GBP/USD: the trend is in favor of the pound

13 September 2017, 15:05

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 1.3262 |

| Take Profit | 1.3480, 1.3570 |

| Stop Loss | 1.2960 |

| Key Levels | 1.2805, 1.2835, 1.2930, 1.3000, 1.3020, 1.3125, 1.3250, 1.3310, 1.3380, 1.3450,1 .3480, 1.3570 |

Current trend

Confirming the previous forecast, GBP rapidly went up against USD in the first half of September. First of all, it gained considerable investor support in the framework of the pair's technical tendency. The second growth factor is the weakness of USD that is still under pressure of the fundamental background.

Last week weak data on the US labor market and several indexes were released and put additional pressure on USD. The releases from the main sectors of the UK economy were positive, and the Bank of England is considering tightening its monetary policy in view of faster economic growth. In the end of the current week the USA is to release main indexes, inflation pressure, industrial output, and retail sales data. The UK will respond with a decision on the interest rate and assets purchase volumes.

Support and resistance

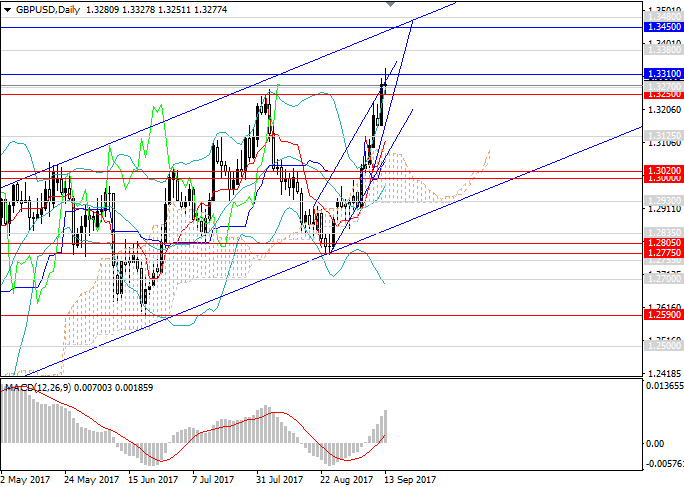

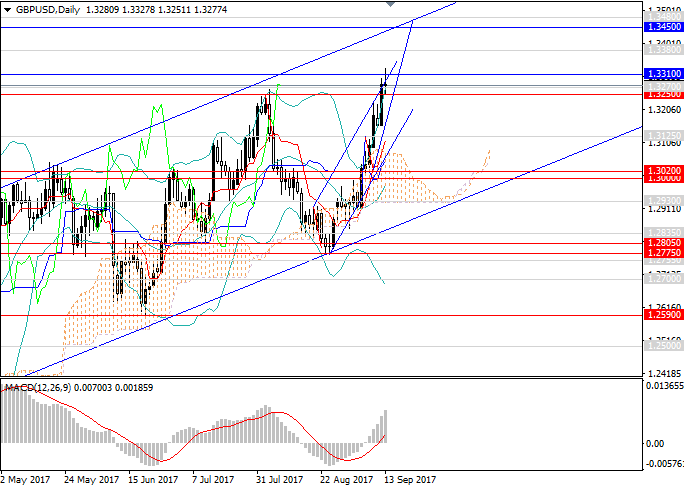

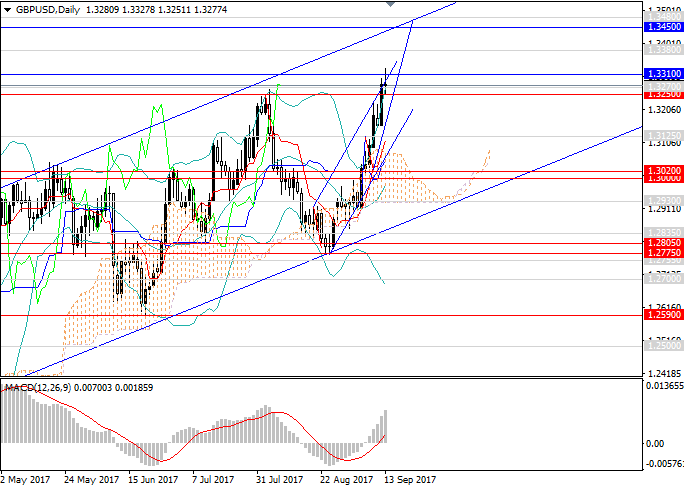

Technically the pair is in the long-term trend, and its next targets are 1.3480, 1.3570. Technical indicators confirm the consolidation outlook in the medium term: MACD shows rapid growth in the volume of long positions, and Bollinger Bands gradually become upward.

Support levels: 1.3250, 1.3125, 1.3020, 1.3000, 1.2930, 1.2835, 1.2805.

Resistance levels: 1.3310, 1.3380, 1.3450, 1.3480, 1.3570.

Trading tips

In this situation long positions may be opened in the trend with targets at 1.3480, 1.3570. Stop-loss may be placed at 1.2960.

Confirming the previous forecast, GBP rapidly went up against USD in the first half of September. First of all, it gained considerable investor support in the framework of the pair's technical tendency. The second growth factor is the weakness of USD that is still under pressure of the fundamental background.

Last week weak data on the US labor market and several indexes were released and put additional pressure on USD. The releases from the main sectors of the UK economy were positive, and the Bank of England is considering tightening its monetary policy in view of faster economic growth. In the end of the current week the USA is to release main indexes, inflation pressure, industrial output, and retail sales data. The UK will respond with a decision on the interest rate and assets purchase volumes.

Support and resistance

Technically the pair is in the long-term trend, and its next targets are 1.3480, 1.3570. Technical indicators confirm the consolidation outlook in the medium term: MACD shows rapid growth in the volume of long positions, and Bollinger Bands gradually become upward.

Support levels: 1.3250, 1.3125, 1.3020, 1.3000, 1.2930, 1.2835, 1.2805.

Resistance levels: 1.3310, 1.3380, 1.3450, 1.3480, 1.3570.

Trading tips

In this situation long positions may be opened in the trend with targets at 1.3480, 1.3570. Stop-loss may be placed at 1.2960.

No comments:

Write comments