GBP/USD: dollar is going down

08 September 2017, 14:41

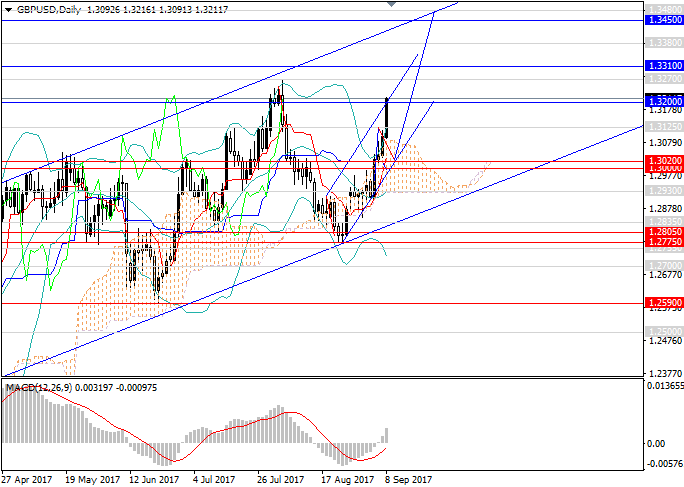

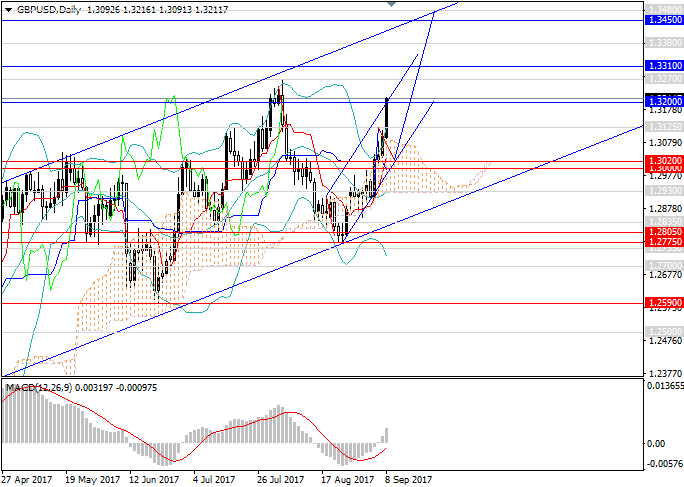

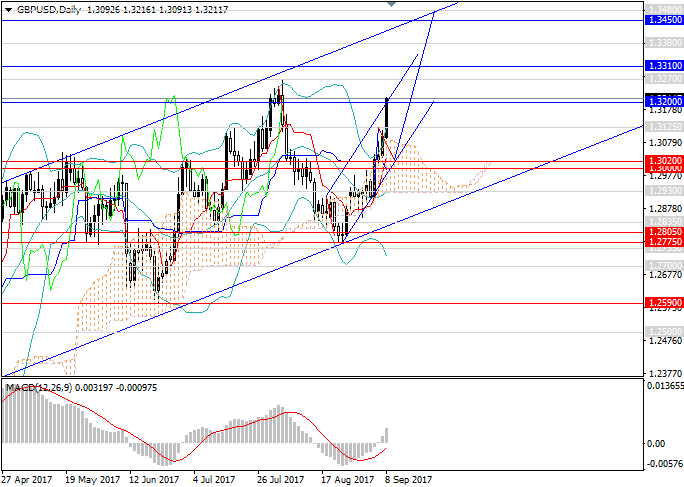

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 1.3215 |

| Take Profit | 1.3450, 1.3480 |

| Stop Loss | 1.2870 |

| Key Levels | 1.2590, 1.2700, 1.2775, 1.2805, 1.2835, 1.2930, 1.3000, 1.3020, 1.3125, 1.3200, 1.3310, 1.3380, 1.3450, 1.3480, 1.3570 |

Current trend

British currency continued to grow against USD due to exceeded demand on pound and sales of weakened US currency after the test of lower border of the long term upward channel at the level of 1.2775. In addition, the fundamental background in the USA is negative, as in the beginning of the week the poor fabric orders release was published, and yesterday the poor data of employment market were released, which is the key economic sector determining the USA Fed’s decision upon the monetary policy tightening.

This week the negative data were published in the UK, too, but didn’t affect the pair’s dynamics. Today the statistics was positive, which added a momentum to the growth of the pair.

In the beginning of the next trading week investors should pay attention to key indices releases, employment market data and Retail Sales publications in the UK, and also to inflation and industrial production data in the USA.

Support and resistance

In the end of the week and in the beginning of the next one the pair will continue to grow to the local maximum at the level of 1.3270. The pair can break this level and test new highs after the UK and USA key releases publications. The possibility of movement within the upward range to the upper border of the channel at the level of 1.3450 is high. Technical indicators confirm the forecast, as MACD long positions volumes are growing, which reflects the rapid growth of the demand on the British pound.

Resistance levels: 1.3200, 1.3310, 1.3380, 1.3450, 1.3480, 1.3570.

Support levels: 1.3125, 1.3020, 1.3000, 1.2930, 1.2835, 1.2805, 1.2775, 1.2700, 1.2590.

Trading tips

It’s better to increase the volume of long positions at the current level with the targets at 1.3450, 1.3480, stop loss is 1.2870.

British currency continued to grow against USD due to exceeded demand on pound and sales of weakened US currency after the test of lower border of the long term upward channel at the level of 1.2775. In addition, the fundamental background in the USA is negative, as in the beginning of the week the poor fabric orders release was published, and yesterday the poor data of employment market were released, which is the key economic sector determining the USA Fed’s decision upon the monetary policy tightening.

This week the negative data were published in the UK, too, but didn’t affect the pair’s dynamics. Today the statistics was positive, which added a momentum to the growth of the pair.

In the beginning of the next trading week investors should pay attention to key indices releases, employment market data and Retail Sales publications in the UK, and also to inflation and industrial production data in the USA.

Support and resistance

In the end of the week and in the beginning of the next one the pair will continue to grow to the local maximum at the level of 1.3270. The pair can break this level and test new highs after the UK and USA key releases publications. The possibility of movement within the upward range to the upper border of the channel at the level of 1.3450 is high. Technical indicators confirm the forecast, as MACD long positions volumes are growing, which reflects the rapid growth of the demand on the British pound.

Resistance levels: 1.3200, 1.3310, 1.3380, 1.3450, 1.3480, 1.3570.

Support levels: 1.3125, 1.3020, 1.3000, 1.2930, 1.2835, 1.2805, 1.2775, 1.2700, 1.2590.

Trading tips

It’s better to increase the volume of long positions at the current level with the targets at 1.3450, 1.3480, stop loss is 1.2870.

No comments:

Write comments