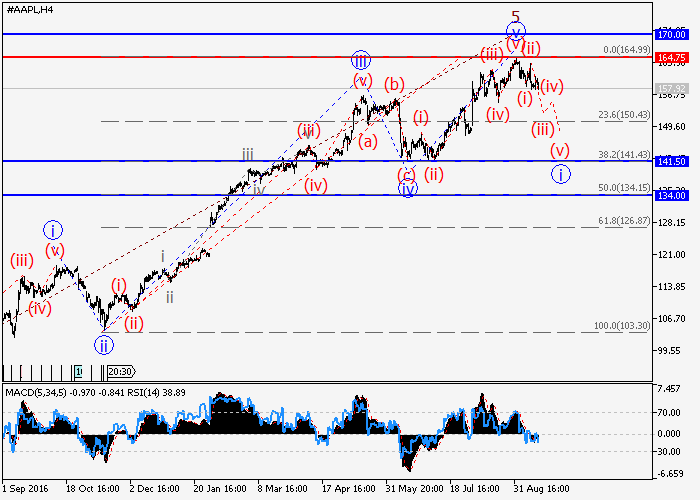

Apple Inc.: wave analysis

19 September 2017, 09:06

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL |

| Entry Point | 158.45 |

| Take Profit | 141.50, 134.00 |

| Stop Loss | 164.10 |

| Key Levels | 134.00, 141.50, 164.75, 170.00 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 164.80 |

| Take Profit | 170.00 |

| Stop Loss | 163.05 |

| Key Levels | 134.00, 141.50, 164.75, 170.00 |

A decrease in the share’s price is expected.

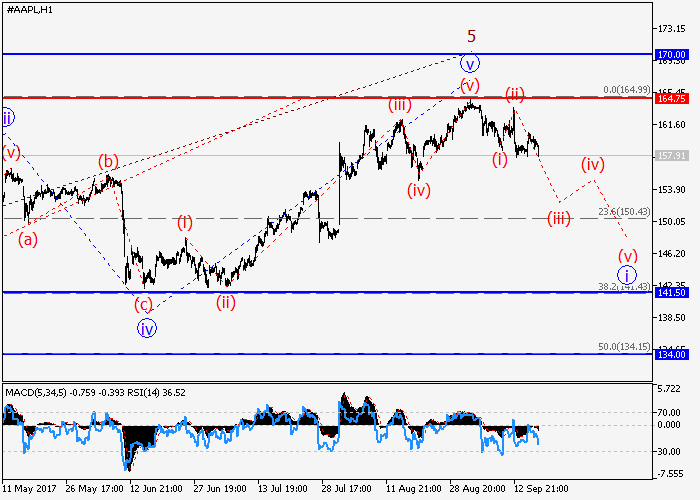

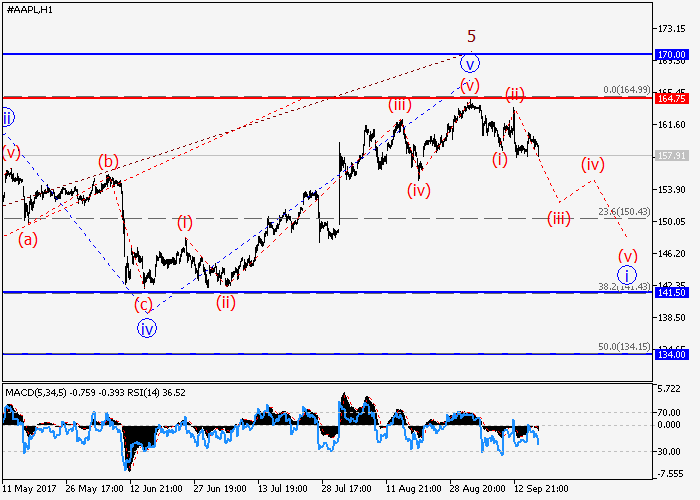

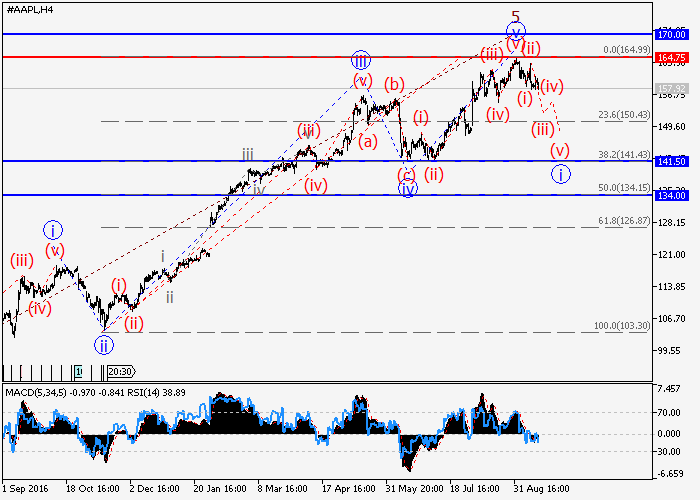

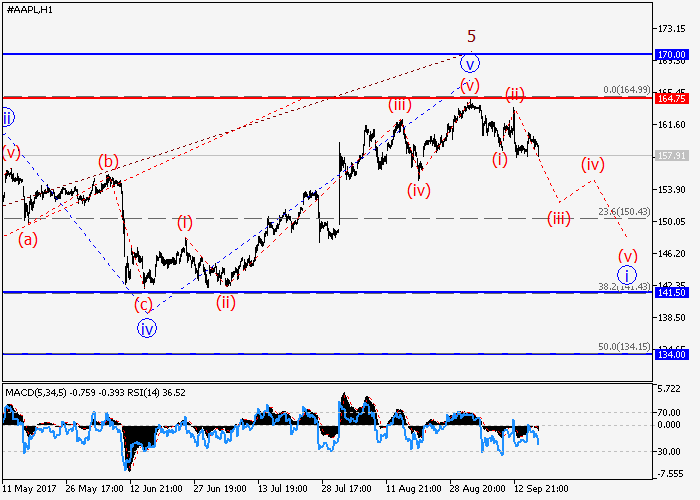

On the four-hour chart, the upward momentum was formed within the fifth wave 5 of the higher level. At the moment, apparently, the development of a downward correction has begun, within which a "bearish" impulse is forming as the first wave i. If the assumption is true, the price will fall to the levels of 141.50-134.00. The level of 164.75 is critical for this scenario.

Main scenario

Sell the asset during the corrections, below the level of 164.75 with a target in the range of 141.50-134.00.

Alternative scenario

Breakout of the level of 164.75 will allow the asset to continue growing to around 170.00.

On the four-hour chart, the upward momentum was formed within the fifth wave 5 of the higher level. At the moment, apparently, the development of a downward correction has begun, within which a "bearish" impulse is forming as the first wave i. If the assumption is true, the price will fall to the levels of 141.50-134.00. The level of 164.75 is critical for this scenario.

Main scenario

Sell the asset during the corrections, below the level of 164.75 with a target in the range of 141.50-134.00.

Alternative scenario

Breakout of the level of 164.75 will allow the asset to continue growing to around 170.00.

No comments:

Write comments