EUR/USD: EUR is ambiguous

22 July 2019, 09:38

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.1235, 1.1250 |

| Take Profit | 1.1316, 1.1343 |

| Stop Loss | 1.1200 |

| Key Levels | 1.1133, 1.1159, 1.1180, 1.1198, 1.1244, 1.1284, 1.1316, 1.1343 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.1190 |

| Take Profit | 1.1133 |

| Stop Loss | 1.1230 |

| Key Levels | 1.1133, 1.1159, 1.1180, 1.1198, 1.1244, 1.1284, 1.1316, 1.1343 |

Current trend

EUR fell markedly against USD on July 19. Technical factors contributed to the weakening of the instrument, while the macroeconomic background remained controversial. The euro was pressured by a weak data on production inflation in Germany. In June, the producer price index fell by 0.4% MoM after falling by 0.1% MoM last month. YoY, the index slowed down from 1.9% to 1.2%, below market expectations of 1.4%. The dollar reacted negatively to the speech of Fed representative James Bullard, who spoke in favor of rapidly lowering interest rates, which would allow avoiding the development of another economic crisis. Investors saw in these words hints of a possible reduction in the interest rate at the end of July.

Today, the instrument shows ambiguous dynamic, awaiting the appearance of new drivers. Investors are focused on the Bundesbank monthly report, as well as the publication of the Chicago Fed National Activity Index for June.

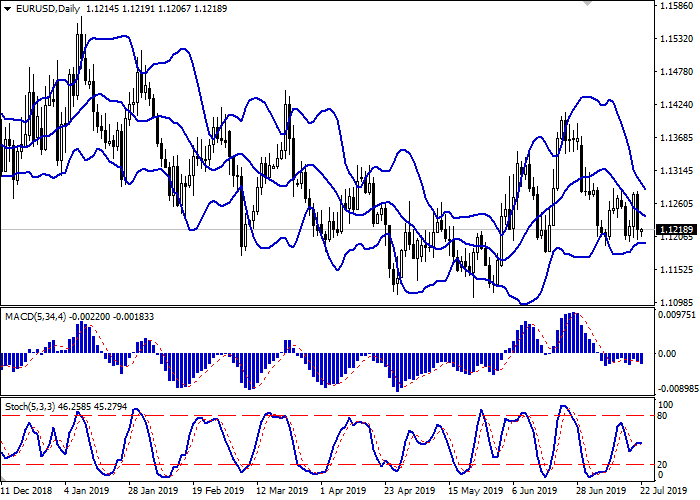

Support and resistance

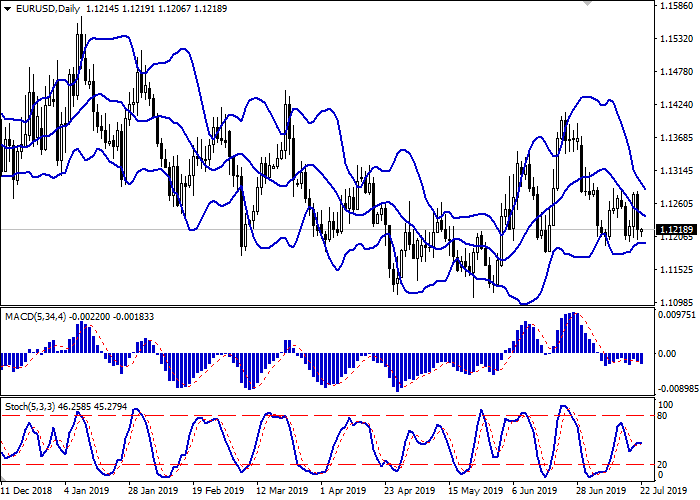

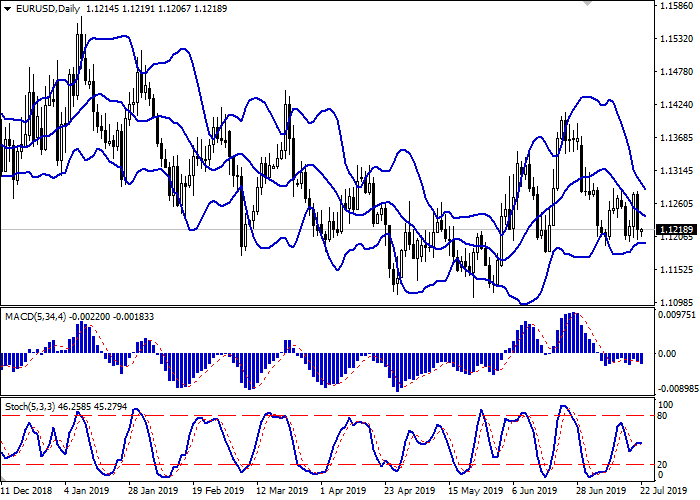

Bollinger Bands in D1 chart demonstrate a gradual decrease. The price range is narrowing, reflecting the ambiguous dynamics of trading in the short term. MACD is going down preserving a weak sell signal (being located under the signal line). Stochastic reversed horizontally near the center of its working area, indicating the balance of power in the ultra-short term.

