Brent Crude Oil: general review

19 September 2017, 11:01

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 55.35 |

| Take Profit | 56.30 |

| Stop Loss | 54.80 |

| Key Levels | 52.80, 53.55, 54.30, 55.00,55.75, 56.10, 56.65, 57.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 54.75 |

| Take Profit | 53.95 |

| Stop Loss | 55.05 |

| Key Levels | 52.80, 53.55, 54.30, 55.00,55.75, 56.10, 56.65, 57.00 |

Current trend

As a result of trading during the previous week the price of Brent oil grew approaching maximums of April 2016. US refineries resume operations after Harvey and Irma storms. Moreover, investors became optimistic after the news about the reduction of drilling activity in the USA. Also Brent continues to receive support from IEA that increased the outlook of global demand for 2017 from 1.5 to 1.6 mln barrels a day.

The trading instrument shows mixed dynamics formed in view of expected Fed's decision on the key interest rate. The demand for high-risk assets dropped. Along with this, according to an OPEC report, the oversupply of oil in the world market is reducing, and soon the cartel and other member states will discuss the extension of the global oil pact.

A key event of the week will be the announcement of the Fed's decision on the monetary policy on Wednesday. Today attention should be paid to API report on the level of oil and petrochemicals stocks in the USA.

Support and resistance

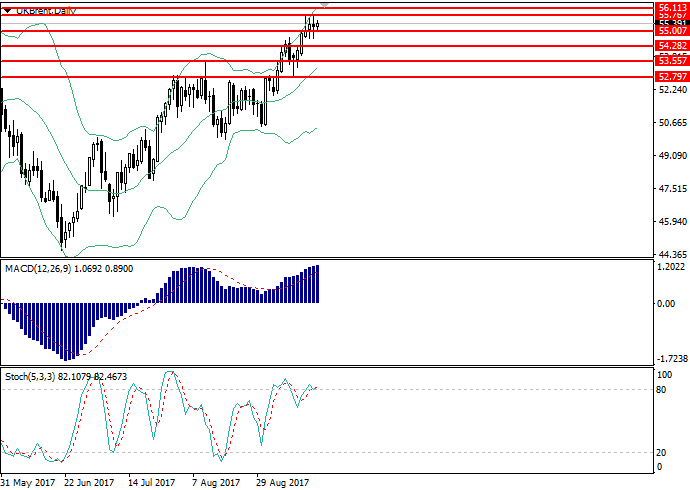

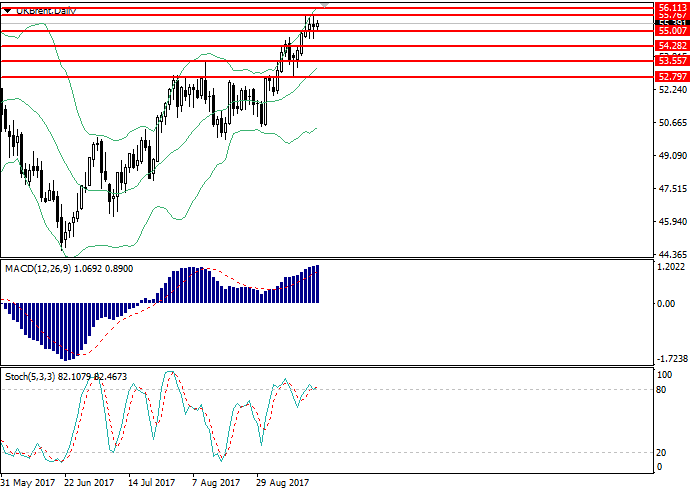

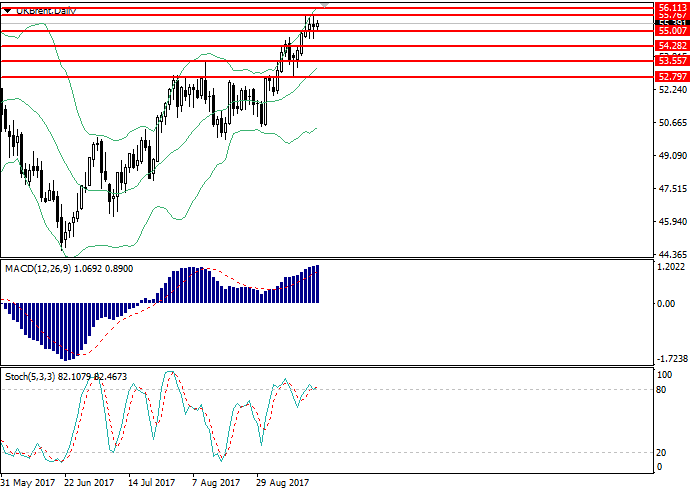

On D1 chart the pair is growing along the upper Bollinger Band. The indicator is directed upwards while the price range has widened indicating the preservation of the upward trend. MACD histogram is in the positive zone, keeping a strong buy signal. Stochastic is about to leave the overbought area.

Support levels: 55.00, 54.30, 53.55, 52.80.

Resistance levels: 55.75, 56.10, 56.65, 57.00.

Trading tips

Long positions may be opened at the current price with target at 56.30 and stop-loss at 54.80. The period of implementation is 1-2 days.

Short positions may be opened from the level of 54.75 with target at 53.95 and stop-loss at 55.05. The period of implementation is 1-2 days.

As a result of trading during the previous week the price of Brent oil grew approaching maximums of April 2016. US refineries resume operations after Harvey and Irma storms. Moreover, investors became optimistic after the news about the reduction of drilling activity in the USA. Also Brent continues to receive support from IEA that increased the outlook of global demand for 2017 from 1.5 to 1.6 mln barrels a day.

The trading instrument shows mixed dynamics formed in view of expected Fed's decision on the key interest rate. The demand for high-risk assets dropped. Along with this, according to an OPEC report, the oversupply of oil in the world market is reducing, and soon the cartel and other member states will discuss the extension of the global oil pact.

A key event of the week will be the announcement of the Fed's decision on the monetary policy on Wednesday. Today attention should be paid to API report on the level of oil and petrochemicals stocks in the USA.

Support and resistance

On D1 chart the pair is growing along the upper Bollinger Band. The indicator is directed upwards while the price range has widened indicating the preservation of the upward trend. MACD histogram is in the positive zone, keeping a strong buy signal. Stochastic is about to leave the overbought area.

Support levels: 55.00, 54.30, 53.55, 52.80.

Resistance levels: 55.75, 56.10, 56.65, 57.00.

Trading tips

Long positions may be opened at the current price with target at 56.30 and stop-loss at 54.80. The period of implementation is 1-2 days.

Short positions may be opened from the level of 54.75 with target at 53.95 and stop-loss at 55.05. The period of implementation is 1-2 days.

No comments:

Write comments