EUR/USD: Draghi and Irma are pushing the pair up

08 September 2017, 14:00

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.2090 |

| Take Profit | 1.2175, 1.2200 |

| Stop Loss | 1.2050 |

| Key Levels | 1.1840, 1.1862, 1.1900, 1.2023, 1.2085, 1.2175, 1.2200, 1.2240 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.2010 |

| Take Profit | 1.1962, 1.1900 |

| Stop Loss | 1.2040 |

| Key Levels | 1.1840, 1.1862, 1.1900, 1.2023, 1.2085, 1.2175, 1.2200, 1.2240 |

Current trend

On Thursday the pair grew to the maximum levels from December 2014 and reached 1.2090. The strengthening of EUR was caused by the speech by Mario Draghi who pointed out that the economy of Eurozone was growing faster than expected in the first half of 2017, and this had to push up the inflation that had not showed any indications of stable growth yet. Moreover, annual inflation values may decrease due to the dynamics of oil prices. Therefore stimulation measures remain necessary in the current conditions.

The morning release of the data in the German trading balance (in July it proficiency was lower than expected and made up 19.5 bln euro) failed to considerably correct the pair. US dollar remains under pressure of the news about hurricanes. Harvey that caused considerable damage to the infrastructure and industry in Texas and Louisiana is followed by Irma that is to hit the shores of Florida on Saturday and is likely to cause massive destruction.

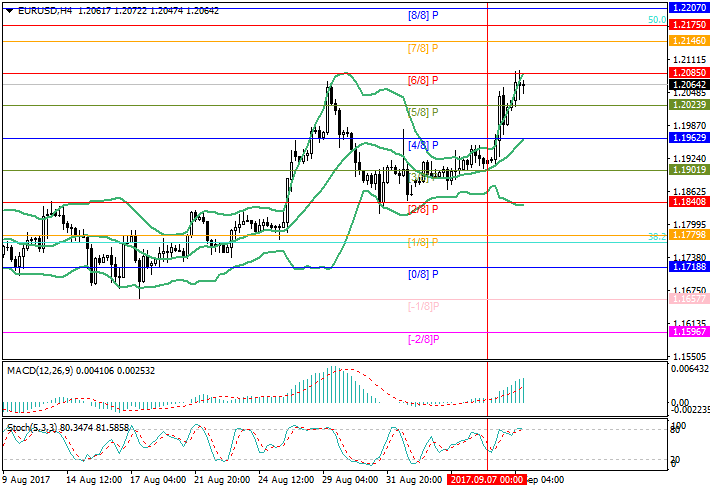

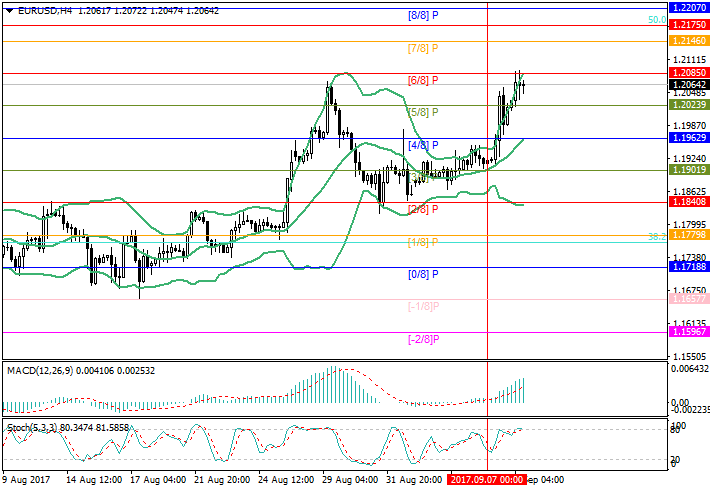

Support and resistance

Technically the pair is trading around 1.2085 (Murrey level [6/8]) that is a key level for the "bulls". Breaking through it will open the way to 1.2175-1.2200 (Fibo correction 50.0%, Murrey level [8/8]). On the other hand, Stochastic is trying to reverse near the overbouht zone, which indicates the possibility of beginning of downward correction with targets at 1.1963 (Murrey level [4/8], middle line of Bollinger Bands) and 1.1900 (Murrey level [3/8]).

Support levels: 1.2023, 1.1862, 1.1900, 1.1840.

Resistance levels: 1.2085, 1.2175, 1.2200, 1.2240.

Trading tips

In the current situation long positions should be opened above the level of 1.2085 with targets at 1.2175, 1.2200 and stop-loss at 1.2050.

Short positions may be opened below the level of 1.2023 with targets at 1.1962, 1.1900 and stop-loss at 1.2040.

On Thursday the pair grew to the maximum levels from December 2014 and reached 1.2090. The strengthening of EUR was caused by the speech by Mario Draghi who pointed out that the economy of Eurozone was growing faster than expected in the first half of 2017, and this had to push up the inflation that had not showed any indications of stable growth yet. Moreover, annual inflation values may decrease due to the dynamics of oil prices. Therefore stimulation measures remain necessary in the current conditions.

The morning release of the data in the German trading balance (in July it proficiency was lower than expected and made up 19.5 bln euro) failed to considerably correct the pair. US dollar remains under pressure of the news about hurricanes. Harvey that caused considerable damage to the infrastructure and industry in Texas and Louisiana is followed by Irma that is to hit the shores of Florida on Saturday and is likely to cause massive destruction.

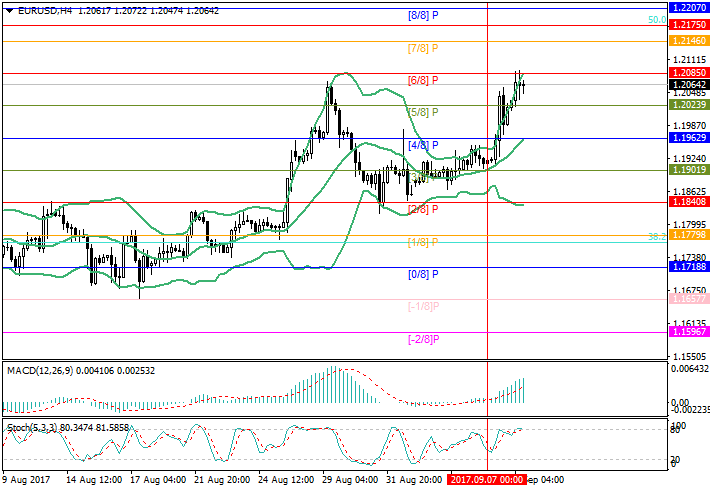

Support and resistance

Technically the pair is trading around 1.2085 (Murrey level [6/8]) that is a key level for the "bulls". Breaking through it will open the way to 1.2175-1.2200 (Fibo correction 50.0%, Murrey level [8/8]). On the other hand, Stochastic is trying to reverse near the overbouht zone, which indicates the possibility of beginning of downward correction with targets at 1.1963 (Murrey level [4/8], middle line of Bollinger Bands) and 1.1900 (Murrey level [3/8]).

Support levels: 1.2023, 1.1862, 1.1900, 1.1840.

Resistance levels: 1.2085, 1.2175, 1.2200, 1.2240.

Trading tips

In the current situation long positions should be opened above the level of 1.2085 with targets at 1.2175, 1.2200 and stop-loss at 1.2050.

Short positions may be opened below the level of 1.2023 with targets at 1.1962, 1.1900 and stop-loss at 1.2040.

No comments:

Write comments