USD/JPY: currency pair continues to rise

13 July 2022, 11:26

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 137.50 |

| Take Profit | 140.00 |

| Stop Loss | 137.00 |

| Key Levels | 131.45, 134.90, 137.44, 140.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 134.85 |

| Take Profit | 131.45 |

| Stop Loss | 136.00 |

| Key Levels | 131.45, 134.90, 137.44, 140.00 |

Current trend

Against the background of the stabilization of the US currency, the USD/JPY pair is correcting around the level of 137.00.

The downward dynamics of the national currency are developing despite the measures to purchase assets for record amounts taken by the Bank of Japan. However, there is still hope for early stabilization of the yen: the elections to the country's parliament ended yesterday, in which the party of the current Prime Minister Fumio Kishida won. The government's approval rating rose to a record high of 63.2%, which means that aggressive monetary policy is likely to continue. Also, investors are encouraged by positive macroeconomic indicators: the corporate goods price index in June rose by 0.7%, which is higher than the 0.5% expected by analysts, and by 9.2% YoY, which exceeds the forecast of 8.8% and only 0.1% lower than last month.

US consumer price data will be published today, which can update the historical record and rise to 8.8% from 8.6% a month earlier, in anticipation of which investors are in no hurry to enter the market, having stabilized the US dollar near 108.000 in the USD Index. The decision of the US Federal Reserve on monetary policy will also depend on inflation data: experts have repeatedly expressed the opinion that if the indicators rise above 9.0%, the regulator can immediately raise the rate by 100 basis points.

Support and resistance

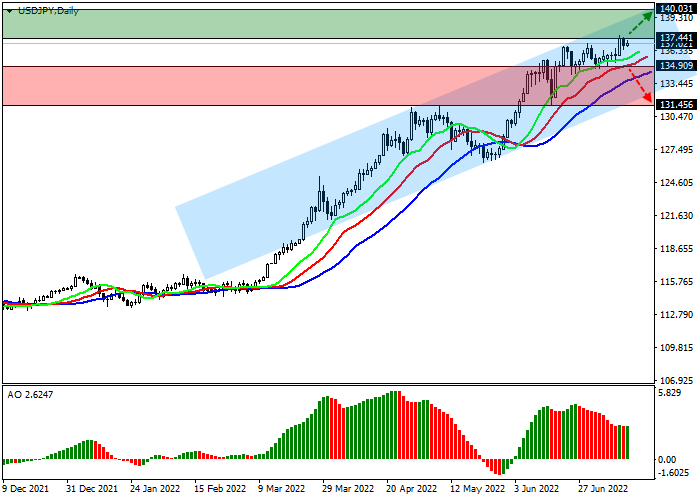

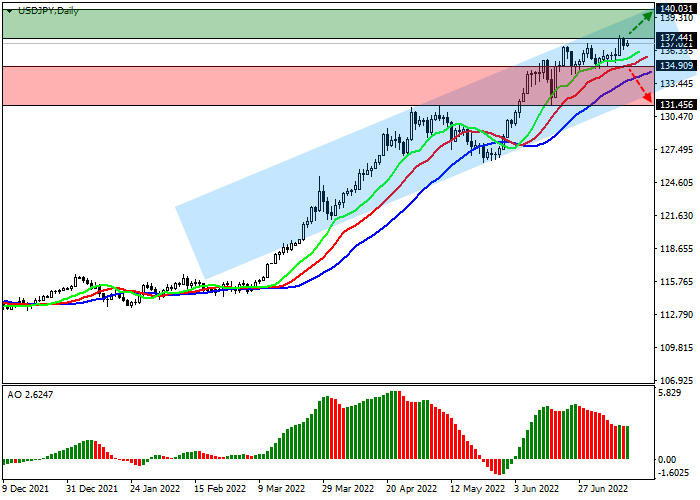

The trading instrument is moving within the global uptrend, holding slightly below the year's high at 137.40. Technical indicators maintain a stable buy signal: indicator Alligator's EMA oscillation range remains wide, and the AO oscillator histogram forms new bars high in the buy zone.

Resistance levels: 137.44, 140.00.

Support levels: 134.90, 131.45.

Trading tips

Long positions may be opened after the price rises and consolidates above 137.44 with the target at 140.00. Stop loss is 137.00. Implementation period: 7 days or more.

Short positions may be opened after a reversal, decrease, and consolidation of the price below 134.90 with the target at 131.45. Stop loss is 136.00.

No comments:

Write comments