NZD/USD: general review

12 September 2017, 12:05

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 0.7301 |

| Take Profit | 0.7415 |

| Stop Loss | 0.7250 |

| Key Levels | 0.7130, 0.7160, 0.7200, 0.7250, 0.7280, 0.7300, 0.7330, 0.7415 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.7220 |

| Take Profit | 0.7160 |

| Stop Loss | 0.7250 |

| Key Levels | 0.7130, 0.7160, 0.7200, 0.7250, 0.7280, 0.7300, 0.7330, 0.7415 |

Current trend

Today NZD is strengthening against US dollar. The price is approaching last week's maximums. Rapid growth was not connected to the release of macroeconomic indicators. On the contrary, yesterday NZD dropped against US dollar in view of the release of mixed statistics on credit card expenses and reduction of expenses for everyday commodities.

Today traders have to pay special attention to the release of the data on changes in Redbook retail sales index in the USA.

Support and resistance

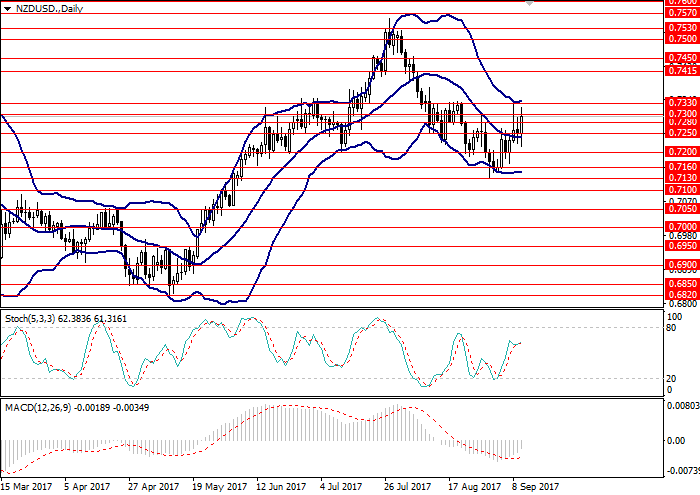

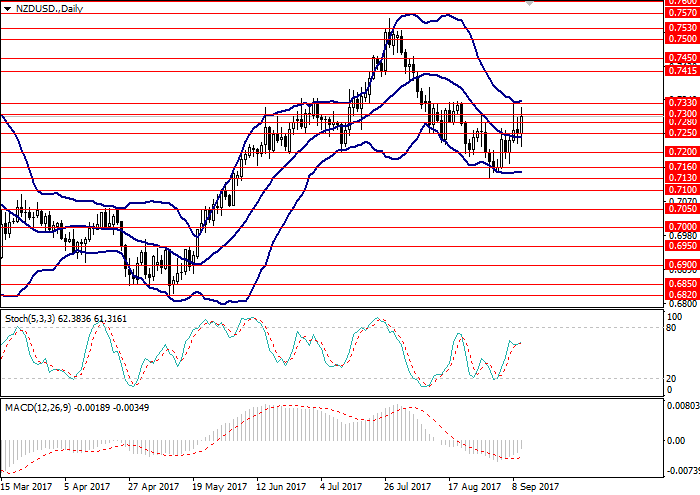

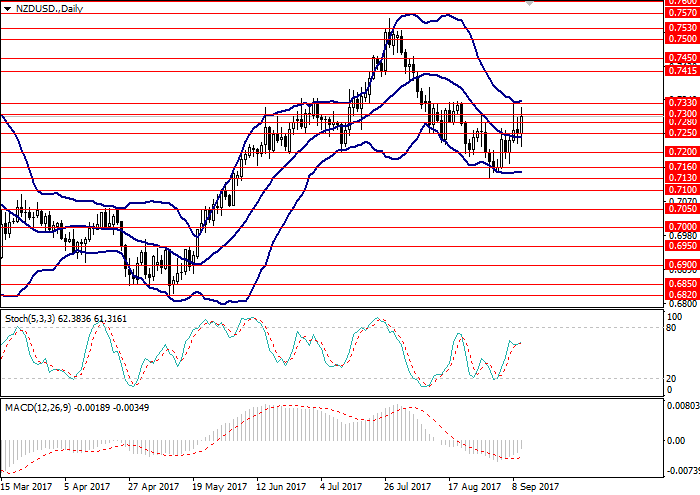

The growth of the price may be technical. It is possible that we are observing a return to an upward trend after a prolonged period of correction. On the D1 chart the pair is growing to the upper border of Bollinger Bands, and MACD histogram is in the negative area. However, its volumes are gradually reducing, and the signal line is reversing upwards. In case the zero mark is broken through from below, a buy signal will be received.

Support levels: 0.7280, 0.7250, 0.7200, 0.7160, 0.7130.

Resistance levels: 0.7300, 0.7330, 0.7415

Trading tips

Long positions may be opened from the current price with targets at 0.7415 and stop-loss at 0.7250.

Short positions may be opened from the level of 0.7220 with target 0.7160 and stop-loss at 0.7250.

The period of implementation is 1-3 days.

Today NZD is strengthening against US dollar. The price is approaching last week's maximums. Rapid growth was not connected to the release of macroeconomic indicators. On the contrary, yesterday NZD dropped against US dollar in view of the release of mixed statistics on credit card expenses and reduction of expenses for everyday commodities.

Today traders have to pay special attention to the release of the data on changes in Redbook retail sales index in the USA.

Support and resistance

The growth of the price may be technical. It is possible that we are observing a return to an upward trend after a prolonged period of correction. On the D1 chart the pair is growing to the upper border of Bollinger Bands, and MACD histogram is in the negative area. However, its volumes are gradually reducing, and the signal line is reversing upwards. In case the zero mark is broken through from below, a buy signal will be received.

Support levels: 0.7280, 0.7250, 0.7200, 0.7160, 0.7130.

Resistance levels: 0.7300, 0.7330, 0.7415

Trading tips

Long positions may be opened from the current price with targets at 0.7415 and stop-loss at 0.7250.

Short positions may be opened from the level of 0.7220 with target 0.7160 and stop-loss at 0.7250.

The period of implementation is 1-3 days.

No comments:

Write comments