EUR/USD: the European currency received a positive impetus

20 July 2022, 10:50

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 1.0350 |

| Take Profit | 1.0624 |

| Stop Loss | 1.0250 |

| Key Levels | 1.0000, 1.0185, 1.0350, 1.0624 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.0185 |

| Take Profit | 1.0000 |

| Stop Loss | 1.0250 |

| Key Levels | 1.0000, 1.0185, 1.0350, 1.0624 |

Current trend

The euro continues to strengthen locally in tandem with the US dollar after the publication of a positive report on the dynamics of consumer prices. Now the quotes of the EUR/USD pair are correcting in the area of 1.0246.

According to statistics, in June the indicator added 0.8% and the annual value reached 8.6%, which is fully consistent with the preliminary estimates of the market and representatives of the European Central Bank (ECB). These macroeconomic data will influence the decision of the members of the regulator during tomorrow's meeting on monetary policy, and the fact that inflation in the eurozone remains in line with expectations may signal an increase in interest rates in a standard 25 basis point increment, which will be enough to contain price increases. In this case, euro quotes will receive short-term support.

Meanwhile, according to The Wall Street Journal, EU oil tanker owners are ramping up their imports of Russian energy as much as possible ahead of the start of sanctions on sea supplies of raw materials adopted under the sixth package. Only in May and June, Greek ships entered Russian ports 151 times, although last year only 89 visits were recorded in the same period of time. Unprecedented demand for "black gold" has tripled the tariffs for its transportation. Experts are sure that after the entry into force of restrictions, the demand for oil will remain at the same high level and its deliveries will have to be made from more remote places, increasing, accordingly, transportation prices, which, in turn, will significantly increase the income of companies specializing in tanker shipping.

A rapid downtrend began in the quotes of the US dollar: in order for the USD Index to fall by a whole point at once, it was enough just to release yesterday's report on the volume of Housing Starts, which did not live up to analysts' expectations. In June, the indicator decreased by 2.0%, amounting to 1.559 million compared to forecasts of 1.580 million and the previous month's value of 1.591 million. On July 27, the US Federal Reserve will hold a meeting on monetary policy, and before this event, serious capital movements in the dollar should not be expected.

Support and resistance

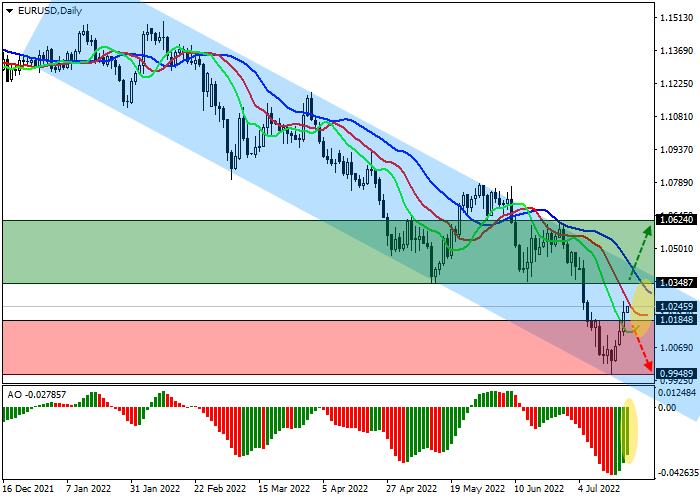

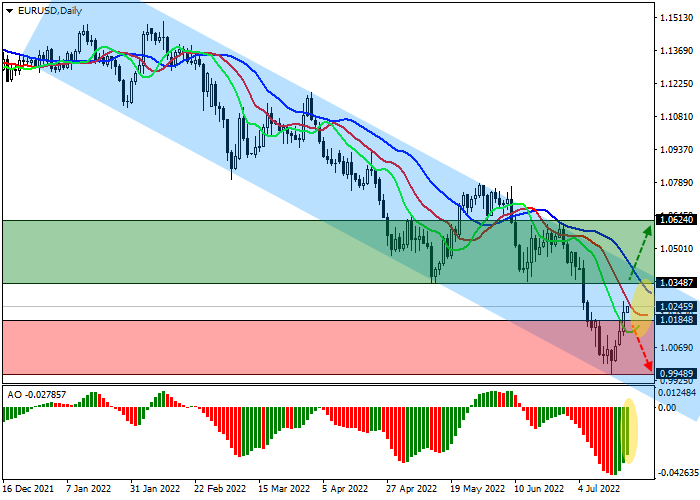

Despite the quite expected achievement of the absolute low of the year, EUR/USD remained within the global downward channel and is now forming another wave of growth. Technical indicators hurried to give a signal for the beginning of the correction: fast EMAs on the Alligator indicator are actively approaching the signal line, and the AO oscillator histogram is forming upward bars.

Support levels: 1.0185, 1.0000.

Resistance levels: 1.0350, 1.0624.

Trading tips

Long positions can be opened after a continued correctional growth of the asset, as well as consolidation of the price above the local resistance level of 1.0350 with the target of 1.0624. Stop-loss — 1.0250. Implementation time: 7 days and more.

Short positions can be opened after a reversal and continued decline in the asset, as well as consolidation of the price below the local support level of 1.0185 with the target of 1.0000. Stop-loss — 1.0250.

No comments:

Write comments