AUD/USD: Murrey analysis

22 July 2019, 14:45

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 0.7085 |

| Take Profit | 0.7141 |

| Stop Loss | 0.7055 |

| Key Levels | 0.6927, 0.6958, 0.7018, 0.7080, 0.7141 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6988 |

| Take Profit | 0.6958, 0.6927 |

| Stop Loss | 0.7815 |

| Key Levels | 0.6927, 0.6958, 0.7018, 0.7080, 0.7141 |

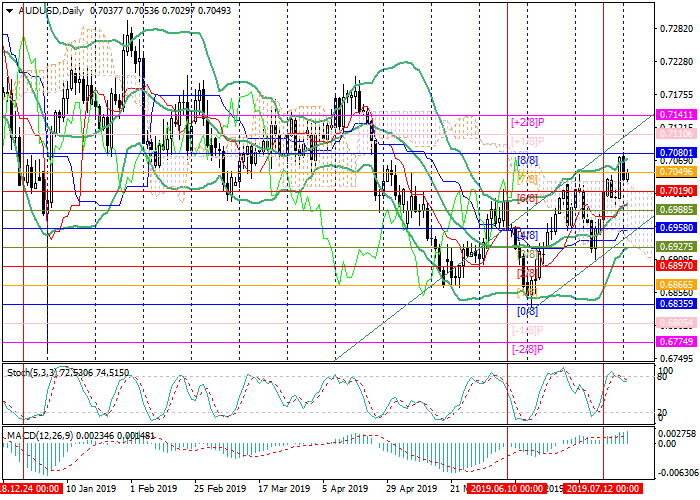

For the second consecutive month, the pair continues to trade within the

ascending corridor. On Friday, the instrument tested the upper border of the

Murrey trading range at 0.7080 ([8/8]), but then corrected downwards. During the

week, the level of 0.7080 can be tested again, as evidenced by the upward

Bollinger Bands and MACD histogram growing in the positive zone. If successful,

the price may reach the level of 0.7141 ([+2/8]). But a serious decrease will be

possible only if the instrument is consolidated below the 0.7018 ([6/8]) and the

midline of Bollinger Bands. In this case, the fall will be possible to the

levels of 0.6958 ([4/8]) and 0.6927 ([3/8], the bottom line of Bollinger Bands).

But so far this scenario seems less probable.

Support and resistance

Resistance levels: 0.7080, 0.7141.

Support levels: 0.7018, 0.6958, 0.6927.

Trading tips

Long positions may be opened above 0.7080 with the target at 0.7141 and stop loss at 0.7055.

Short positions may be opened from 0.6988 with targets at 0.6958, 0.6927 and stop loss at 0.7815.

Implementation period: 3-4 days.

Support and resistance

Resistance levels: 0.7080, 0.7141.

Support levels: 0.7018, 0.6958, 0.6927.

Trading tips

Long positions may be opened above 0.7080 with the target at 0.7141 and stop loss at 0.7055.

Short positions may be opened from 0.6988 with targets at 0.6958, 0.6927 and stop loss at 0.7815.

Implementation period: 3-4 days.

No comments:

Write comments