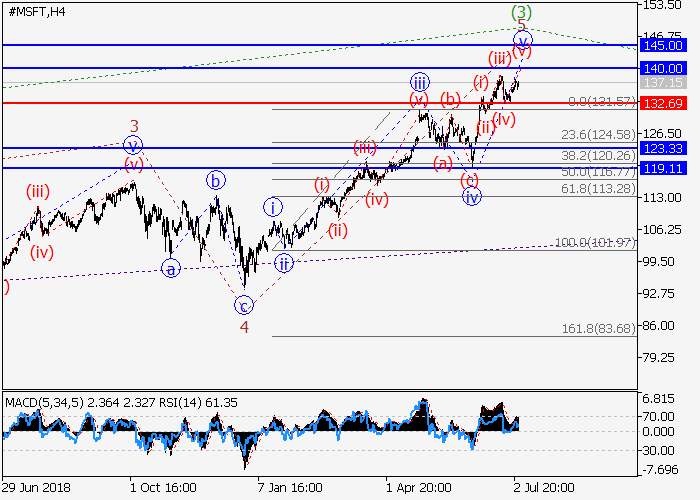

Microsoft Corp.: wave analysis

08 July 2019, 09:28

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 137.17 |

| Take Profit | 140.00, 145.00 |

| Stop Loss | 138.10 |

| Key Levels | 119.11, 123.33, 132.69, 140.00, 145.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 132.60 |

| Take Profit | 123.33, 119.11 |

| Stop Loss | 135.70 |

| Key Levels | 119.11, 123.33, 132.69, 140.00, 145.00 |

The price may grow.

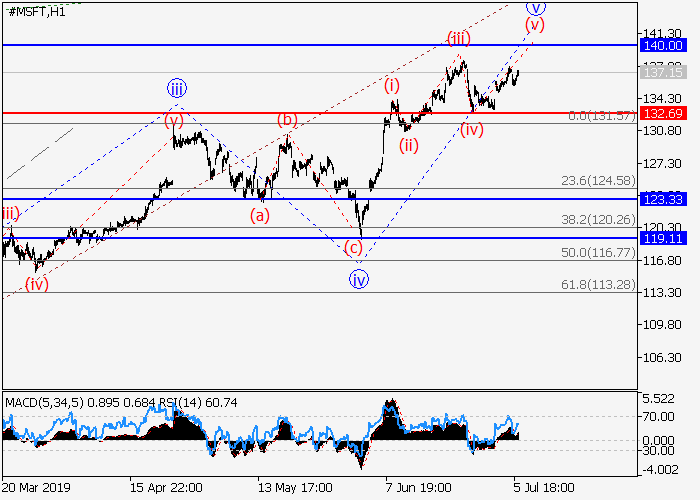

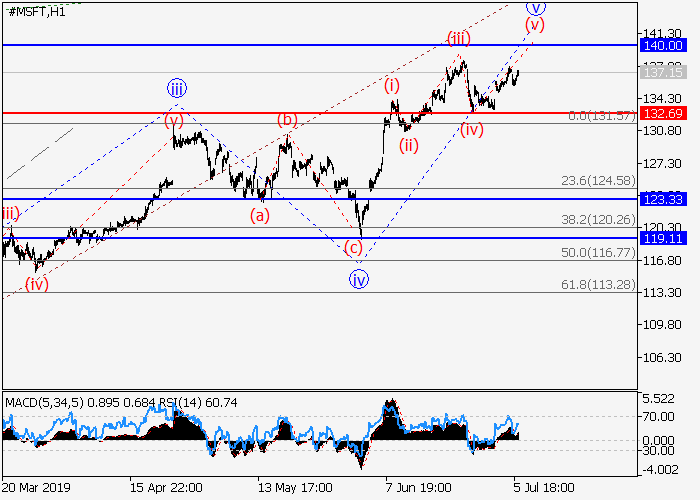

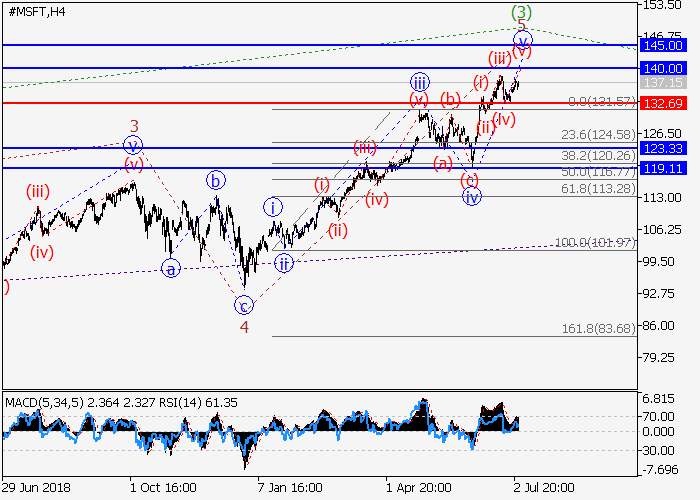

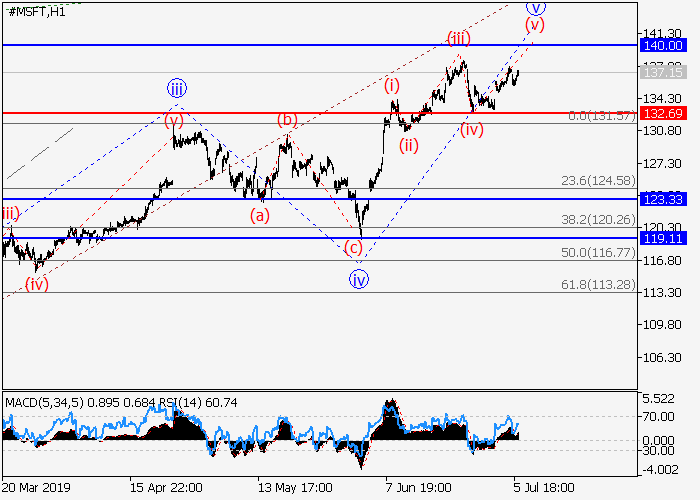

On the 4-hour chart, the fifth wave 5 of (3) of the higher level is forming. Now the local correction iv of 5 has formed, and the fifth wave v of 5 is developing, within which the wave of the lower level (v) of v is forming. If the assumption is correct, the price will grow to the levels of 140.00–145.00. In this scenario, critical stop loss level is 132.69.

Main scenario

Long positions will become relevant during the correction, above the level of 132.69 with the targets at 140.00–145.00. Implementation period: 5–7 days.

Alternative scenario

The breakout and the consolidation of the price below the level of 132.69 will let the price go down to the levels of 123.33–119.11.

On the 4-hour chart, the fifth wave 5 of (3) of the higher level is forming. Now the local correction iv of 5 has formed, and the fifth wave v of 5 is developing, within which the wave of the lower level (v) of v is forming. If the assumption is correct, the price will grow to the levels of 140.00–145.00. In this scenario, critical stop loss level is 132.69.

Main scenario

Long positions will become relevant during the correction, above the level of 132.69 with the targets at 140.00–145.00. Implementation period: 5–7 days.

Alternative scenario

The breakout and the consolidation of the price below the level of 132.69 will let the price go down to the levels of 123.33–119.11.

No comments:

Write comments