AUD/USD: the pair is falling

12 September 2017, 09:52

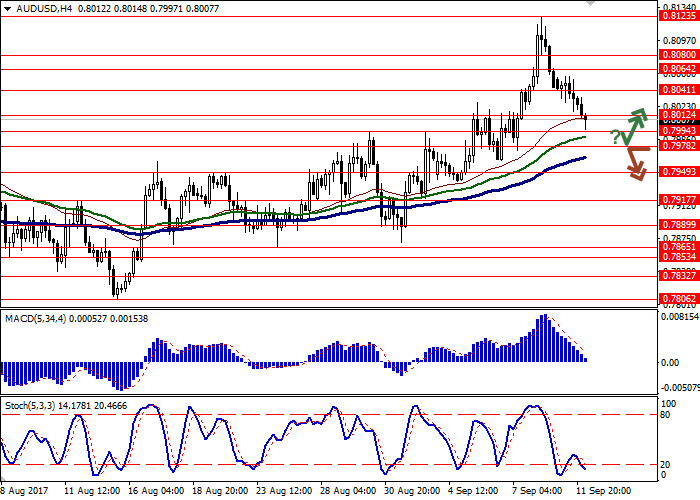

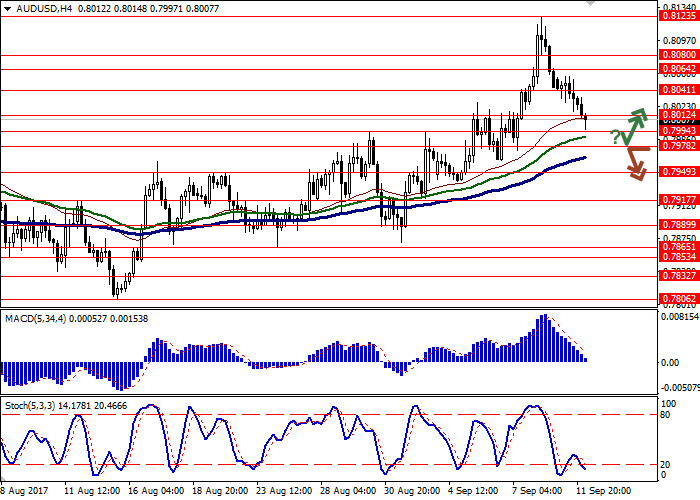

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 0.8045 |

| Take Profit | 0.8064, 0.8080 |

| Stop Loss | 0.8025 |

| Key Levels | 0.7917, 0.7949, 0.7978, 0.7994, 0.8012, 0.8041, 0.8064, 0.8080, 0.8123 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.7965 |

| Take Profit | 0.7900 |

| Stop Loss | 0.8030 |

| Key Levels | 0.7917, 0.7949, 0.7978, 0.7994, 0.8012, 0.8041, 0.8064, 0.8080, 0.8123 |

Current trend

Australian dollar is developing downward correction during the morning session on September 12, reducing after the update of record-setting maximums in the end of the previous week. The mood of the investors about the US currency is improving which is supported by the reduction of tension around North Korea and better forecasts on Irma storm.

During the morning session on Tuesday AUD was under pressure from Australian macroeconomic statistics. Thus, business confidence index of the National Bank of Australia dropped from 12 to 5 points in August which showed the reaction of companies to the instability of internal and external factors.

On Wednesday, September 13, investors are waiting for the release of Westpac consumer confidence index, and on Thursday a key report on the Australian labor market for August is to be released.

