USD/CAD: the dollar is under pressure

31 January 2019, 09:02

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.3145, 1.3175 |

| Take Profit | 1.3300, 1.3322 |

| Stop Loss | 1.3120, 1.3100 |

| Key Levels | 1.3000, 1.3047, 1.3100, 1.3140, 1.3179, 1.3200, 1.3247, 1.3322 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.3095 |

| Take Profit | 1.3000 |

| Stop Loss | 1.3150 |

| Key Levels | 1.3000, 1.3047, 1.3100, 1.3140, 1.3179, 1.3200, 1.3247, 1.3322 |

Current trend

Yesterday, USD fell steadily against CAD, having updated lows since November 8. Investors were focused on the Fed interest rate meeting.

As expected, the regulator kept the rate at 2.25–2.5% after a fourfold increase in 2018. In a related press conference, Fed Chairman Jerome Powell noted the growing global risks but favorably assessed the situation inside the country in the labor market. In addition, he noted the consequences of the long Shutdown in January. According to Powell, the real size of these effects can be estimated by the publication of data for the first quarter of 2019 only.

USD was negatively affected by Pending Home Sales statistics. In December, the indicator fell by 2.2% MoM, with analysts' forecast of +0.5% MoM, and decreased by 9.8% YoY.

Support and resistance

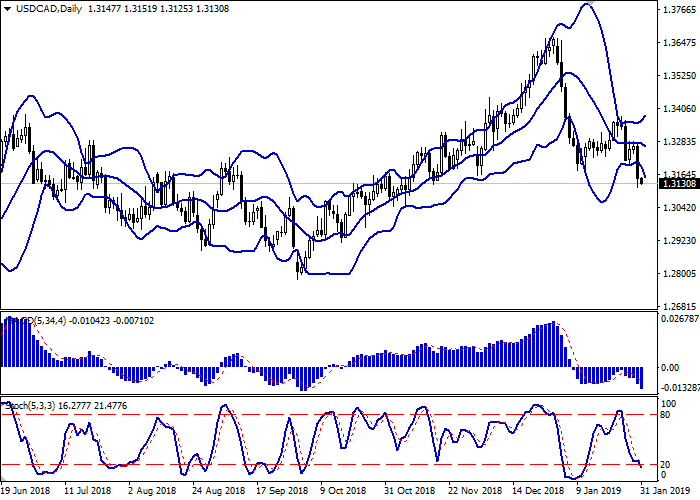

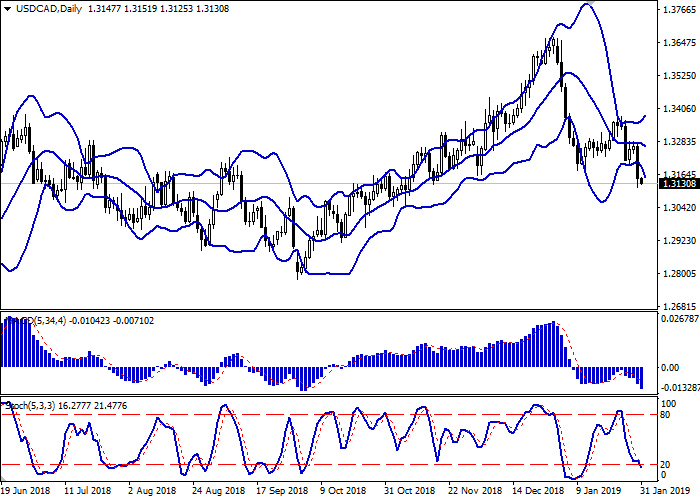

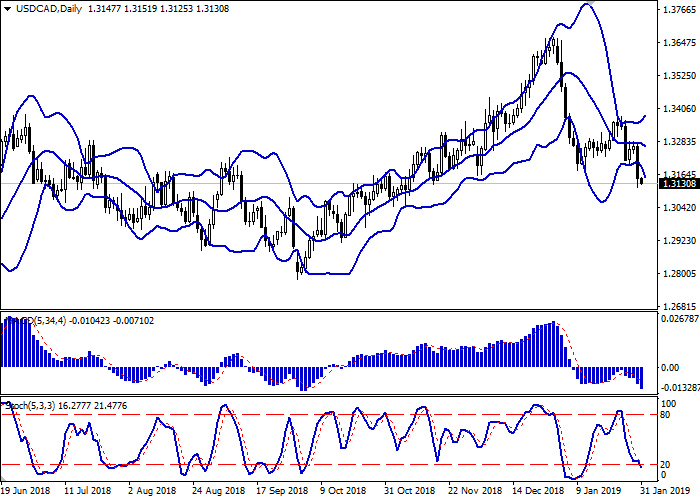

On the daily chart, Bollinger bands fall. The price range actively expands but not as fast as "bearish" trend develops. MACD falls, keeping a strong sell signal (the histogram is below the signal line). Stochastic falls but is reaching its lows, which indicates that the instrument may become oversold in a super short term.

