USD/CHF: general review

05 December 2019, 10:23

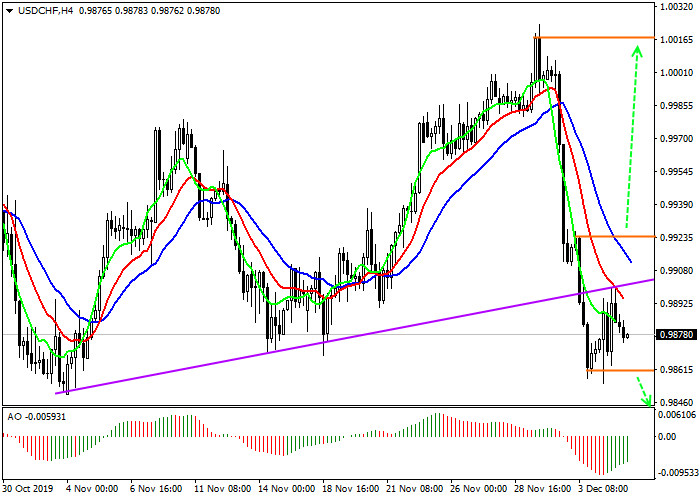

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 0.9860 |

| Take Profit | 0.9720 |

| Stop Loss | 0.9910 |

| Key Levels | 0.9720, 0.9860, 0.9920, 1.0000 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 0.9920 |

| Take Profit | 1.0000 |

| Stop Loss | 0.9850 |

| Key Levels | 0.9720, 0.9860, 0.9920, 1.0000 |

Current trend

The Swiss Federal Statistical Office continues publishing expected results. Consumer Price Index came out in line with expectations (–0.1% versus –0.2% last month), which had a positive effect on CHF.

However, the publication of data on Nonfarm Employment Change in the US came as a big surprise, because the number of jobs fell to 67K, despite a positive forecast of 140K. Such weak statistics are a leading indicator for main employment data, which will negatively affect the already weakening US dollar.

Besides, on Wednesday, the USD Index overcame the psychological level of 98 points, falling so low for the first time since the beginning of autumn. Pessimism is also caused by statements by the US President Donald Trump that the deal with China may be delayed for a year. All this does not speak in favor of the currency pair, and most likely will lead to its further decrease.

Support and resistance

Since the beginning of this week, the pair has clearly indicated the desire to overcome many months of support and consolidate below it. At the moment, this is successful, and the Alligator indicator is in no hurry to cancel a stable sell signal, which may increase after breaking the local low.

Resistance levels: 0.9920, 1.0000.

Support levels: 0.9860, 0.9720.

Trading tips

If the asset continues to decline, and the price consolidates below the local low at 0.9860, short positions can be opened with the target at 0.9720. Stop loss should be placed beyond the local low, at 0.9910.

If the price reverses, the asset grows, and the price consolidates above 0.9920, buy positions with the target of 1.0000 will be relevant. It is advisable to place the stop loss below the local low at around 0.9850.

Implementation time: 7 days and more.

The Swiss Federal Statistical Office continues publishing expected results. Consumer Price Index came out in line with expectations (–0.1% versus –0.2% last month), which had a positive effect on CHF.

However, the publication of data on Nonfarm Employment Change in the US came as a big surprise, because the number of jobs fell to 67K, despite a positive forecast of 140K. Such weak statistics are a leading indicator for main employment data, which will negatively affect the already weakening US dollar.

Besides, on Wednesday, the USD Index overcame the psychological level of 98 points, falling so low for the first time since the beginning of autumn. Pessimism is also caused by statements by the US President Donald Trump that the deal with China may be delayed for a year. All this does not speak in favor of the currency pair, and most likely will lead to its further decrease.

Support and resistance

Since the beginning of this week, the pair has clearly indicated the desire to overcome many months of support and consolidate below it. At the moment, this is successful, and the Alligator indicator is in no hurry to cancel a stable sell signal, which may increase after breaking the local low.

Resistance levels: 0.9920, 1.0000.

Support levels: 0.9860, 0.9720.

Trading tips

If the asset continues to decline, and the price consolidates below the local low at 0.9860, short positions can be opened with the target at 0.9720. Stop loss should be placed beyond the local low, at 0.9910.

If the price reverses, the asset grows, and the price consolidates above 0.9920, buy positions with the target of 1.0000 will be relevant. It is advisable to place the stop loss below the local low at around 0.9850.

Implementation time: 7 days and more.

No comments:

Write comments