USD/CHF: USD is trying to strengthen

07 September 2017, 09:21

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.9580, 0.9605 |

| Take Profit | 0.9650, 0.9670 |

| Stop Loss | 0.9540 |

| Key Levels | 0.9425, 0.9474, 0.9496, 0.9525, 0.9541, 0.9575, 0.9600, 0.9650, 0.9677, 0.9695 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.9535, 0.9520 |

| Take Profit | 0.9450, 0.9425 |

| Stop Loss | 0.9575, 0.9600 |

| Key Levels | 0.9425, 0.9474, 0.9496, 0.9525, 0.9541, 0.9575, 0.9600, 0.9650, 0.9677, 0.9695 |

Current trend

Dollar has shown unstable growth against Swiss franc as a result of trading on Wednesday, September 6, moving away from the updated local minimum since August 29. The reason for this dynamics was uncertain macroeconomic statistics from the USA and growing risks of the Fed's refusal from yet another increase of the interest rate in the end of the year.

Similar dynamics is observed during the morning session on September 7. This is partially explained by expected volumes of statistics from Eurozone. Thus, Eurozone GDP for Q2 2017 is due at 11:00 (GMT+2). ECB is to publish its decision on the interest rate at 13:45 (GMT+2) and host a press conference on fiscal policy at 14:30 (GMT+2).

Support and resistance

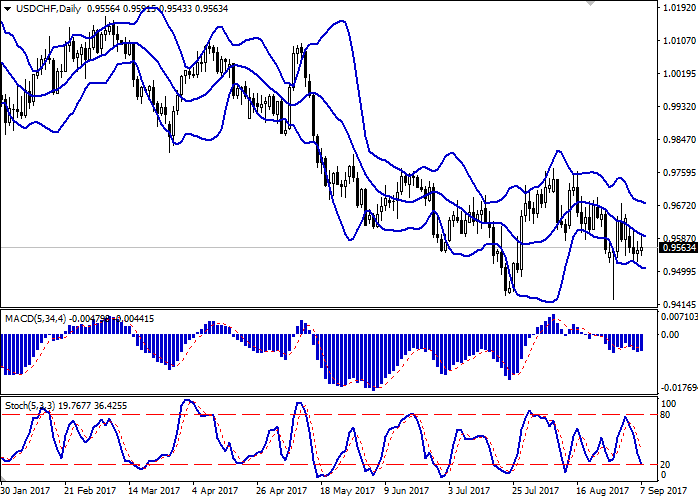

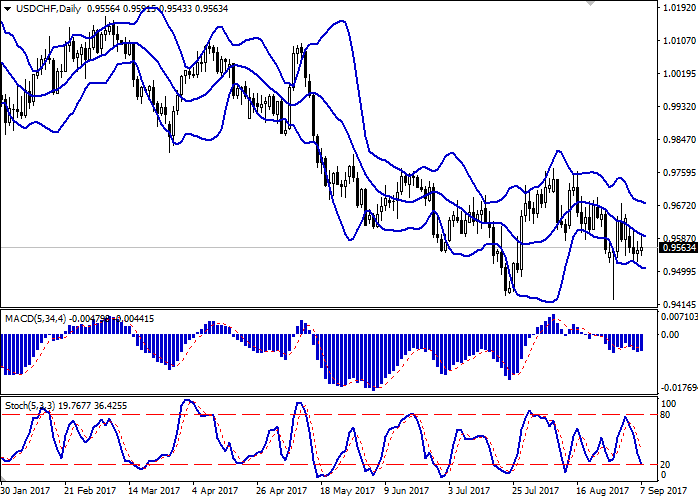

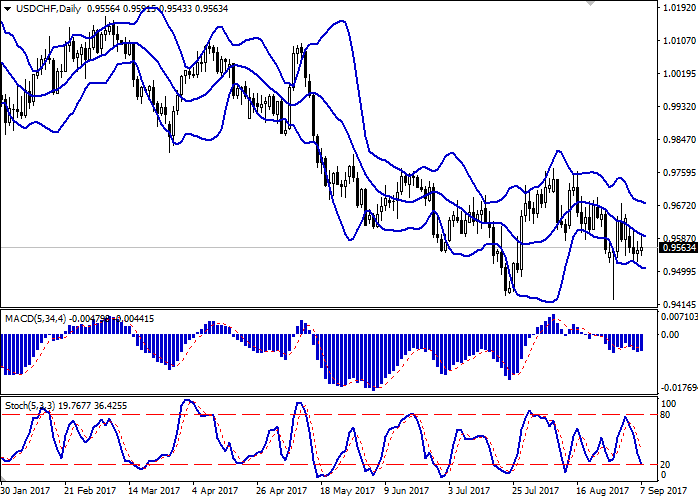

Bollinger Bands in D1 chart demonstrate moderate decrease. The price range practically does not change its borders.

