YM: general review

13 September 2017, 09:04

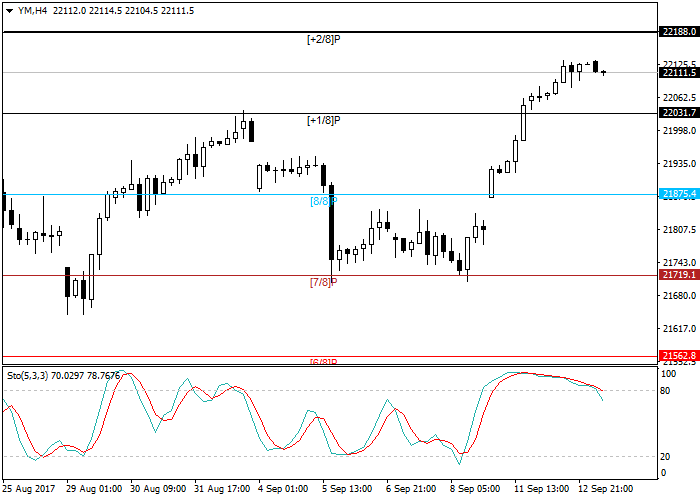

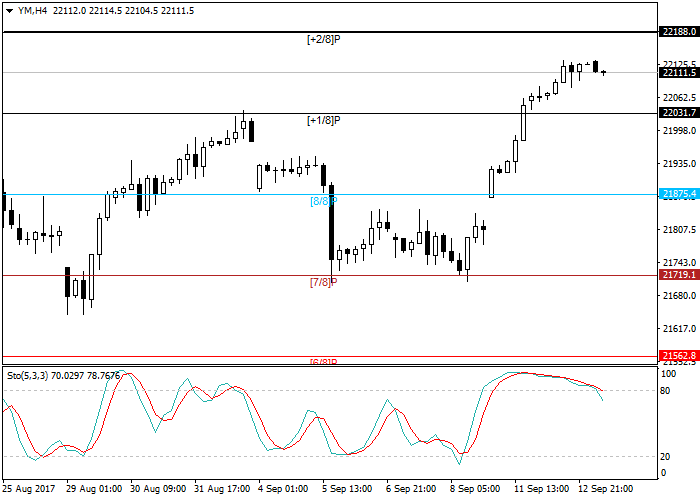

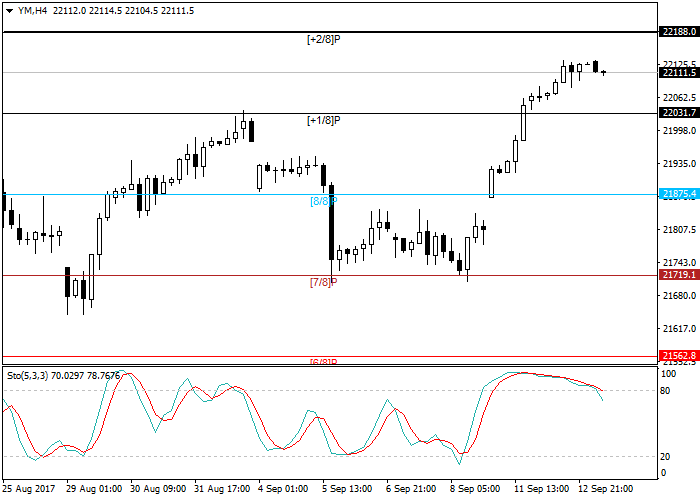

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 22031.7 |

| Take Profit | 22188.0 |

| Stop Loss | 21932.0 |

| Key Levels | 22031.7, 22188.0 |

Current trend

Dow Jones index continues to trade around its historical values at 22111.5. The nearest support level is at +1/8 Murrey or 22031.7.

The growth of American indexes is explained by the release of tension around North Korea. The second important factor is the assessment of the consequences of Irma storm that were not very strong in economic terms. In view of this the stock of many insurance companies and the banking sector showed considerably growth which had a positive effect on the stock index. Technological sector securities also played an important role. The leader here was Apple that presented three new iPhones today with wireless charging and stronger modern processors.

Support and resistance

Stochastic is at 78 points indicating possible correction from current levels. Therefore long positions should be opened from the level of 22031.7 or 1/8 Murrey.

Resistance levels: 22188.0.

Support levels: 22031.7.

Trading tips

Long positions may be opened from the level of 22031.7 with target at 22188.0 and stop-loss at 21932.0.

Dow Jones index continues to trade around its historical values at 22111.5. The nearest support level is at +1/8 Murrey or 22031.7.

The growth of American indexes is explained by the release of tension around North Korea. The second important factor is the assessment of the consequences of Irma storm that were not very strong in economic terms. In view of this the stock of many insurance companies and the banking sector showed considerably growth which had a positive effect on the stock index. Technological sector securities also played an important role. The leader here was Apple that presented three new iPhones today with wireless charging and stronger modern processors.

Support and resistance

Stochastic is at 78 points indicating possible correction from current levels. Therefore long positions should be opened from the level of 22031.7 or 1/8 Murrey.

Resistance levels: 22188.0.

Support levels: 22031.7.

Trading tips

Long positions may be opened from the level of 22031.7 with target at 22188.0 and stop-loss at 21932.0.

No comments:

Write comments