EUR/USD: the pair is preparing to consolidate below the historical low

14 July 2022, 11:35

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 0.9975 |

| Take Profit | 0.9800 |

| Stop Loss | 1.0050 |

| Key Levels | 0.9800, 0.9980, 1.0150, 1.0370 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.0155 |

| Take Profit | 1.0370 |

| Stop Loss | 1.0100 |

| Key Levels | 0.9800, 0.9980, 1.0150, 1.0370 |

Current trend

The EUR/USD pair is moving within a downtrend, trading around 1.0020.

Conflicting macroeconomic statistics from the EU do not allow the euro to interrupt the protracted decline: inflation in Germany in June was 7.6%, which is the same as in May, and CPI in France rose not as much as analysts expected but still amounted to 5.8%, up from 5.2% in May, while the same figure for Spain reached a record high of 10.2%, up sharply from 8.7% in May. With such a significant increase in local values, the composite price index of the EU countries will also increase significantly, preventing a possible reversal and growth of the euro.

The US dollar expectedly consolidated above 108,000 in the USD Index after the release of the US CPI, which for the first time since 1981 amounted to 9.1%, which is 0.5% higher than in May. Yesterday, several experts pointed to a possible rise in inflation above 9.0%. They noted that in this case, a rate increase by 75 basis points at the upcoming US Federal Reserve meeting is practically guaranteed and did not even rule out the option of increasing the rate by 100 basis points, which would provide the dollar with another short-term positive momentum.

Support and resistance

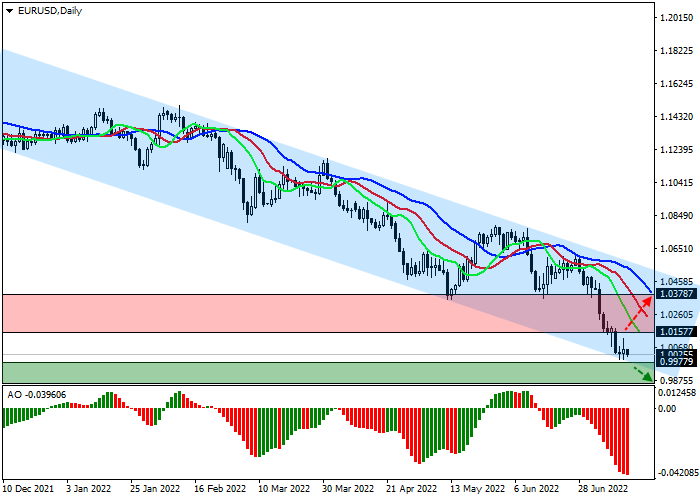

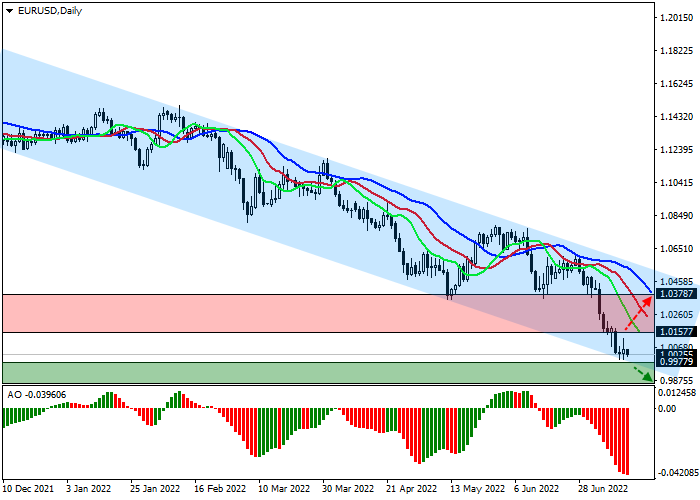

The trading instrument moves within the global downward channel, near the support line. Technical indicators maintain a global sell signal: fast EMAs on the Alligator indicator expand the range of fluctuations in the direction of decline, and the AO oscillator histogram forms downward bars in the sell zone.

Resistance levels: 1.0150, 1.0370.

Support levels: 0.9980, 0.9800.

Trading tips

Short positions may be opened after the price drops and consolidates below 0.9980 with the target at 0.9800. Stop loss – 1.0050. Implementation period: 7 days or more.

Long positions may be opened after a reversal, growth, and consolidation above 1.0150, with the target around 1.0370. Stop loss – 1.0100.

No comments:

Write comments