MACD is reversing upwards preserving a sell signal (being located under the signal line). Stochastic remains directed downwards approaching the border of the oversold area.

Resistance levels: 0.9575, 0.9600, 0.9650, 0.9677, 0.9695.

Support levels: 0.9541, 0.9525, 0.9496, 0.9474, 0.9425.

Trading tips

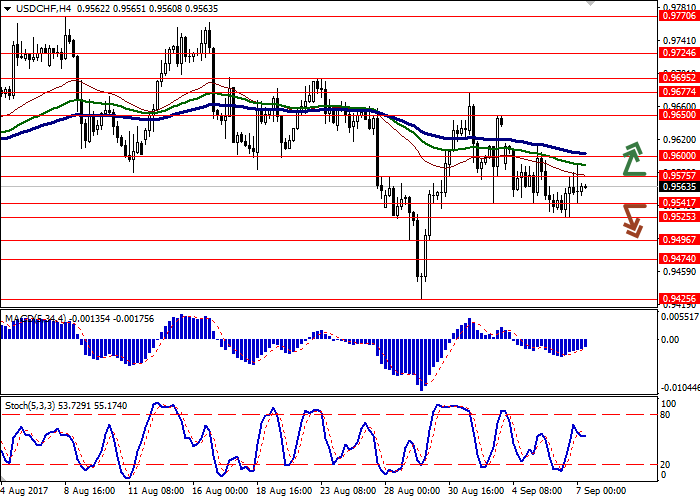

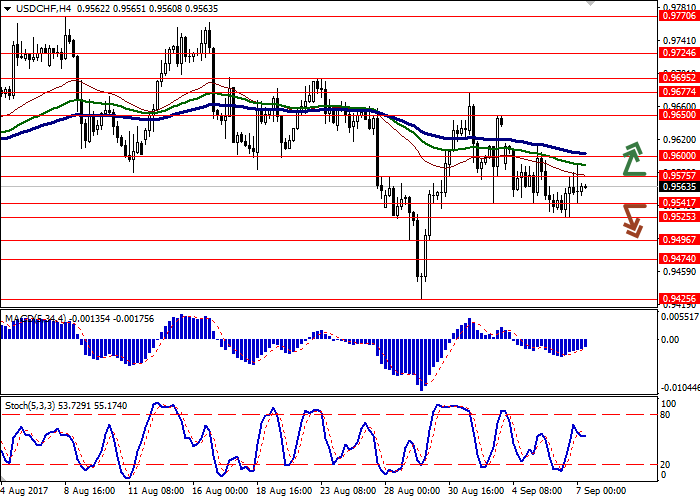

Long positions may be opened after breaking through the levels of 0.9575, 0.9600 with targets at 0.9650, 0.9670 and stop-loss at 0.9540. The period of implementation is 2-3 days.

The consolidation of the instrument below the levels of 0.9541, 0.9525 may indicate sales with targets at 0.9450, 0.9425 and stop-loss at 0.9575, 0.9600. The period of implementation is 2-3 days.

Dollar has shown unstable growth against Swiss franc as a result of trading on Wednesday, September 6, moving away from the updated local minimum since August 29. The reason for this dynamics was uncertain macroeconomic statistics from the USA and growing risks of the Fed's refusal from yet another increase of the interest rate in the end of the year.

Similar dynamics is observed during the morning session on September 7. This is partially explained by expected volumes of statistics from Eurozone. Thus, Eurozone GDP for Q2 2017 is due at 11:00 (GMT+2). ECB is to publish its decision on the interest rate at 13:45 (GMT+2) and host a press conference on fiscal policy at 14:30 (GMT+2).

Support and resistance

Bollinger Bands in D1 chart demonstrate moderate decrease. The price range practically does not change its borders.

MACD is reversing upwards preserving a sell signal (being located under the signal line). Stochastic remains directed downwards approaching the border of the oversold area.

Resistance levels: 0.9575, 0.9600, 0.9650, 0.9677, 0.9695.

Support levels: 0.9541, 0.9525, 0.9496, 0.9474, 0.9425.

Trading tips

Long positions may be opened after breaking through the levels of 0.9575, 0.9600 with targets at 0.9650, 0.9670 and stop-loss at 0.9540. The period of implementation is 2-3 days.

The consolidation of the instrument below the levels of 0.9541, 0.9525 may indicate sales with targets at 0.9450, 0.9425 and stop-loss at 0.9575, 0.9600. The period of implementation is 2-3 days.

No comments:

Write comments