NZD/USD: general analysis

09 December 2019, 13:49

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 0.6540 |

| Take Profit | 0.6505 |

| Stop Loss | 0.6560 |

| Key Levels | 0.6360, 0.6385, 0.6432, 0.6475, 0.6508, 0.6544, 0.6580, 0.6596, 0.6615, 0.6645 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 0.6585 |

| Take Profit | 0.6625 |

| Stop Loss | 0.6565 |

| Key Levels | 0.6360, 0.6385, 0.6432, 0.6475, 0.6508, 0.6544, 0.6580, 0.6596, 0.6615, 0.6645 |

Current trend

The NZD/USD pair continues to trade near 5-month highs.

US November Nonfarm Payrolls grew by 266K, which decreased the unemployment to a record low of 3.5%. If employment continues to grow, in 2020, the unemployment rate may fall to 3.4–3.3%. However, the slowdown in average hourly wage growth limited the USD strengthening. A strong labor market can be a catalyst for Q4 GDP growth but the Fed plans to limit the USD potential must be taken into account. The increased Chinese Manufacturing PMI keeps the instrument near local highs for more than a week.

Today, there is a lack of key releases, and the pair will consolidate within a limited range of 0.6540–0.6580. Tomorrow at 03:30 (GMT+2), China will publish CPI and PPI data: a negative release will not have significant pressure on the price; however, positive values will help it to break the strong resistance of 0.6580. At 15:30 (GMT+2), US Nonfarm Productivity and Q3 Unit Labor Costs will be released. At 23:45 (GMT+2), New Zealand will publish data on Electronic Cards Retail Sales for November.

Support and resistance

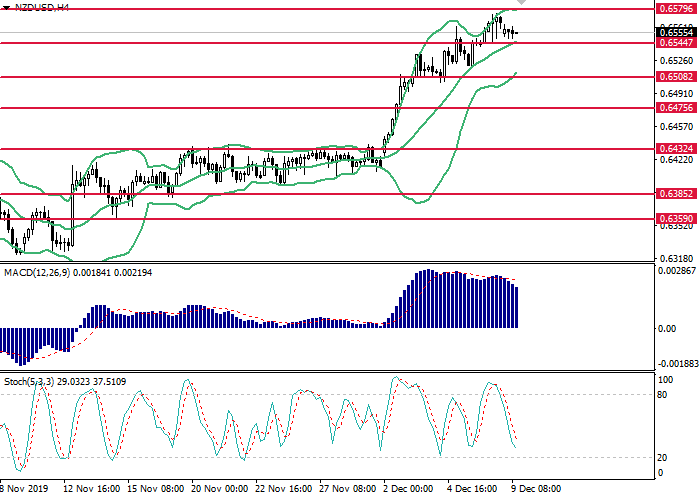

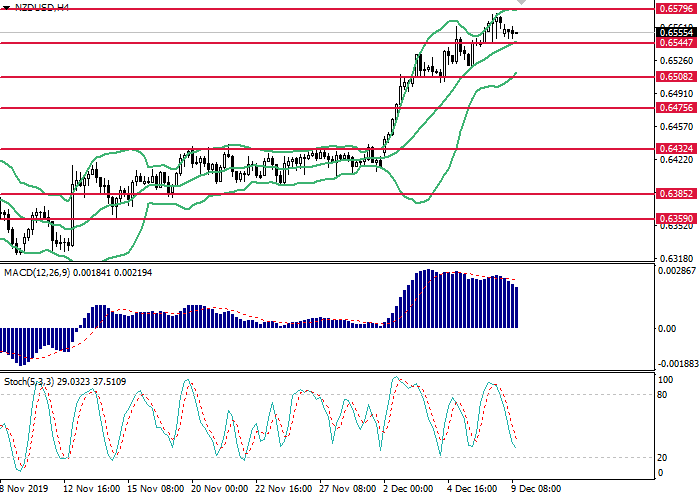

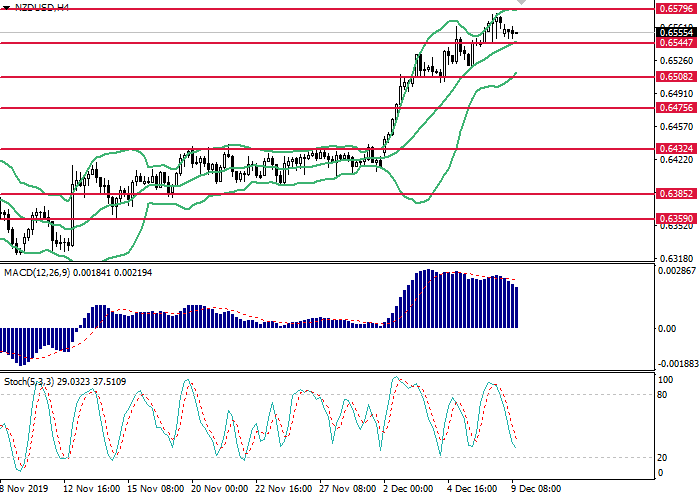

On the 4-hour chart, an uptrend is in a correction. The instrument trades at the top of Bollinger bands. The indicator grows, and the price range slightly decreased, which indicates the continuation of the correction. MACD is in the positive zone, the buy signal is relevant. Stochastic approaches the oversold zone without a signal to enter the market.

Resistance levels: 0.6580, 0.6596, 0.6615, 0.6645.

Support levels: 0.6544, 0.6508, 0.6475, 0.6432, 0.6385, 0.6360.

Trading tips

Short positions may be opened below 0.6544 with the target at 0.6505 and stop loss 0.6560.

Long positions may be opened above 0.6580 with the target at 0.6625 and stop loss 0.6565.

Implementation period: 1–2 days.

The NZD/USD pair continues to trade near 5-month highs.

US November Nonfarm Payrolls grew by 266K, which decreased the unemployment to a record low of 3.5%. If employment continues to grow, in 2020, the unemployment rate may fall to 3.4–3.3%. However, the slowdown in average hourly wage growth limited the USD strengthening. A strong labor market can be a catalyst for Q4 GDP growth but the Fed plans to limit the USD potential must be taken into account. The increased Chinese Manufacturing PMI keeps the instrument near local highs for more than a week.

Today, there is a lack of key releases, and the pair will consolidate within a limited range of 0.6540–0.6580. Tomorrow at 03:30 (GMT+2), China will publish CPI and PPI data: a negative release will not have significant pressure on the price; however, positive values will help it to break the strong resistance of 0.6580. At 15:30 (GMT+2), US Nonfarm Productivity and Q3 Unit Labor Costs will be released. At 23:45 (GMT+2), New Zealand will publish data on Electronic Cards Retail Sales for November.

Support and resistance

On the 4-hour chart, an uptrend is in a correction. The instrument trades at the top of Bollinger bands. The indicator grows, and the price range slightly decreased, which indicates the continuation of the correction. MACD is in the positive zone, the buy signal is relevant. Stochastic approaches the oversold zone without a signal to enter the market.

Resistance levels: 0.6580, 0.6596, 0.6615, 0.6645.

Support levels: 0.6544, 0.6508, 0.6475, 0.6432, 0.6385, 0.6360.

Trading tips

Short positions may be opened below 0.6544 with the target at 0.6505 and stop loss 0.6560.

Long positions may be opened above 0.6580 with the target at 0.6625 and stop loss 0.6565.

Implementation period: 1–2 days.

No comments:

Write comments