One should wait for the clarification of trade signals.

Resistance levels: 1.1244, 1.1284, 1.1316, 1.1343.

Support levels: 1.1198, 1.1180, 1.1159, 1.1133.

Trading tips

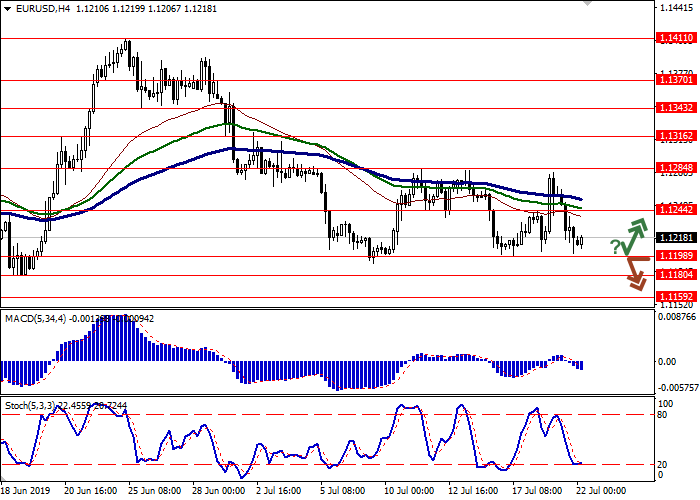

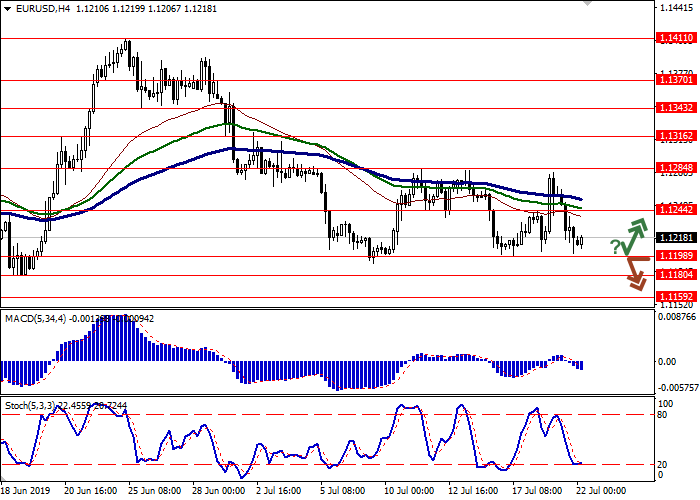

Long positions may be opened if the price moves away from 1.1198, as from support, followed by the breakout of 1.1230–1.1244. Take profit — 1.1316 or 1.1343. Stop loss – 1.1200.

A confident breakdown of the level of 1.1198 may serve as a signal to further sales with the target at 1.1133. Stop loss – 1.1230.

Implementation period: 2-3 days.

EUR fell markedly against USD on July 19. Technical factors contributed to the weakening of the instrument, while the macroeconomic background remained controversial. The euro was pressured by a weak data on production inflation in Germany. In June, the producer price index fell by 0.4% MoM after falling by 0.1% MoM last month. YoY, the index slowed down from 1.9% to 1.2%, below market expectations of 1.4%. The dollar reacted negatively to the speech of Fed representative James Bullard, who spoke in favor of rapidly lowering interest rates, which would allow avoiding the development of another economic crisis. Investors saw in these words hints of a possible reduction in the interest rate at the end of July.

Today, the instrument shows ambiguous dynamic, awaiting the appearance of new drivers. Investors are focused on the Bundesbank monthly report, as well as the publication of the Chicago Fed National Activity Index for June.

Support and resistance

Bollinger Bands in D1 chart demonstrate a gradual decrease. The price range is narrowing, reflecting the ambiguous dynamics of trading in the short term. MACD is going down preserving a weak sell signal (being located under the signal line). Stochastic reversed horizontally near the center of its working area, indicating the balance of power in the ultra-short term.

One should wait for the clarification of trade signals.

Resistance levels: 1.1244, 1.1284, 1.1316, 1.1343.

Support levels: 1.1198, 1.1180, 1.1159, 1.1133.

Trading tips

Long positions may be opened if the price moves away from 1.1198, as from support, followed by the breakout of 1.1230–1.1244. Take profit — 1.1316 or 1.1343. Stop loss – 1.1200.

A confident breakdown of the level of 1.1198 may serve as a signal to further sales with the target at 1.1133. Stop loss – 1.1230.

Implementation period: 2-3 days.

No comments:

Write comments