USD/CHF: the pair is preparing to continue the decline

02 November 2021, 11:40

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 0.9035 |

| Take Profit | 0.8930 |

| Stop Loss | 0.9100 |

| Key Levels | 0.8930, 0.9035, 0.9136, 0.9267 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 0.9136 |

| Take Profit | 0.9267 |

| Stop Loss | 0.9080 |

| Key Levels | 0.8930, 0.9035, 0.9136, 0.9267 |

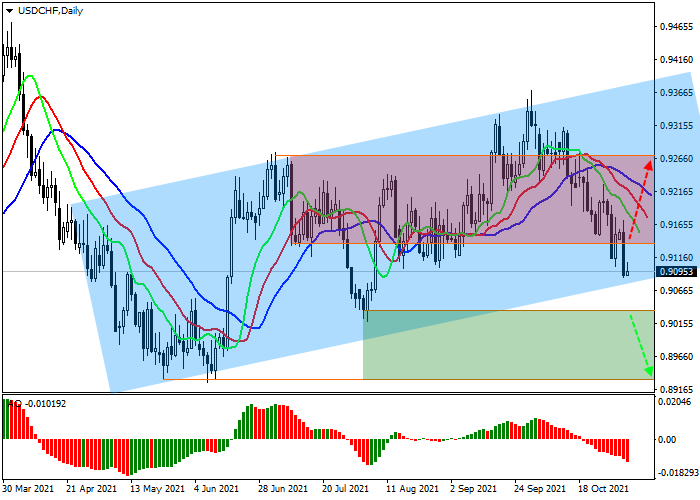

Current trend

USD/CHF is demonstrating a local downtrend against the background of CHF growth and is at 0.9092.

USD is correcting against the background of low trading activity caused by expectations of the US Fed’s meeting on monetary policy, scheduled for tomorrow. In addition to the fact that the regulator may decide to start curtailing the asset purchase program, before the meeting, data on ADP Employment Change will be published. Analysts expect a reduction in the number of jobs created to 400K after 568K a week earlier, which may be a negative signal for the US Fed, because the weakness of the US labor market is the main reason for the regulator's passivity in relation to changes in monetary policy.

In turn, CHF continues to lead in USD/CHF amid the return of key macroeconomic indicators to pre-crisis levels. Yesterday’s procure.ch PMI fell to 65.4 points in October from 68.1 points in September, driven by global disruptions in the supply chain, which have already begun to recover. Today Switzerland is expected to publish data on consumer price inflation, where analysts expect the annual rate to rise to 1.1% from 0.9% a month earlier, which is another sign of the recovery of the national economy.

Support and resistance

On the global chart of the asset, the price is trading within an ascending channel, having approached the support line. Technical indicators maintain the global sell signal: the range of the Alligator indicator EMAs fluctuations is expanding and the histogram of the AO oscillator forms new descending bars.

Resistance levels: 0.9136, 0.9267.

Support levels: 0.9035, 0.8930.

Trading tips

If the asset continues global decline and the price consolidates below 0.9035, short positions can be opened with the target at 0.8930. Stop-loss – 0.9100. Implementation time: 7 days and more.

If the asset reverses and continues growing and the price consolidates above 0.9136, long positions will be relevant with target at 0.9267. Stop-loss – 0.9080.

No comments:

Write comments