GBP/USD: general analysis

04 February 2019, 12:38

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 1.3040 |

| Take Profit | 1.2940 |

| Stop Loss | 1.3095 |

| Key Levels | 1.2830, 1.2940, 1.3011, 1.3041, 1.3095, 1.3122, 1.3160, 1.3216 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.3130 |

| Take Profit | 1.3200 |

| Stop Loss | 1.3095 |

| Key Levels | 1.2830, 1.2940, 1.3011, 1.3041, 1.3095, 1.3122, 1.3160, 1.3216 |

Current trend

On Friday, the GBP/USD pair fell due to poor data on UK manufacturing activity. The index dropped from 54.2 to 52.8 points, which, combined with the lack of progress on Brexit, affected GBP negatively. Meanwhile, USD rose due to strong economic data on the US labor market. The Unemployment Rate rose from 3.9% to 4.0%. However, investors focused on Employment growth: the figure increased from 206K to 296K. Also, USD was strengthened by Manufacturing PMI data. In January, the figure rose from 54.3 to 56.6 points.

During the day, January Construction PMI data will be published data in the UK. It is expected that the figure will be falling for the second month in a row, this time from 52.8 to 52.6 points. The implementation of the forecast could affect GBP negatively. In the United States, November Factory Orders data will be released. It is predicted that the figure will grow by 0.3%, which may provide additional support for USD.

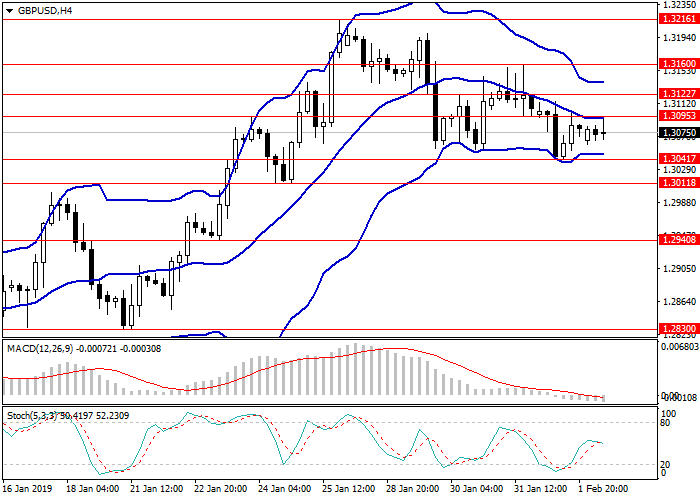

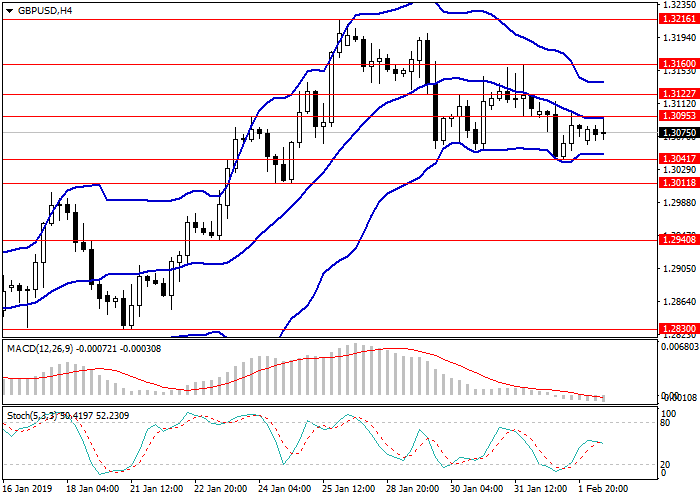

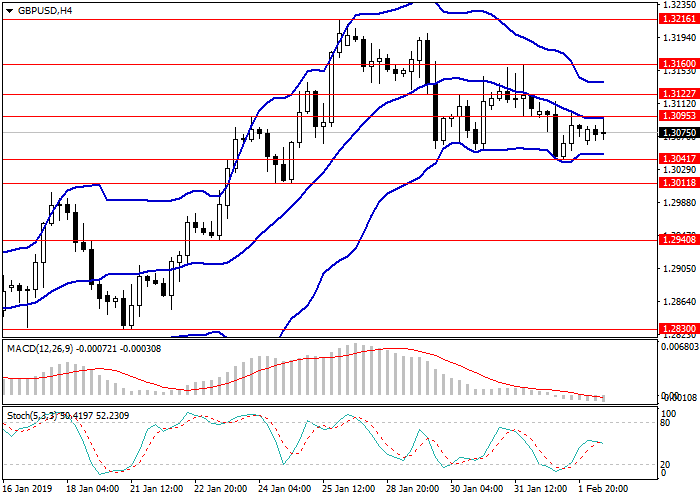

Support and resistance

On the 4-hour chart, the pair moves within a narrow sideways channel formed by the middle line and the lower border of Bollinger bands. MACD histogram is around the zero line, its volumes are minimal.

Resistance levels: 1.3095, 1.3122, 1.3160, 1.3216.

Support levels: 1.3041, 1.3011, 1.2940, 1.2830.

Trading tips

Short positions can be opened from 1.3040 with the target at 1.2940 and stop loss 1.3095. Implementation period: 1–3 days.

Long positions can be opened from 1.3130 with the target at 1.3200 and stop loss 1.3095. Implementation period: 3–5 days.

On Friday, the GBP/USD pair fell due to poor data on UK manufacturing activity. The index dropped from 54.2 to 52.8 points, which, combined with the lack of progress on Brexit, affected GBP negatively. Meanwhile, USD rose due to strong economic data on the US labor market. The Unemployment Rate rose from 3.9% to 4.0%. However, investors focused on Employment growth: the figure increased from 206K to 296K. Also, USD was strengthened by Manufacturing PMI data. In January, the figure rose from 54.3 to 56.6 points.

During the day, January Construction PMI data will be published data in the UK. It is expected that the figure will be falling for the second month in a row, this time from 52.8 to 52.6 points. The implementation of the forecast could affect GBP negatively. In the United States, November Factory Orders data will be released. It is predicted that the figure will grow by 0.3%, which may provide additional support for USD.

Support and resistance

On the 4-hour chart, the pair moves within a narrow sideways channel formed by the middle line and the lower border of Bollinger bands. MACD histogram is around the zero line, its volumes are minimal.

Resistance levels: 1.3095, 1.3122, 1.3160, 1.3216.

Support levels: 1.3041, 1.3011, 1.2940, 1.2830.

Trading tips

Short positions can be opened from 1.3040 with the target at 1.2940 and stop loss 1.3095. Implementation period: 1–3 days.

Long positions can be opened from 1.3130 with the target at 1.3200 and stop loss 1.3095. Implementation period: 3–5 days.

No comments:

Write comments