eBay Inc. (EBAY/NASD/S&P500)

13 September 2017, 12:30

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 38.30 |

| Take Profit | 38.60, 38.90, 39.25 |

| Stop Loss | 37.90 |

| Key Levels | 36.60, 37.20, 37.80, 38.25 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 37.70 |

| Take Profit | 37.20, 36.85 |

| Stop Loss | 38.15 |

| Key Levels | 36.60, 37.20, 37.80, 38.25 |

Industry: retail sales, other

Current trend

In the beginning of the trading week eBay stocks renewed the 52-week maximum and grew by more than 28% since the beginning of the current year. Investors hope that the world markets expansion attempts of eBay will be successful. In the end of last month the company announced the strategic partnership with MallforAfrica – digital platform to connect the companies in Africa. According to consulting company McKinsey, online sales in Africa will exceed 75 billion USD by 2025.

During the last week eBay stocks grew by 5.79% against the growth of the S&P 500 index by 1.22%.

The comparative analysis between the indicators of the company and its competitors suggest that the stocks are underpriced.

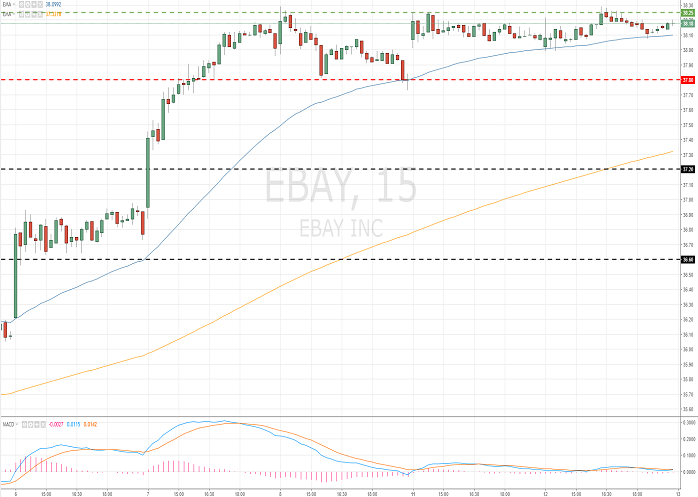

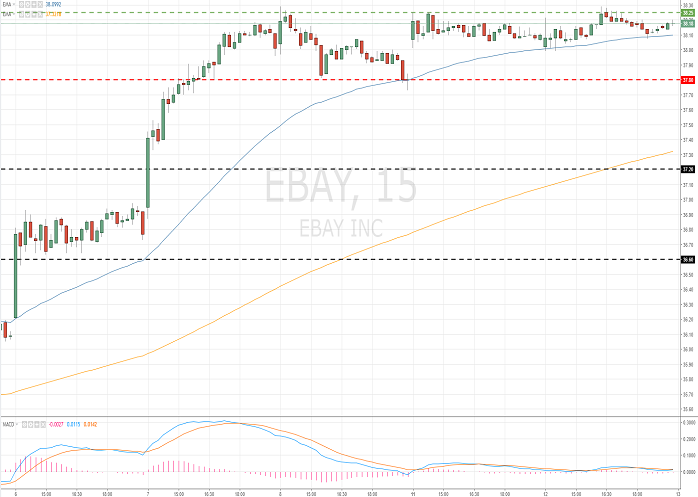

Key levels

At the moment the price is in the consolidation after the significant growth since the beginning of the month. The technical picture is mixed. A correction is not excluded in the nearest future. The key support and resistance levels are 37.80 and 38.25 correspondingly. Indicators don’t dive clear signals.

Resistance levels: 38.25.

Support levels: 37.80, 37.20, 36.60.

Trading tips

If the price is set above the level of 38.25, it’s better to open long positions. Closing profitable positions is better at the levels of 38.60, 38.90, 39.25. Stop loss is 37.90.

If the price is set below the local support level of 37.80, find entering points to open short positions with the targets at 37.20-36.85. Stop loss is 38.15.

Implementation period: 3 days.

Current trend

In the beginning of the trading week eBay stocks renewed the 52-week maximum and grew by more than 28% since the beginning of the current year. Investors hope that the world markets expansion attempts of eBay will be successful. In the end of last month the company announced the strategic partnership with MallforAfrica – digital platform to connect the companies in Africa. According to consulting company McKinsey, online sales in Africa will exceed 75 billion USD by 2025.

During the last week eBay stocks grew by 5.79% against the growth of the S&P 500 index by 1.22%.

The comparative analysis between the indicators of the company and its competitors suggest that the stocks are underpriced.

Key levels

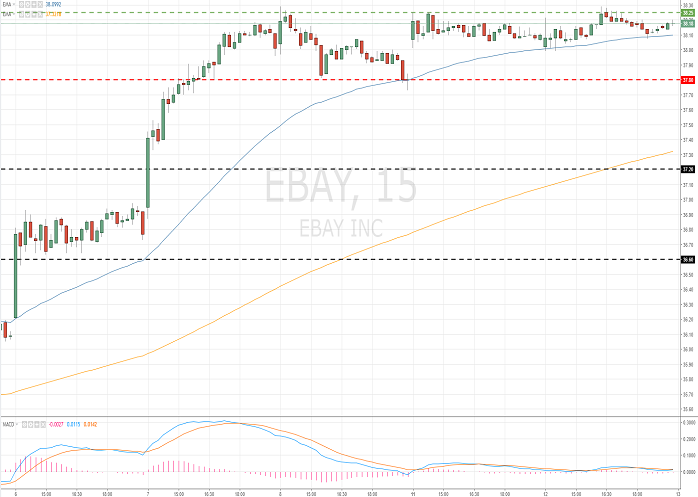

At the moment the price is in the consolidation after the significant growth since the beginning of the month. The technical picture is mixed. A correction is not excluded in the nearest future. The key support and resistance levels are 37.80 and 38.25 correspondingly. Indicators don’t dive clear signals.

Resistance levels: 38.25.

Support levels: 37.80, 37.20, 36.60.

Trading tips

If the price is set above the level of 38.25, it’s better to open long positions. Closing profitable positions is better at the levels of 38.60, 38.90, 39.25. Stop loss is 37.90.

If the price is set below the local support level of 37.80, find entering points to open short positions with the targets at 37.20-36.85. Stop loss is 38.15.

Implementation period: 3 days.

No comments:

Write comments