesterday's Fed's meeting. According to its minutes, the regulator pointed out that economic activity continued to strengthen, and risks remained balanced, therefore one more increase of the interest rate before the end of the year was possible. The growth of bank loans prices or the refinancing rate will stop the inflow of cheap money into the US companies leading to correction in the financial markets.

Another interesting statement of Fed was the decision to start balance reduction in October. According to the initial plan, the regulator will reduce it by about $10 bln each month increasing the sum on a quarterly basis until it reached $50 bln. Therefore within the first year the balance may be reduced by about $300 bln.

Support and resistance

Stochastic is trading at the level of 80 points and indicates possible correction of the index. Short positions may be opened after the breakthrough of the previous minimum or the level of 22321.1.

Resistance levels: 22500.0.

Support levels: 22321.1.

Trading tips

Short positions may be opened from the level of 22321.1 with target at 22187.5 and stop-loss at 22410.0.

No comments:

Write comments