AUD/USD: Bank of Australia left interest rate unchanged

02 November 2021, 11:39

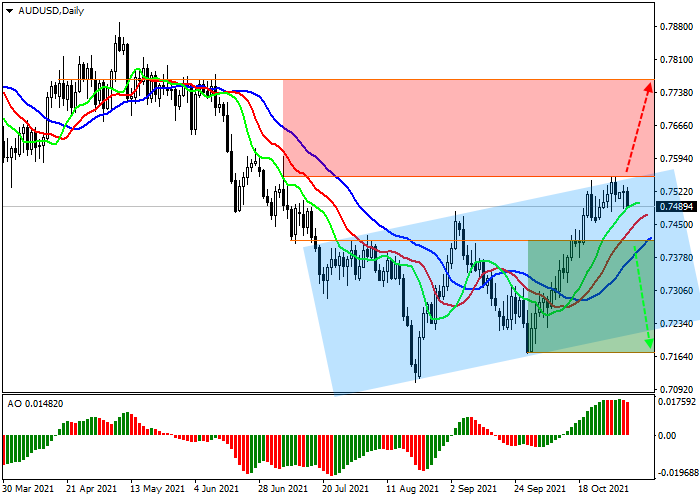

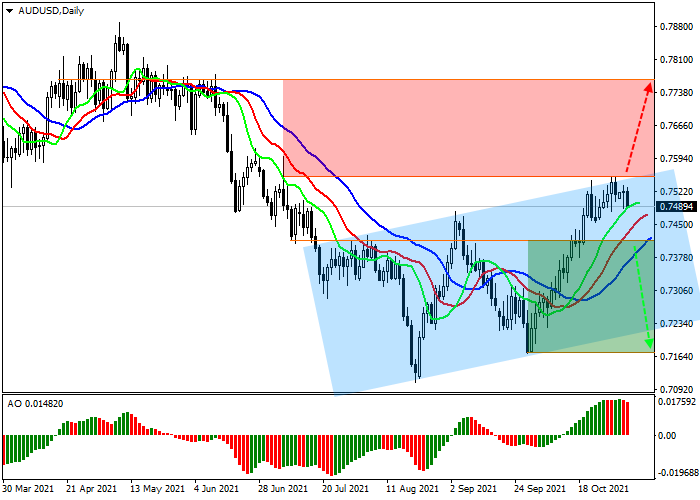

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 0.7415 |

| Take Profit | 0.7170 |

| Stop Loss | 0.7520 |

| Key Levels | 0.7170, 0.7415, 0.7555, 0.7764 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 0.7555 |

| Take Profit | 0.7764 |

| Stop Loss | 0.7480 |

| Key Levels | 0.7170, 0.7415, 0.7555, 0.7764 |

Current trend

AUD is holding in an uptrend against USD, trading at 0.7495.

Today the Reserve Bank of Australia (RBA) decided to leave the monetary policy parameters unchanged. The interest rate remains at 10 basis points (0.10%), as well as the rate for the purchase of government bonds, the volume of which is fixed at AUD 4 billion per week at least until mid-February 2022; however, in the forecast for the near future, the regulator assumes GDP growth within 3% by the end of this year and acceleration to 5.5% in 2022.

In turn, USD failed to consolidate above 94.000 in the USD Index and fell below it amid the publication of weak data on business activity in the US manufacturing sector, which in October fell to 58.4 points from 60.7 points a month earlier. A similar indicator, calculated by the Institute for Supply Management (ISM), in October was 60.8 points, down from 61.1 points demonstrated in September. These data are indirect confirmation of the fact that employment in the main sectors of the economy remains low, which leads to a decrease in activity and, as a result, a decrease in sales in GDP.

Support and resistance

On the global chart of the asset, the price is forming an ascending channel, preparing to reverse downwards. Technical indicators are holding a buy signal, which is gradually weakening: the range of the Alligator indicator EMAs fluctuations starts to narrow down and the histogram of the AO oscillator forms new descending bars.

Resistance levels: 0.7555, 0.7764.

Support levels: 0.7415, 0.7170.

Trading tips

If the asset reverses and declines and the price consolidates below 0.7415, short positions can be opened with the target at 0.7170. Stop-loss – 0.7520. Implementation time: 7 days and more.

If the asset continues growing and the price consolidates above the local resistance at 0.7555, long positions will be relevant with target at 0.7764. Stop-loss – 0.7480.

No comments:

Write comments