EUR/USD: the pair hit an all-time low

12 July 2022, 15:49

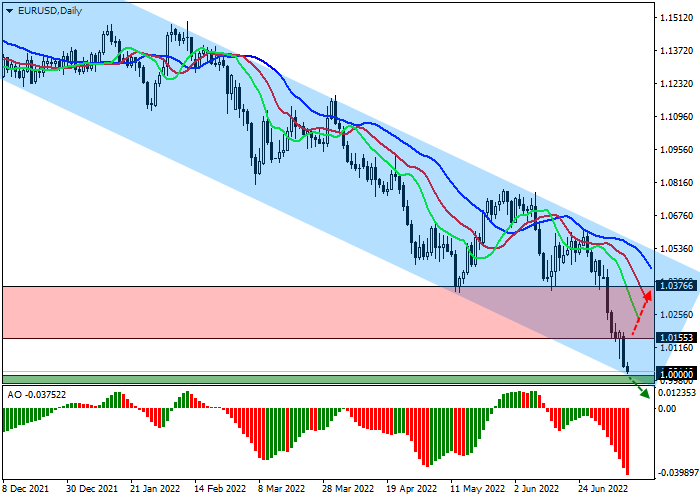

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 1.0000 |

| Take Profit | 0.9900 |

| Stop Loss | 1.0050 |

| Key Levels | 0.9900, 1.0000, 1.0150, 1.0370 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.0150 |

| Take Profit | 1.0370 |

| Stop Loss | 1.0100 |

| Key Levels | 0.9900, 1.0000, 1.0150, 1.0370 |

Current trend

The EUR/USD pair is actively losing value and yesterday reached a historical milestone, which coincides with a 20-year low at 1.0000: the value of the euro caught with the value of the US dollar against the backdrop of a tense economic situation in the EU, where macroeconomic indicators are declining for the second quarter in a row. Today, statistics from Germany for July will be published, and, according to forecasts, the index of current economic conditions from ZEW may correct to –34.5 points from –27.6 points, and the economic sentiment index risks dropping to 2020 levels around –38.3 points, which puts pressure on the single currency.

Yesterday, the gas transportation to Germany via the Nord Stream gas pipeline was stopped for at least July 21 to maintain the infrastructure. The German authorities fear that against the backdrop of increased geopolitical tensions caused by the escalation of the military conflict on the territory of Ukraine and the growing pressure in bilateral relations, this pause may last indefinitely. Earlier, German Minister for Economic Affairs and Climate Protection Robert Habeck acknowledged that the situation with gas reserves in storage facilities remains tense and urged residents to switch to a savings regime. Also, the government will provide an additional 15B euros in loans for fuel purchases outside of Russia, while more coal-fired power plants will be used to generate electricity.

The American currency continue to grow, renewing yesterday the historical maximum of around 108.000 in the USD Index, which was facilitated by the readings of key indicators that measure trends in the US labor market, the composite index of which amounted to 119.38 points, which is higher than 118.88 points a month earlier and indicates that the labor force sector is on the rise. Tomorrow, data on inflation will be published, which may reach another record of 8.8%. Investors are in no hurry to make transactions and prefer to wait for official statistics.

Support and resistance

The trading instrument is moving within the global downward channel, reaching its support line yesterday. Technical indicators maintain a global sell signal: indicator Alligator’s fast EMA oscillation range expands downwards, and the AO oscillator histogram has formed another down bar in the sell zone.

Resistance levels: 1.0150, 1.0370.

Support levels: 1.0000, 0.9900.

Trading tips

Short positions may be opened after the price drops and consolidates below 1.0000, with the target at 0.9900. Stop loss – 1.0050. Implementation period: 7 days or more.

Long positions may be opened after a reversal, growth, and consolidation above 1.0150 with the target at 1.0370. Stop loss – 1.0100.

No comments:

Write comments