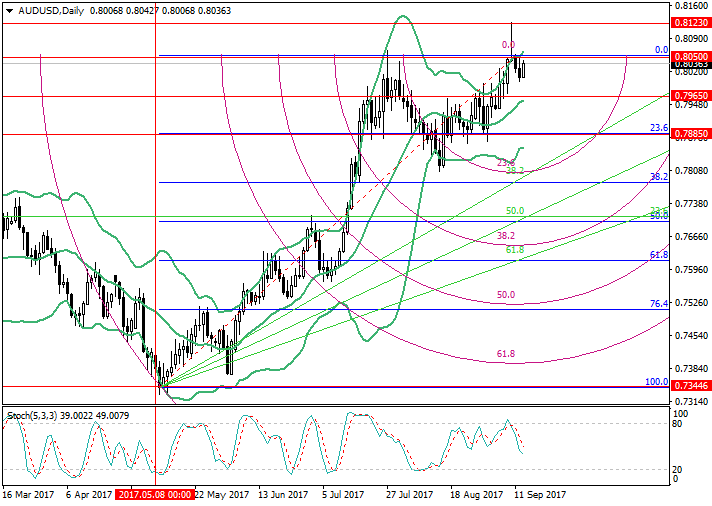

AUD/USD: Fibonacci analysis

13 September 2017, 13:56

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 0.8030 |

| Take Profit | 0.8000, 0.7965 |

| Stop Loss | 0.8060 |

| Key Levels | 0.7965, 0.8000, 0.8050, 0.8085, 0.8120, 0.8123 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 0.8055 |

| Take Profit | 0.8085, 0.8123 |

| Stop Loss | 0.8020 |

| Key Levels | 0.7965, 0.8000, 0.8050, 0.8085, 0.8120, 0.8123 |

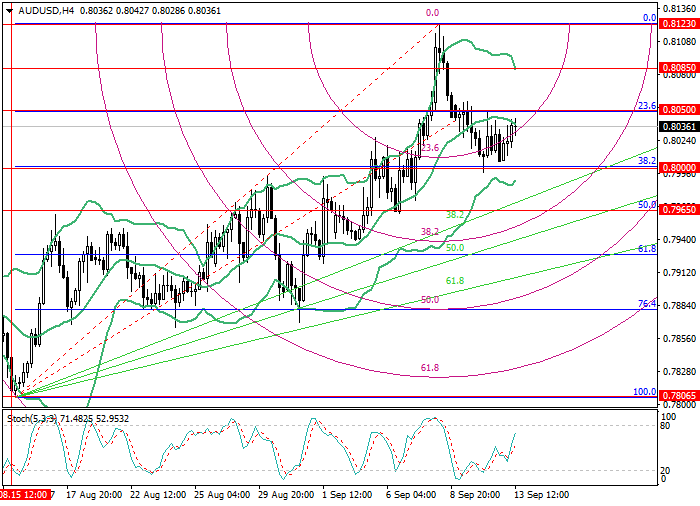

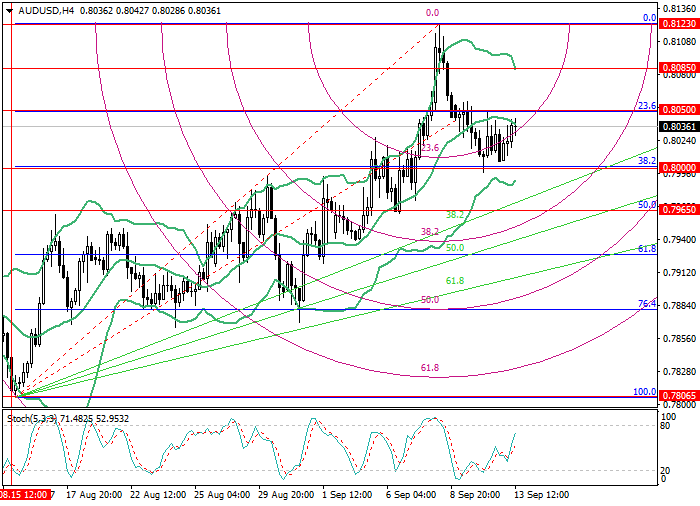

On the 4-hour chart the price has rebounded from of 0.8000 (correction 23.6%)

and is moving upwards along the curve 23.6%. The level of 0.8050 (correction

23.6%, the middle line of Bollinger Bands) is the obstacle to the growth. In

case of breakout the price can grow to the levels of 0.8085 (the upper border of

Bollinger Bands) and 0.8123 (September highs). Otherwise the correction to the

levels of 0.8000 and 0.7965 (correction 50.0%) at the area of crossing with the

upward fan line 38.2% is possible. Stochastic has reversed upwards, but is not

far from the overbought area, which limits the growth potential.

