USD/JPY: dollar is correcting

11 September 2017, 09:55

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 108.60 |

| Take Profit | 109.11, 109.41 |

| Stop Loss | 108.00 |

| Key Levels | 107.30, 107.50, 108.00, 108.24, 108.54, 108.83, 109.11, 109.41, 109.82 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 108.20 |

| Take Profit | 107.50, 107.30 |

| Stop Loss | 108.70 |

| Key Levels | 107.30, 107.50, 108.00, 108.24, 108.54, 108.83, 109.11, 109.41, 109.82 |

Current trend

During morning trading session on September, 11, USD is moderately growing, stepping off the record lows, renewed in the end of the last week. Yen ended the week growing, despite the publication of controversial macroeconomic statistics from Japan on Friday, September, 8.

Releases, published in the morning of September, 11, are affecting the market’s dynamics controversial. In July Machinery Orders grew by 8.0% MoM against the expected growth by 4.4% MoM, but the YoY index decreased by 7.5%, while the value of –7.3% was expected.

Despite the number of technical facts, the growth of dollar was supported by the decrease of tense upon the North Korea situation, as there was no missile testing on weekend, despite the expectations.

Support and resistance

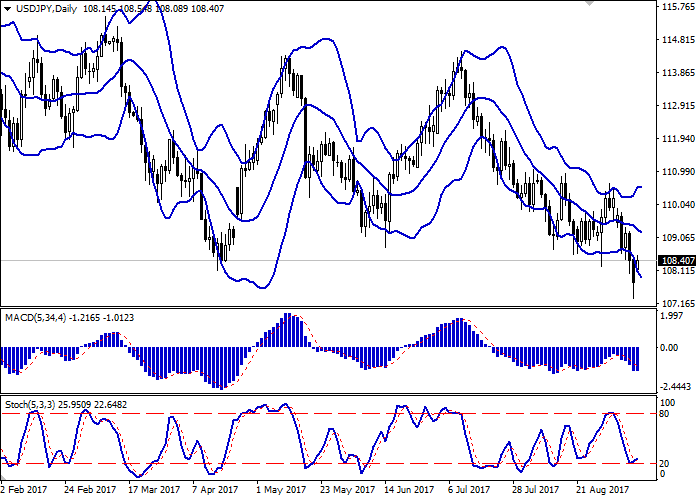

On the daily chart Bollinger Bands are falling. The price range is widening from below. The indicator reflects the possibility of the correctional growth of the pair to the area of 109.00–109.20.

MACD is trying to reverse into growing, keeping the same sell signal (the histogram is above the signal line). It’s better to wait until the situation is clear. Some of the profitable short positions can be closed.

Stochastic is reversing upwards, kicking off the border of the oversold area. According to the indicator’s readings, the short term upward correction of the instrument can develop further.

Resistance levels: 108.54, 108.83, 109.11, 109.41, 109.82.

Support levels: 108.24, 108.00, 107.50, 107.30.

Trading tips

Long positions can be opened after the breakout of the level of 108.54. Take profit is 109.11–109.41. Stop loss is 108.00. Implementation period: 1-2 days.

The downward reversal around the level of 108.54 can reflect the returning of the previous trend. In this case the “bearish” targets are around 107.50–107.30. Stop loss is 108.70. Implementation period: 2-3 days.

During morning trading session on September, 11, USD is moderately growing, stepping off the record lows, renewed in the end of the last week. Yen ended the week growing, despite the publication of controversial macroeconomic statistics from Japan on Friday, September, 8.

Releases, published in the morning of September, 11, are affecting the market’s dynamics controversial. In July Machinery Orders grew by 8.0% MoM against the expected growth by 4.4% MoM, but the YoY index decreased by 7.5%, while the value of –7.3% was expected.

Despite the number of technical facts, the growth of dollar was supported by the decrease of tense upon the North Korea situation, as there was no missile testing on weekend, despite the expectations.

Support and resistance

On the daily chart Bollinger Bands are falling. The price range is widening from below. The indicator reflects the possibility of the correctional growth of the pair to the area of 109.00–109.20.

MACD is trying to reverse into growing, keeping the same sell signal (the histogram is above the signal line). It’s better to wait until the situation is clear. Some of the profitable short positions can be closed.

Stochastic is reversing upwards, kicking off the border of the oversold area. According to the indicator’s readings, the short term upward correction of the instrument can develop further.

Resistance levels: 108.54, 108.83, 109.11, 109.41, 109.82.

Support levels: 108.24, 108.00, 107.50, 107.30.

Trading tips

Long positions can be opened after the breakout of the level of 108.54. Take profit is 109.11–109.41. Stop loss is 108.00. Implementation period: 1-2 days.

The downward reversal around the level of 108.54 can reflect the returning of the previous trend. In this case the “bearish” targets are around 107.50–107.30. Stop loss is 108.70. Implementation period: 2-3 days.

No comments:

Write comments