GBP/USD: investors do not believe in the strengthening of the pound

13 July 2022, 13:12

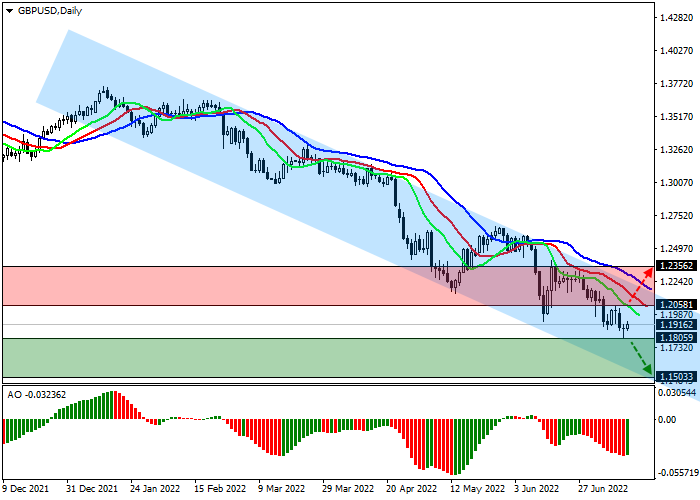

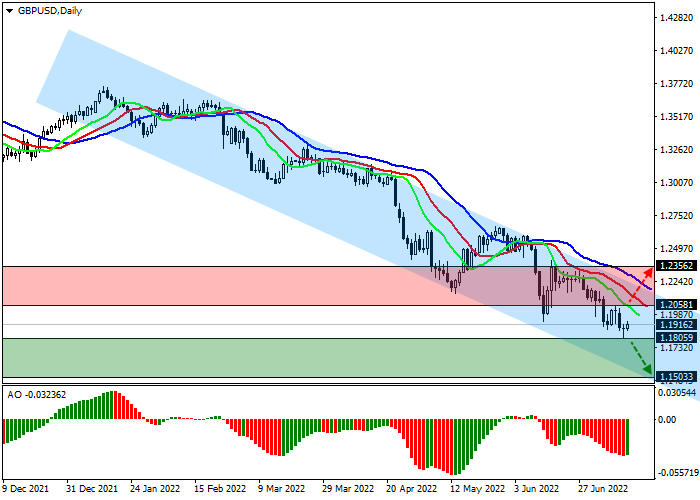

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 1.1800 |

| Take Profit | 1.1500 |

| Stop Loss | 1.1900 |

| Key Levels | 1.1500, 1.1806, 1.2058, 1.2356 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.2065 |

| Take Profit | 1.2356 |

| Stop Loss | 1.2000 |

| Key Levels | 1.1500, 1.1806, 1.2058, 1.2356 |

Current trend

Due to the stable growth of the American currency, the GBP/USD pair is declining, trading around 1.1911.

Today's large block of macroeconomic data did not affect the downward dynamics of the pound: UK GDP was 0.5% in May, which is slightly better than the 0.1% increase expected by analysts, but the quarterly figure slowed down compared to April's 0.8%, amounting to 0.4%. The annual value decreased to 3.5% from 3.7% earlier, which indicates dangerous proximity to a full-fledged recession. Industrial production for the same period was 0.9%, higher than the forecast growth of 0.2%, and the annual rate continued to slow down at 1.4%, slightly worse than the 1.6% increase in April.

The US dollar slowed down, dropping slightly below 108.000 in the USD Index against investors' expectations of today's publication of inflation data, which will directly affect the further actions of the US Federal Reserve. Analysts suggest that the rate will rise to 8.8% from 8.6%, but some experts fear reaching 9.0%, which could lead to a rise in interest rates by 1.0%.

Support and resistance

The trading instrument moves within the global downward channel, gradually approaching the support line. Technical indicators keep a sell signal, and a possible renewal of the local low of the year at 1.1806 strengthens it: indicator Alligator's EMA oscillation range expands downward, and the AO oscillator histogram forms downward bars.

Resistance levels: 1.2058, 1.2356.

Support levels: 1.1806, 1.1500.

Trading tips

Short positions may be opened after the price drops and consolidates below 1.1806 with the target at 1.1500. Stop loss is 1.1900. Implementation period: 7 days or more.

Long positions may be opened after a reversal, growth, and prices above 1.2058 with the target at 1.2356. Stop loss is 1.2000.

No comments:

Write comments