GBP/USD: the pair is going up

18 September 2017, 14:26

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY LIMIT |

| Entry Point | 1.3480, 1.3450, 1.3310 |

| Take Profit | 1.3820, 1.3900 |

| Stop Loss | 1.3110 |

| Key Levels | 1.2930, 1.3020, 1.3125, 1.3270, 1.3310, 1.3380, 1.3450, 1.3480, 1.3615, 1.3715, 1.3820, 1.3900, 1.3950, 1.4570 |

Current trend

Last trading week the British currency rushed to new local maximums in view of investors' interest. There are three main catalysts to this factor: stable weakness of the US currency; growth of investment attractiveness of high-risk assets; and strong fundamental background in the UK that has preserved for a long time.

Last week strong releases on key indexes, inflation, and labor market were published in the UK. These indicators play a key role in making a decision on the tightening of the Bank of England's monetary policy.

During the next trading week special attention should be paid to the statement by the head of the Bank of England Mark Carney, the release of the data on retail sales, and credit applications in the UK. The USA will respond wil labor market data, main indexes, and the Fed's decision on interest rates.

Support and resistance

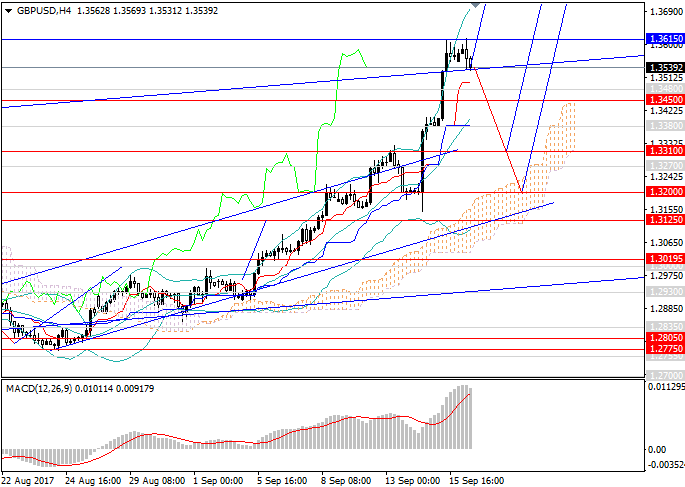

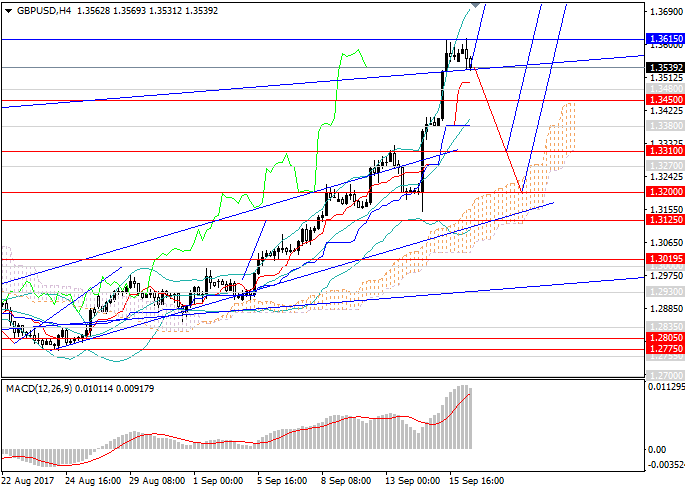

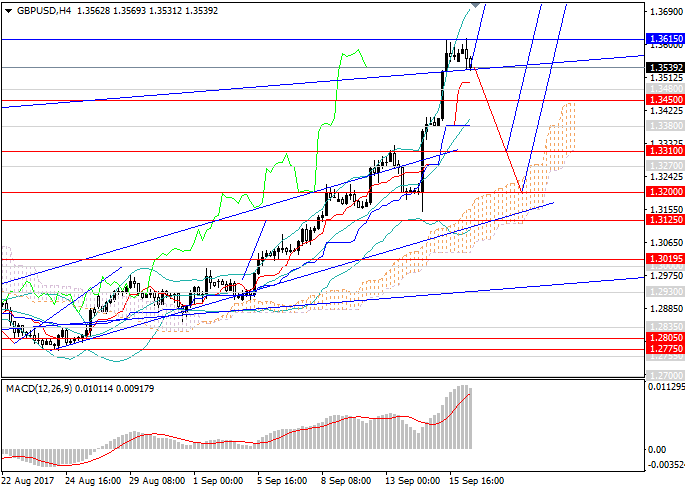

Technical indicators confirm the outlook of the pair's further consolidation. MACD indicates rapid growth in the volume of long positions in the pair, and on the monthly chart the price has broken through the middle line of Bollinger Bands and moved to their upper border at 1.4570.

Support levels: 1.3125,1 .3020, 1.2930.

Resistance levels: 1.3615, 1.3715, 1.3820, 1.3900, 1.3950, 1.4570.

Trading tips

Long positions may be opened from key support levels 1.3480, 1.3450, 1.3310 with targets at 1.3820, 1.3900. Stop-loss may be placed at 1.3110.

Last trading week the British currency rushed to new local maximums in view of investors' interest. There are three main catalysts to this factor: stable weakness of the US currency; growth of investment attractiveness of high-risk assets; and strong fundamental background in the UK that has preserved for a long time.

Last week strong releases on key indexes, inflation, and labor market were published in the UK. These indicators play a key role in making a decision on the tightening of the Bank of England's monetary policy.

During the next trading week special attention should be paid to the statement by the head of the Bank of England Mark Carney, the release of the data on retail sales, and credit applications in the UK. The USA will respond wil labor market data, main indexes, and the Fed's decision on interest rates.

Support and resistance

Technical indicators confirm the outlook of the pair's further consolidation. MACD indicates rapid growth in the volume of long positions in the pair, and on the monthly chart the price has broken through the middle line of Bollinger Bands and moved to their upper border at 1.4570.

Support levels: 1.3125,1 .3020, 1.2930.

Resistance levels: 1.3615, 1.3715, 1.3820, 1.3900, 1.3950, 1.4570.

Trading tips

Long positions may be opened from key support levels 1.3480, 1.3450, 1.3310 with targets at 1.3820, 1.3900. Stop-loss may be placed at 1.3110.

No comments:

Write comments