GBP/NZD: Ichimoku clouds

07 September 2017, 19:46| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 1.8098 |

| Take Profit | 1.8185 |

| Stop Loss | 1.8075 |

| Key Levels | 1.8052, 1.8075, 1.8100, 1.8145, 1.8165, 1.8190. |

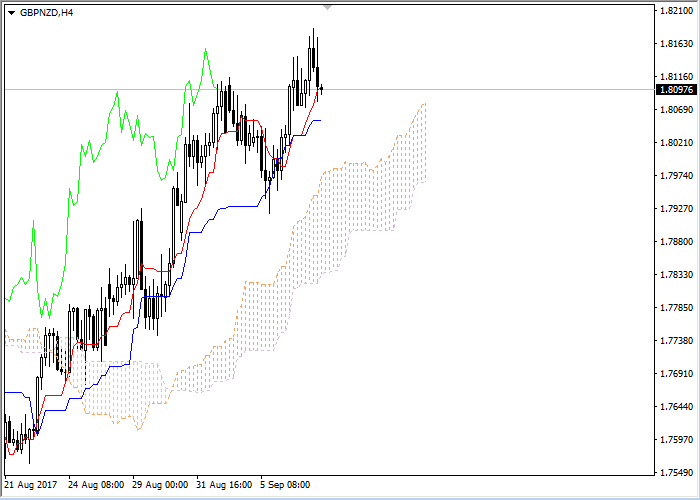

Let's look at the four-hour chart. Tenkan-sen line is above Kijun-sen, the lines are horizontal . Confirmative line Chikou Span is approaching the price chart from above, current cloud is ascending. The instrument has been corrected to the Tenkan-sen line. The closest support level is the upper border of the cloud (1.8075). The closest resistance level is Tenkan-sen line (1.8100).

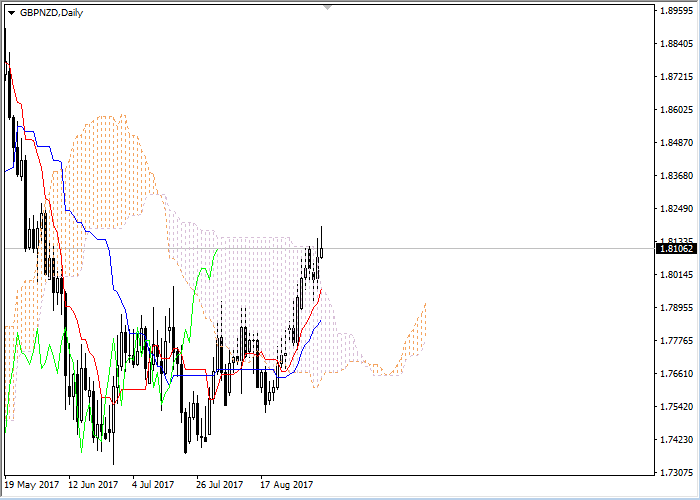

On the daily chart Tenkan-sen line is above Kijun-sen, both lines are directed upwards. Confirmative line Chikou Span is above the price chart, current cloud is ascending. The instrument is trading above Tenkan-sen and Kijun-sen lines; the Bullish trend is still strong. The closest support level is Tenkan-sen line (1.7965). One of the previous maximums of Chikou Span line is expected to be a resistance level (1.8190).

On the four-hour chart we can see a correction of the downward movement. On the daily chart the Bullish trend is still strong. It is recommended to open long positions at current price with the target at the level of previous maximum of Chikou Span line (1.8185) and Stop Loss at the upper border of the cloud (1.8075).

No comments:

Write comments