EUR/USD: Atlantic storms may weaken the US economy

13 September 2017, 12:26

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL |

| Entry Point | 1.1975 |

| Take Profit | 1.1925, 1.1875 |

| Stop Loss | 1.2000 |

| Key Levels | 1.1825, 1.1875, 1.1925, 1.1990, 1.2055, 1.2090 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.1995 |

| Take Profit | 1.2055, 1.2090 |

| Stop Loss | 1.1970 |

| Key Levels | 1.1825, 1.1875, 1.1925, 1.1990, 1.2055, 1.2090 |

Current trend

On Tuesday the pair reversed around the level of 1.1930 and started to grow. However, the growth was limited by unsatisfying statistics on the volume of industrial output in Eurozone. The most important data for the pair will be released on Thursday and Friday when August statistics on inflation and retail sales will be published in the USA. Basic CPI (on which the Fed focuses when making interest rate decisions) may drop from 1.7% to 1.6% and the indicator of retail sales volume - from 0.6% to 0.1%.

Experts are considering the influence of Harvey and Irma toms on the US economy in general. The representatives of the Bank of America believe that the growth of the US GDP in Q3 2017 may slow down, and that there may be impact on retail trade and production sectors as well. On the other hand, usually the influence of the elements is of temporary nature.

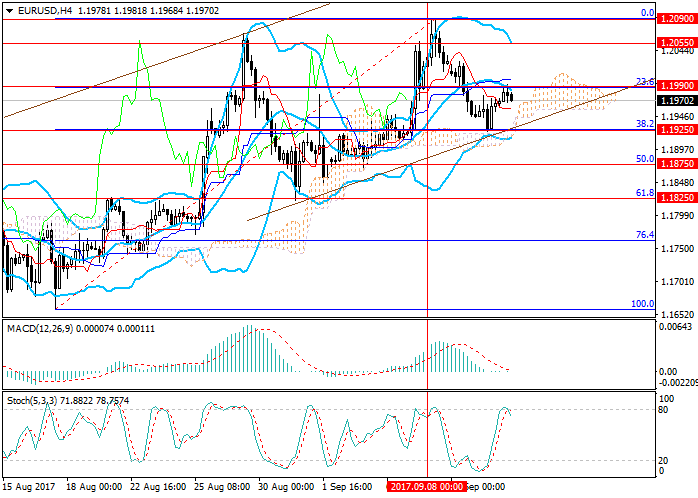

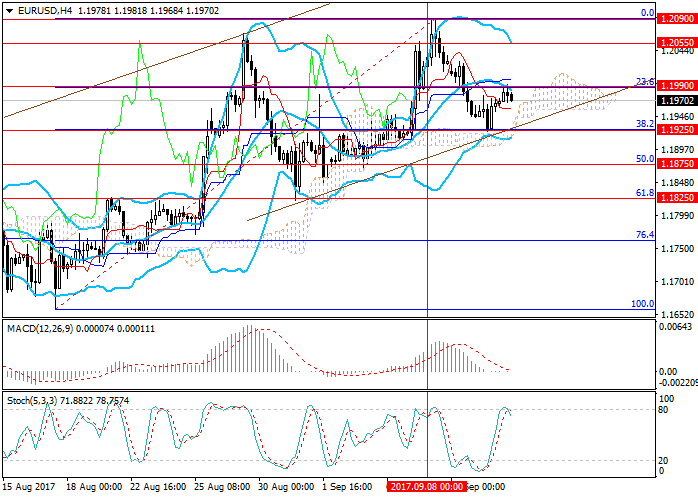

Support and resistance

Technically the pair has stopped near the level of 1.1990 (Fibo correction 23.6%, middle line of Bollinger Bands) and may start correcting from here to the levels of 1.1925 (Fibo correction 38.2%, lower line of Bollinger Bands, and lower border of the downward channel) and 1.1875 (Fibo correction 50.0%). The possibility of a fall is confirmed by Stochastic that is leaving the overbought area, and MACD histogram is forming a divergence with the price chart. On the other hand, in case the US releases are negative, the price may break through the level of 1.1990 and further grow to September maximums at 1.2055 and 1.2090.

Support levels: 1.1925, 1.1875, 1.1825.

Resistance levels: 1.1990, 1.2055, 1.2090.

Trading tips

In the current situation short positions should be opened at the current price with targets at 1.1925, 1.1875 and stop-loss at 1.2000. Long positions may be opened above the level of 1.1990 with targets at 1.2055, 1.2090 and stop-loss at 1.1970.

On Tuesday the pair reversed around the level of 1.1930 and started to grow. However, the growth was limited by unsatisfying statistics on the volume of industrial output in Eurozone. The most important data for the pair will be released on Thursday and Friday when August statistics on inflation and retail sales will be published in the USA. Basic CPI (on which the Fed focuses when making interest rate decisions) may drop from 1.7% to 1.6% and the indicator of retail sales volume - from 0.6% to 0.1%.

Experts are considering the influence of Harvey and Irma toms on the US economy in general. The representatives of the Bank of America believe that the growth of the US GDP in Q3 2017 may slow down, and that there may be impact on retail trade and production sectors as well. On the other hand, usually the influence of the elements is of temporary nature.

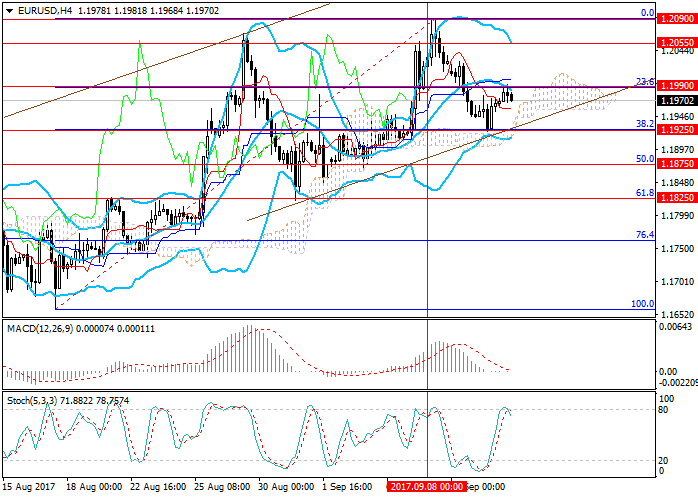

Support and resistance

Technically the pair has stopped near the level of 1.1990 (Fibo correction 23.6%, middle line of Bollinger Bands) and may start correcting from here to the levels of 1.1925 (Fibo correction 38.2%, lower line of Bollinger Bands, and lower border of the downward channel) and 1.1875 (Fibo correction 50.0%). The possibility of a fall is confirmed by Stochastic that is leaving the overbought area, and MACD histogram is forming a divergence with the price chart. On the other hand, in case the US releases are negative, the price may break through the level of 1.1990 and further grow to September maximums at 1.2055 and 1.2090.

Support levels: 1.1925, 1.1875, 1.1825.

Resistance levels: 1.1990, 1.2055, 1.2090.

Trading tips

In the current situation short positions should be opened at the current price with targets at 1.1925, 1.1875 and stop-loss at 1.2000. Long positions may be opened above the level of 1.1990 with targets at 1.2055, 1.2090 and stop-loss at 1.1970.

No comments:

Write comments