The current readings of the indicators do not contradict the further development of the “bearish” trend in the short term.

Resistance levels: 1.3179, 1.3200, 1.3247, 1.3322.

Support levels: 1.3140, 1.3100, 1.3047, 1.3000.

Trading tips

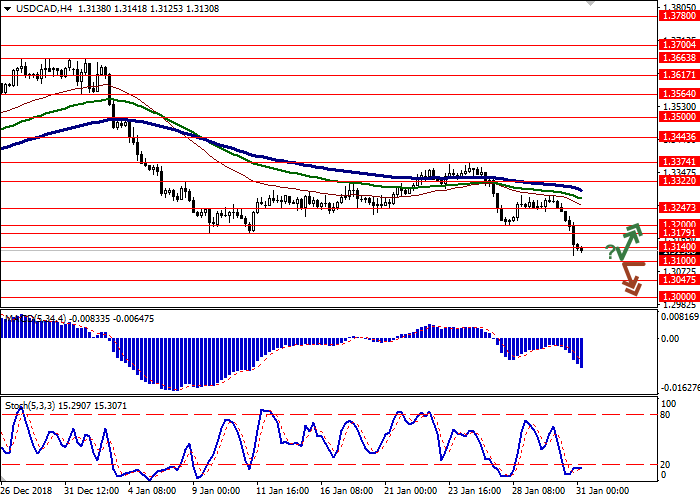

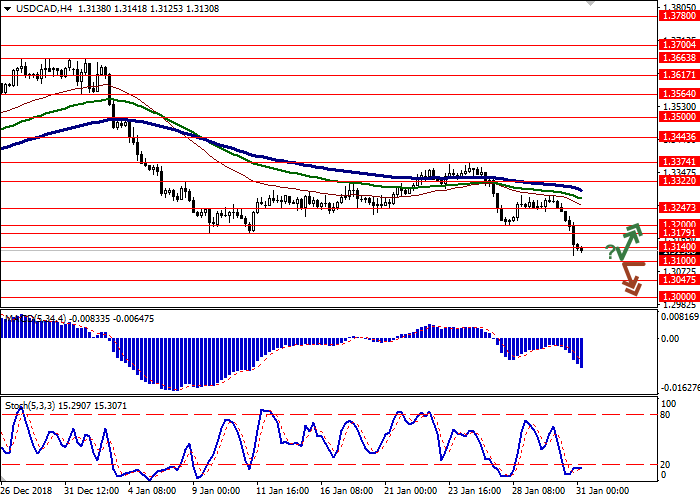

Long positions can be opened after a rebound from 1.3100 or 1.3140 and the breakout of 1.3140–1.3170 with the targets at 1.3300–1.3322. Stop loss is 1.3120–1.3100. Implementation period: 2–3 days.

Short positions can be opened after the breakdown of 1.3100 with the target at 1.3000. Stop loss is 1.3150. Implementation period: 1–2 days.

Yesterday, USD fell steadily against CAD, having updated lows since November 8. Investors were focused on the Fed interest rate meeting.

As expected, the regulator kept the rate at 2.25–2.5% after a fourfold increase in 2018. In a related press conference, Fed Chairman Jerome Powell noted the growing global risks but favorably assessed the situation inside the country in the labor market. In addition, he noted the consequences of the long Shutdown in January. According to Powell, the real size of these effects can be estimated by the publication of data for the first quarter of 2019 only.

USD was negatively affected by Pending Home Sales statistics. In December, the indicator fell by 2.2% MoM, with analysts' forecast of +0.5% MoM, and decreased by 9.8% YoY.

Support and resistance

On the daily chart, Bollinger bands fall. The price range actively expands but not as fast as "bearish" trend develops. MACD falls, keeping a strong sell signal (the histogram is below the signal line). Stochastic falls but is reaching its lows, which indicates that the instrument may become oversold in a super short term.

The current readings of the indicators do not contradict the further development of the “bearish” trend in the short term.

Resistance levels: 1.3179, 1.3200, 1.3247, 1.3322.

Support levels: 1.3140, 1.3100, 1.3047, 1.3000.

Trading tips

Long positions can be opened after a rebound from 1.3100 or 1.3140 and the breakout of 1.3140–1.3170 with the targets at 1.3300–1.3322. Stop loss is 1.3120–1.3100. Implementation period: 2–3 days.

Short positions can be opened after the breakdown of 1.3100 with the target at 1.3000. Stop loss is 1.3150. Implementation period: 1–2 days.

No comments:

Write comments