Support and resistance

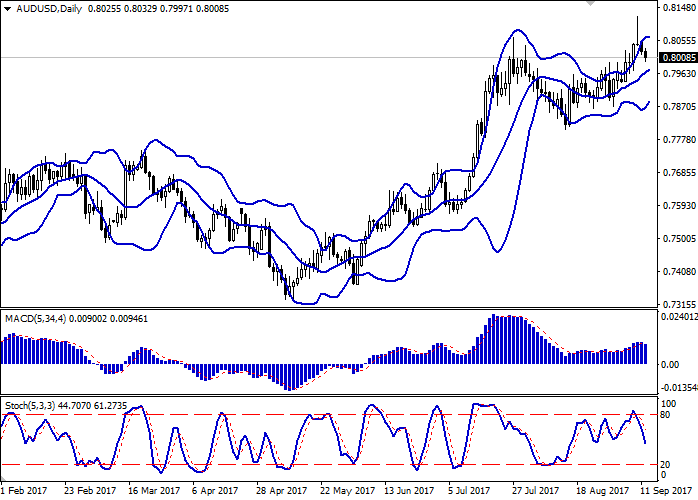

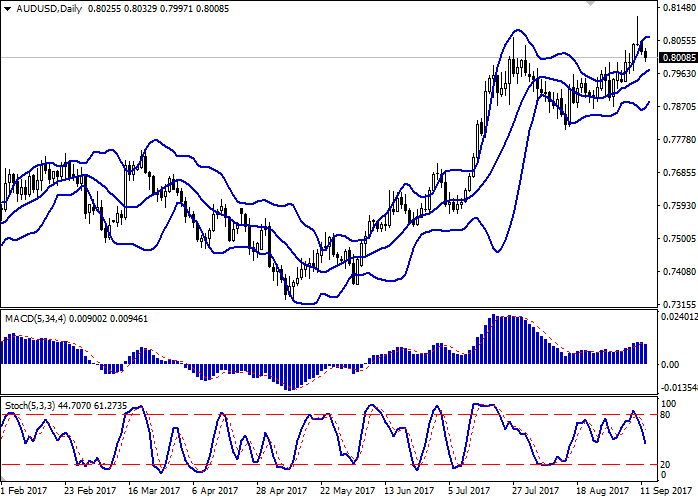

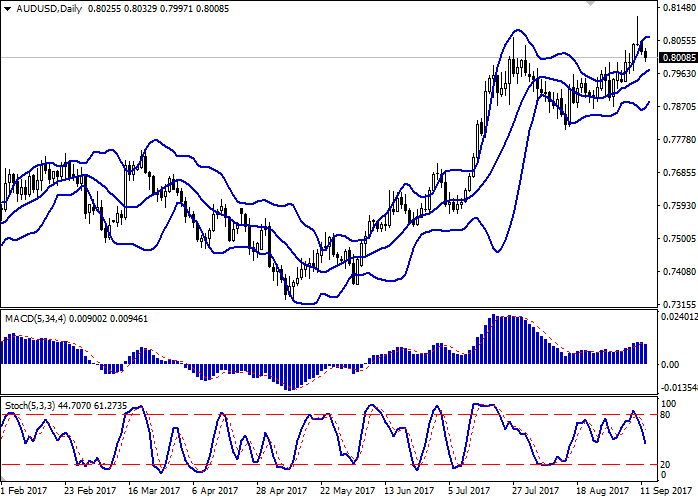

Bollinger Bands in D1 chart demonstrate moderate increase. The price range is slightly narrowing in the lower part. MACD is going down having formed a sell signal (being located under the signal line). Stochastic is in a stable fall and is currently approaching the border with the oversold area.

Resistance levels: 0.8012, 0.8041, 0.8064, 0.8080, 0.8123.

Support levels: 0.7994, 0.7978, 0.7949, 0.7917.

Trading tips

Long positions may be opened at the current price with targets at 0.8064, 0.8080 and stop-loss at 0.8025. The period of implementation is 2 days.

A breakdown of the level of 0.7978 may be a signal for further sales with target at 0.7900 and stop-loss at 0.8030. The period of implementation is 2-3 days.

Australian dollar is developing downward correction during the morning session on September 12, reducing after the update of record-setting maximums in the end of the previous week. The mood of the investors about the US currency is improving which is supported by the reduction of tension around North Korea and better forecasts on Irma storm.

During the morning session on Tuesday AUD was under pressure from Australian macroeconomic statistics. Thus, business confidence index of the National Bank of Australia dropped from 12 to 5 points in August which showed the reaction of companies to the instability of internal and external factors.

On Wednesday, September 13, investors are waiting for the release of Westpac consumer confidence index, and on Thursday a key report on the Australian labor market for August is to be released.

Support and resistance

Bollinger Bands in D1 chart demonstrate moderate increase. The price range is slightly narrowing in the lower part. MACD is going down having formed a sell signal (being located under the signal line). Stochastic is in a stable fall and is currently approaching the border with the oversold area.

Resistance levels: 0.8012, 0.8041, 0.8064, 0.8080, 0.8123.

Support levels: 0.7994, 0.7978, 0.7949, 0.7917.

Trading tips

Long positions may be opened at the current price with targets at 0.8064, 0.8080 and stop-loss at 0.8025. The period of implementation is 2 days.

A breakdown of the level of 0.7978 may be a signal for further sales with target at 0.7900 and stop-loss at 0.8030. The period of implementation is 2-3 days.

No comments:

Write comments