GBP/USD: waiting for the inflation data

11 September 2017, 12:48

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.3220 |

| Take Profit | 1.3300 |

| Stop Loss | 1.3170 |

| Key Levels | 1.2930, 1.3000, 1.3100, 1.3215, 1.3300, 1.3370 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.3155 |

| Take Profit | 1.3100, 1.3000 |

| Stop Loss | 1.3190 |

| Key Levels | 1.2930, 1.3000, 1.3100, 1.3215, 1.3300, 1.3370 |

Current trend

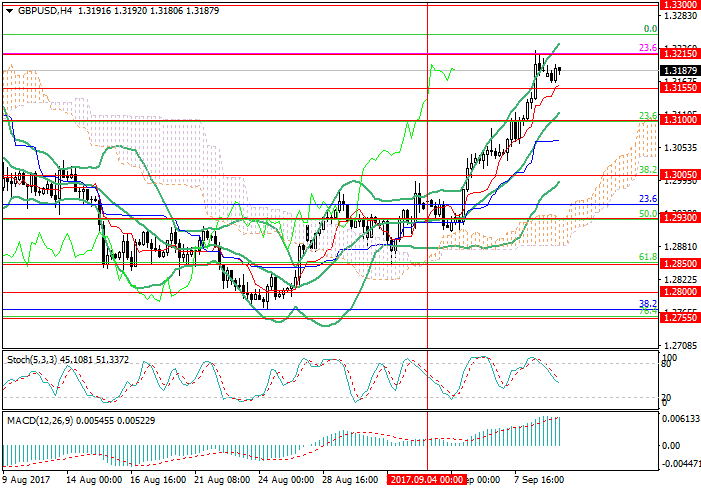

During the last week pound was growing against dollar, and on Friday the pair tested the level of 1.3215 (Fibonacci correction 23.6% for long term trend). The consolidation of the price above this level will let the price to grow to the levels of 1.3300 (Murray [+2/8]) and 1.3370. Otherwise the correction to the levels of 1.3100 (the middle line of Bollinger Bands, Fibonacci correction 23.6%) and 1.3000 (Fibonacci correction 38.2%, Murray [5/8]) can begin.

At the moment the pair is calm, as the investors are waiting for a number of fundamental issues. Today the British Parliament will vote upon the cessation of the EU laws primacy on the Great Britain territory, if the vote fails, the pound will be under pressure. However, August inflation UK statistics to be published on Tuesday seems more important. The index is expected to go upwards again and reach the level of 2.8%. In this case the Bank of England officials should think about the reduction of the stimulation measures and the possibility of interest rate rise. The nearest regulator’s meeting is due at Thursday, and inflation data can greatly affect its agenda.

Support and resistance

Technical indicators don’t give clear signals, reflecting the uncertainty of the market before the key fundamental issues. Bollinger Bands are pointed upwards, confirming the upward trend. MACD histogram is stable in the positive zone, Stochastic is pointed downwards.

Resistance levels: 1.3215, 1.3300, 1.3370.

Support levels: 1.3100, 1.3000, 1.2930.

Trading tips

Long positions can be opened above the level of 1.3215 with the target at 1.3300 and stop loss at 1.3170.

Short positions can be opened at the level of 1.3155 with the targets at 1.3100, 1.3000 and stop loss at 1.3190.

During the last week pound was growing against dollar, and on Friday the pair tested the level of 1.3215 (Fibonacci correction 23.6% for long term trend). The consolidation of the price above this level will let the price to grow to the levels of 1.3300 (Murray [+2/8]) and 1.3370. Otherwise the correction to the levels of 1.3100 (the middle line of Bollinger Bands, Fibonacci correction 23.6%) and 1.3000 (Fibonacci correction 38.2%, Murray [5/8]) can begin.

At the moment the pair is calm, as the investors are waiting for a number of fundamental issues. Today the British Parliament will vote upon the cessation of the EU laws primacy on the Great Britain territory, if the vote fails, the pound will be under pressure. However, August inflation UK statistics to be published on Tuesday seems more important. The index is expected to go upwards again and reach the level of 2.8%. In this case the Bank of England officials should think about the reduction of the stimulation measures and the possibility of interest rate rise. The nearest regulator’s meeting is due at Thursday, and inflation data can greatly affect its agenda.

Support and resistance

Technical indicators don’t give clear signals, reflecting the uncertainty of the market before the key fundamental issues. Bollinger Bands are pointed upwards, confirming the upward trend. MACD histogram is stable in the positive zone, Stochastic is pointed downwards.

Resistance levels: 1.3215, 1.3300, 1.3370.

Support levels: 1.3100, 1.3000, 1.2930.

Trading tips

Long positions can be opened above the level of 1.3215 with the target at 1.3300 and stop loss at 1.3170.

Short positions can be opened at the level of 1.3155 with the targets at 1.3100, 1.3000 and stop loss at 1.3190.

No comments:

Write comments