EUR/USD: general review

04 February 2019, 14:26

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 1.1449 |

| Take Profit | 1.1540, 1.1570 |

| Stop Loss | 1.1360 |

| Key Levels | 1.1170, 1.1200, 1.1250, 1.1290, 1.1335, 1.1375, 1.1415, 1.1485, 1.1515, 1.1540, 1.1570, 1.1630, 1.1650, 1.1710 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY LIMIT |

| Entry Point | 1.1415, 1.1375 |

| Take Profit | 1.1540, 1.1570 |

| Stop Loss | 1.1315 |

| Key Levels | 1.1170, 1.1200, 1.1250, 1.1290, 1.1335, 1.1375, 1.1415, 1.1485, 1.1515, 1.1540, 1.1570, 1.1630, 1.1650, 1.1710 |

Current trend

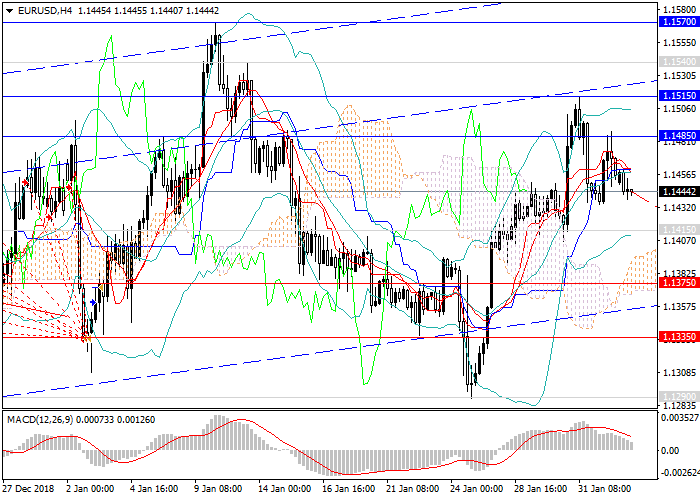

The euro continues to trade within a wide, flat uptrend against the US dollar.

In the second half of January, the pair declined significantly amid the strengthening of USD and weak macroeconomic data from Europe. The instrument reached the key support levels of 1.1335, 1.1290, after which it changed direction and formed a new upward wave. The dollar fell under sales after the Fed decision on rates and soft comments about further monetary policy, after which the pair reached 1.1515. However, on January 31, the instrument returned to the level of 1.1450 amid weak data on the growth rates of the Eurozone economy for 4Q2018.

Today, negative releases on European indices came out again, which put additional pressure on the pair. This week, one should focus on data on the US labor market and retail sales in the Eurozone.

Support and resistance

In the short term, the instrument will continue to move within narrow lateral consolidation. In the future, a decline is expected to the lower border of the ascending channel at 1.1375, after which the price will go up to the local maxima of 1.1515, 1.1540, 1.1570. Taking the level of 1.1570 is unlikely in the medium term due to the lack of strong key releases capable of supporting EUR.

Technical indicators confirm the growth forecast: MACD indicates the preservation of the high volume of long positions, Bollinger Bands are directed upwards.

Support levels: 1.1415, 1.1375, 1.1335, 1.1290, 1.1250, 1.1200, 1.1170.

Resistance levels: 1.1485, 1.1515, 1.1540, 1.1570, 1.1630, 1.1650, 1.1710.

Trading tips

Long positions may be opened from the current level; pending orders can be opened from the levels of 1.1415, 1.1375 with targets at 1.1540, 1.1570 and stop loss at 1.1315.

The euro continues to trade within a wide, flat uptrend against the US dollar.

In the second half of January, the pair declined significantly amid the strengthening of USD and weak macroeconomic data from Europe. The instrument reached the key support levels of 1.1335, 1.1290, after which it changed direction and formed a new upward wave. The dollar fell under sales after the Fed decision on rates and soft comments about further monetary policy, after which the pair reached 1.1515. However, on January 31, the instrument returned to the level of 1.1450 amid weak data on the growth rates of the Eurozone economy for 4Q2018.

Today, negative releases on European indices came out again, which put additional pressure on the pair. This week, one should focus on data on the US labor market and retail sales in the Eurozone.

Support and resistance

In the short term, the instrument will continue to move within narrow lateral consolidation. In the future, a decline is expected to the lower border of the ascending channel at 1.1375, after which the price will go up to the local maxima of 1.1515, 1.1540, 1.1570. Taking the level of 1.1570 is unlikely in the medium term due to the lack of strong key releases capable of supporting EUR.

Technical indicators confirm the growth forecast: MACD indicates the preservation of the high volume of long positions, Bollinger Bands are directed upwards.

Support levels: 1.1415, 1.1375, 1.1335, 1.1290, 1.1250, 1.1200, 1.1170.

Resistance levels: 1.1485, 1.1515, 1.1540, 1.1570, 1.1630, 1.1650, 1.1710.

Trading tips

Long positions may be opened from the current level; pending orders can be opened from the levels of 1.1415, 1.1375 with targets at 1.1540, 1.1570 and stop loss at 1.1315.

No comments:

Write comments