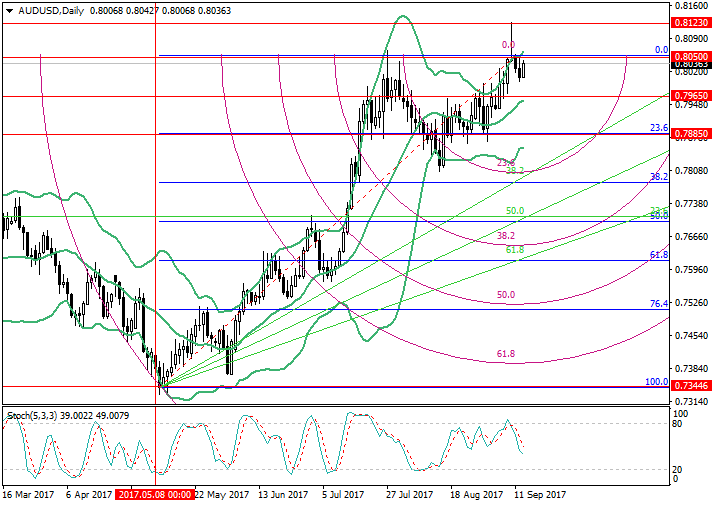

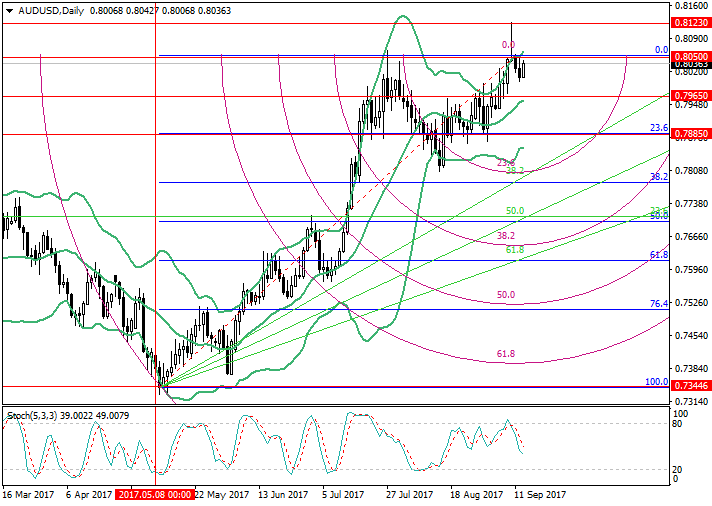

On the daily chart the price is reaching the key level of 0.8050 and in case of the breakout can grow to September highs around 0.8120. Otherwise the pair can be corrected to the level of 0.7965 (the middle line of Bollinger Bands, correction 50.0% for H4). Taking into the consideration the downward reversal of Stochastic, the price wouldn’t consolidate above the level of 0.8050 in the nearest future.

Main scenario

Short positions can be opened at the level of 0.8030 with the targets at 0.8000, 0.7965. Stop loss is around 0.8060.

Alternative scenario

Long positions can be opened if the price is set above the level of 0.8050 with the targets at 0.8085, 0.8123 and stop loss at 0.8020.

On the daily chart the price is reaching the key level of 0.8050 and in case of the breakout can grow to September highs around 0.8120. Otherwise the pair can be corrected to the level of 0.7965 (the middle line of Bollinger Bands, correction 50.0% for H4). Taking into the consideration the downward reversal of Stochastic, the price wouldn’t consolidate above the level of 0.8050 in the nearest future.

Main scenario

Short positions can be opened at the level of 0.8030 with the targets at 0.8000, 0.7965. Stop loss is around 0.8060.

Alternative scenario

Long positions can be opened if the price is set above the level of 0.8050 with the targets at 0.8085, 0.8123 and stop loss at 0.8020.

No comments:

Write comments