GBP/USD: general analysis

31 January 2019, 09:25

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 1.3055 |

| Take Profit | 1.2985 |

| Stop Loss | 1.3090 |

| Key Levels | 1.3000, 1.3061, 1.3183, 1.3245 |

Current trend

GBP is trading against USD with a slight increase but overall, the downward trend remains in force.

GBP is under pressure of the failure of the negotiations: the plan that Teresa May presented to parliament was not approved. Two amendments were adopted. The first one recommends not leaving the EU without an agreement, and the second one emphasizes the need to reconsider issues regarding Ireland and its borders, which may close after the UK leaves the EU. The question about the movement of people and goods across the border remains open: London intends to tighten migration control, and Brussels opposes it. The next meeting in parliament will be held on February 13, and the likelihood of withdrawal without agreement increases significantly.

On the other hand, GBP was supported in a short-term by yesterday's decision of the US Federal Reserve to leave the interest rate unchanged, which was supported by all ten members of the committee. Investors were alarmed by the statement by the head of the regulator Jerome Powell, who noted that recently there were fewer and fewer arguments in favor of a rate hike, and the committee would follow a waiting policy, using economic indicators to make a decision. As a result, yesterday USD fell significantly against major world currencies.

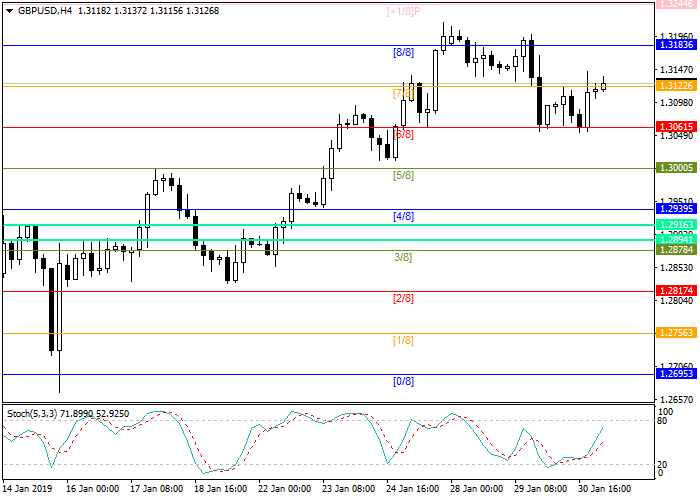

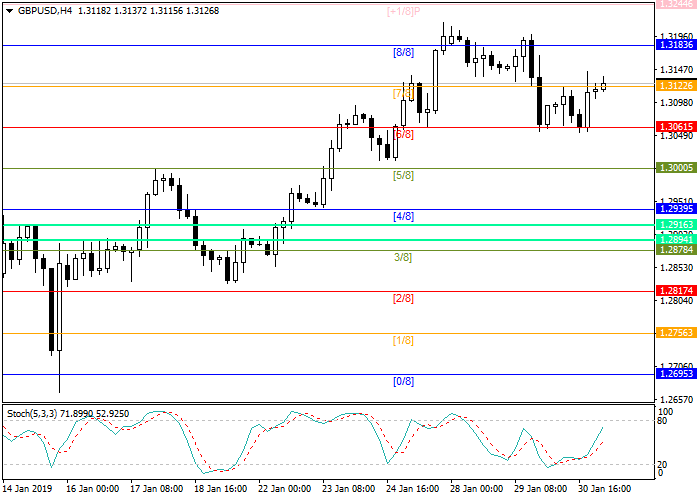

Support and resistance

Stochastic is at 45 points and does not give signals for opening positions.

Resistance levels: 1.3183, 1.3245.

Support levels: 1.3061, 1.3000.

Trading tips

Short positions can be opened after the breakdown of the level of 1.3061 with the target at 1.2985 and stop loss 1.3090.

GBP is trading against USD with a slight increase but overall, the downward trend remains in force.

GBP is under pressure of the failure of the negotiations: the plan that Teresa May presented to parliament was not approved. Two amendments were adopted. The first one recommends not leaving the EU without an agreement, and the second one emphasizes the need to reconsider issues regarding Ireland and its borders, which may close after the UK leaves the EU. The question about the movement of people and goods across the border remains open: London intends to tighten migration control, and Brussels opposes it. The next meeting in parliament will be held on February 13, and the likelihood of withdrawal without agreement increases significantly.

On the other hand, GBP was supported in a short-term by yesterday's decision of the US Federal Reserve to leave the interest rate unchanged, which was supported by all ten members of the committee. Investors were alarmed by the statement by the head of the regulator Jerome Powell, who noted that recently there were fewer and fewer arguments in favor of a rate hike, and the committee would follow a waiting policy, using economic indicators to make a decision. As a result, yesterday USD fell significantly against major world currencies.

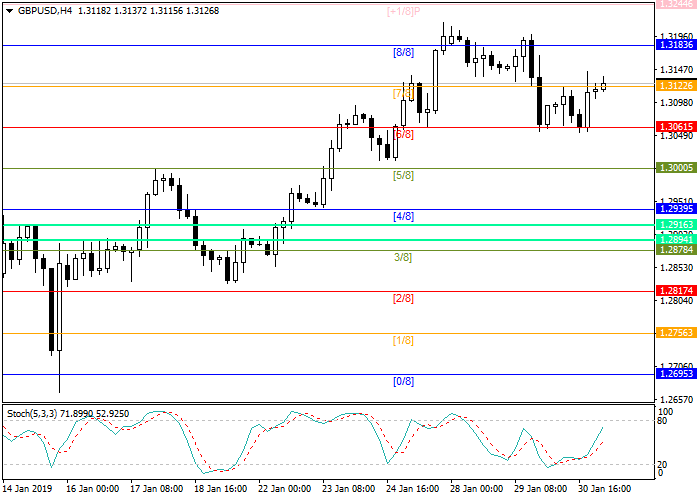

Support and resistance

Stochastic is at 45 points and does not give signals for opening positions.

Resistance levels: 1.3183, 1.3245.

Support levels: 1.3061, 1.3000.

Trading tips

Short positions can be opened after the breakdown of the level of 1.3061 with the target at 1.2985 and stop loss 1.3090.

No comments:

Write comments