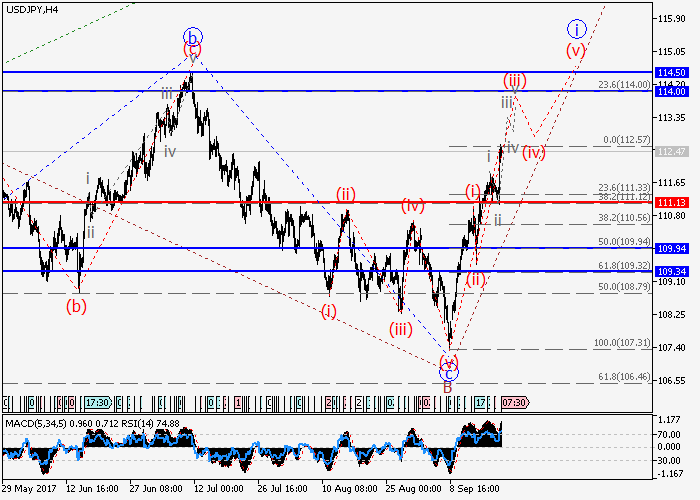

USD/JPY: wave analysis

21 September 2017, 09:16

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 112.60 |

| Take Profit | 114.00, 114.50 |

| Stop Loss | 112.00 |

| Key Levels | 109.34, 109.94, 111.13, 114.00, 114.50 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 111.10 |

| Take Profit | 109.94, 109.34 |

| Stop Loss | 111.70 |

| Key Levels | 109.34, 109.94, 111.13, 114.00, 114.50 |

The upward trend is in force.

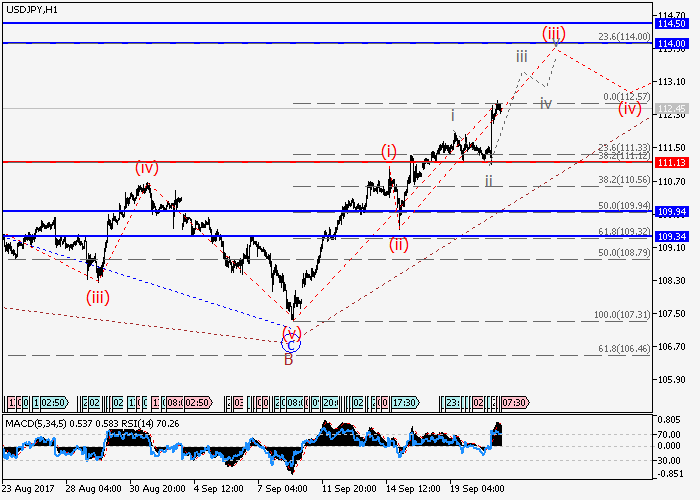

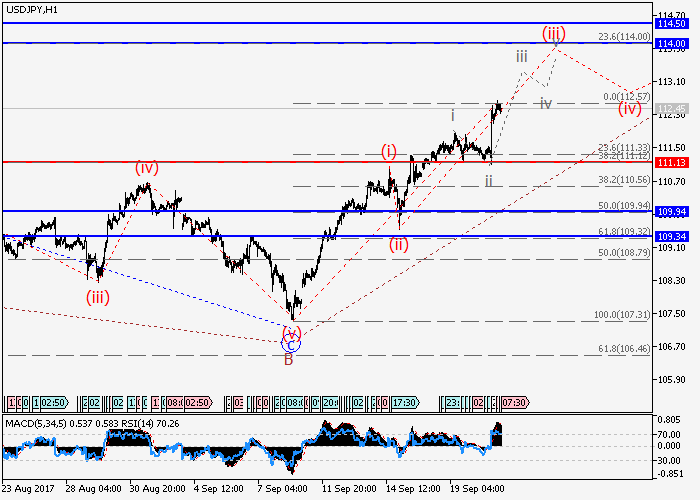

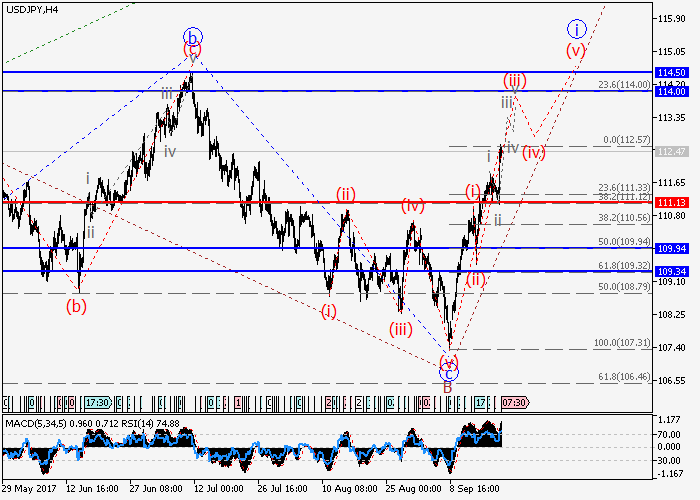

Presumably, the higher level C wave is forming, within the framework of which the first wave i is developing. At the moment, the third wave of the lower level (iii) of i is forming. If the assumption is true, it is logical to expect the pair to rise to 114.00-114.50. The level of 111.13 is critical for this scenario.

Main scenario

Buy during corrections, above the level of 111.13 with a target in the range of 114.00-114.50.

Alternative scenario

Breakdown of the level of 111.13 will allow the pair to continue the decline to the levels of 109.94-109.34.

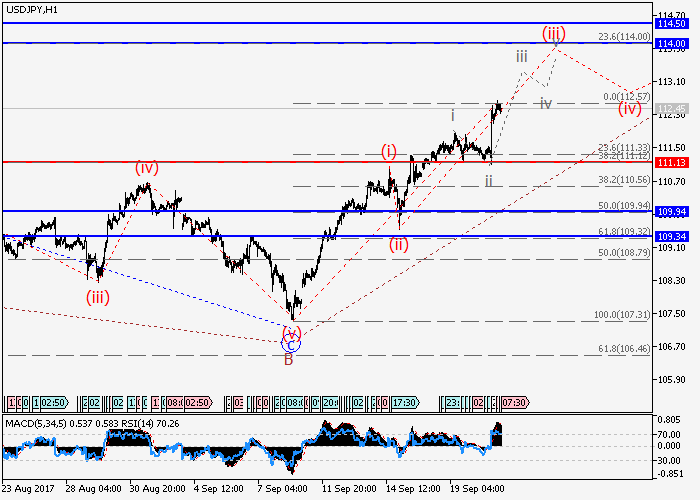

Presumably, the higher level C wave is forming, within the framework of which the first wave i is developing. At the moment, the third wave of the lower level (iii) of i is forming. If the assumption is true, it is logical to expect the pair to rise to 114.00-114.50. The level of 111.13 is critical for this scenario.

Main scenario

Buy during corrections, above the level of 111.13 with a target in the range of 114.00-114.50.

Alternative scenario

Breakdown of the level of 111.13 will allow the pair to continue the decline to the levels of 109.94-109.34.

No comments:

Write comments