USD/CAD: general analysis

12 September 2017, 12:14

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL |

| Entry Point | 1.2116 |

| Take Profit | 1.2000, 1.1960 |

| Stop Loss | 1.2180 |

| Key Levels | 1.1910, 1.1955, 1.2000, 1.2075, 1.2175, 1.2255, 1.2360, 1.2425, 1.2540, 1.2660, 1.2800 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.2175 |

| Take Profit | 1.2250 |

| Stop Loss | 1.2145 |

| Key Levels | 1.1910, 1.1955, 1.2000, 1.2075, 1.2175, 1.2255, 1.2360, 1.2425, 1.2540, 1.2660, 1.2800 |

Current trend

The USD/CAD pair is the only one which continued to trade in the downward trend. The restoration of USD is due to the fact the hurricane Irma has brought lesser damage to Florida than expected. In addition, the DPRK didn’t start the missile test last weekend, and the news that North Korea is ready to negotiate gives a hope that a conflict will soon be solved peacefully.

At the same time the Canadian dollar is strengthening. The main growth driver is the increase of oil prices by 1.2%. In addition, Canada Housing Starts indicator has grown, as the analysts expected the significant fall of the value. Taking into consideration that the world oil recourses are supposed to fall further and the investors’ waiting of the new interest rate rise by Canadian regulator this year, CAD has very good growth perspectives.

Today the key issue is API Weekly Crude Oil Stock publication. If the index falls, the pair will decrease.

Support and resistance

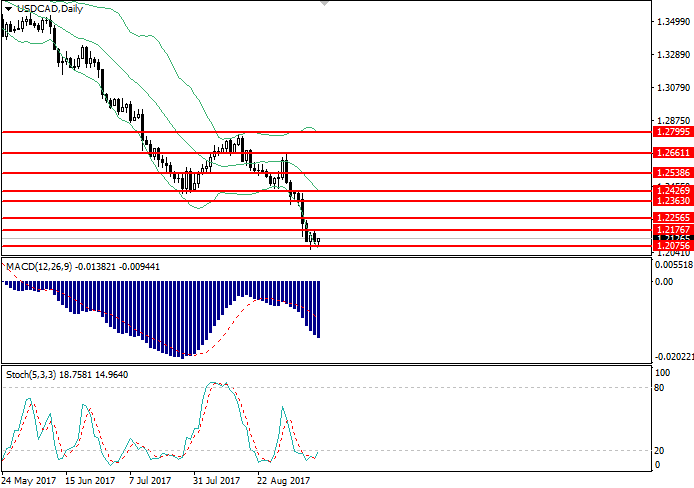

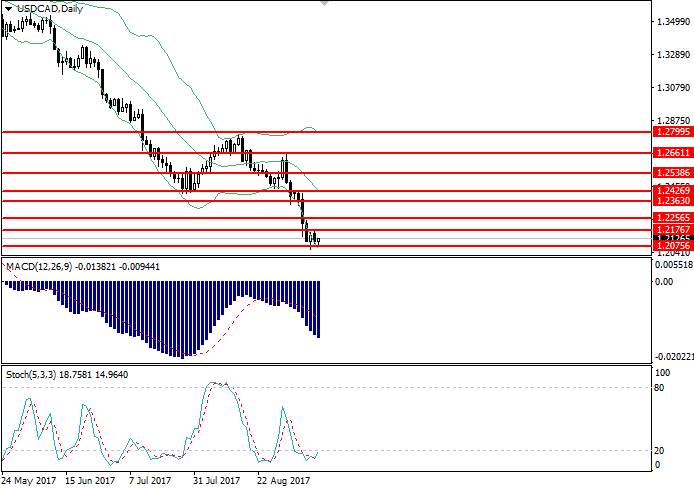

On the daily chart the instrument is testing the resistance level of 1.2075. Bollinger Bands are pointed downwards, as the price range is widen, reflecting the development of the downward trend. MACD histogram is in the negative zone, keeping a strong sell signal. Stochastic is ready to leave the overbought area.

Resistance levels: 1.2175, 1.2255, 1.2360, 1.2425, 1.2540, 1.2660, 1.2800.

Support levels: 1.2075, 1.2000, 1.1955, 1.1910.

Trading tips

Short positions can be opened at the current price with the targets at 1.2000, 1.1960 and stop loss at 1.2180. Implementation period: 1-3 days.

Long positions can be opened at the level of 1.2175 with the target at 1.2250 and stop loss at 1.2145. Implementation period: 1-2 days.

The USD/CAD pair is the only one which continued to trade in the downward trend. The restoration of USD is due to the fact the hurricane Irma has brought lesser damage to Florida than expected. In addition, the DPRK didn’t start the missile test last weekend, and the news that North Korea is ready to negotiate gives a hope that a conflict will soon be solved peacefully.

At the same time the Canadian dollar is strengthening. The main growth driver is the increase of oil prices by 1.2%. In addition, Canada Housing Starts indicator has grown, as the analysts expected the significant fall of the value. Taking into consideration that the world oil recourses are supposed to fall further and the investors’ waiting of the new interest rate rise by Canadian regulator this year, CAD has very good growth perspectives.

Today the key issue is API Weekly Crude Oil Stock publication. If the index falls, the pair will decrease.

Support and resistance

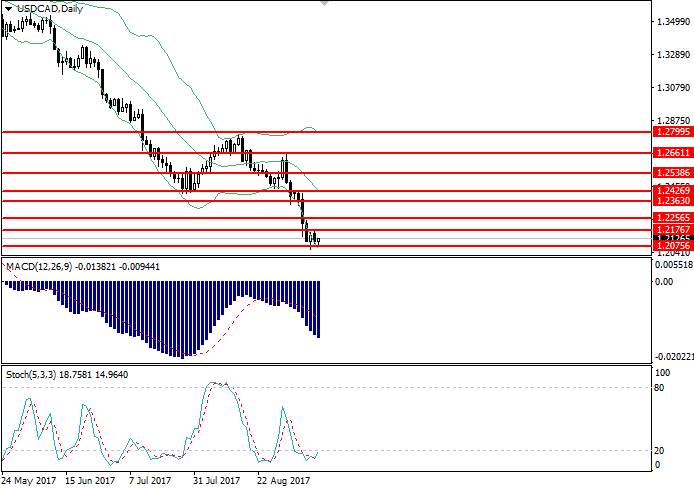

On the daily chart the instrument is testing the resistance level of 1.2075. Bollinger Bands are pointed downwards, as the price range is widen, reflecting the development of the downward trend. MACD histogram is in the negative zone, keeping a strong sell signal. Stochastic is ready to leave the overbought area.

Resistance levels: 1.2175, 1.2255, 1.2360, 1.2425, 1.2540, 1.2660, 1.2800.

Support levels: 1.2075, 1.2000, 1.1955, 1.1910.

Trading tips

Short positions can be opened at the current price with the targets at 1.2000, 1.1960 and stop loss at 1.2180. Implementation period: 1-3 days.

Long positions can be opened at the level of 1.2175 with the target at 1.2250 and stop loss at 1.2145. Implementation period: 1-2 days.

No comments:

Write comments