USD/JPY: downtrend continues

28 June 2019, 14:43

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL |

| Entry Point | 107.70 |

| Take Profit | 106.75, 106.00 |

| Stop Loss | 108.40 |

| Key Levels | 104.00, 104.70, 105.50, 106.00, 106.75, 107.40, 107.70, 108.15, 108.70, 109.10, 110.00 |

Current trend

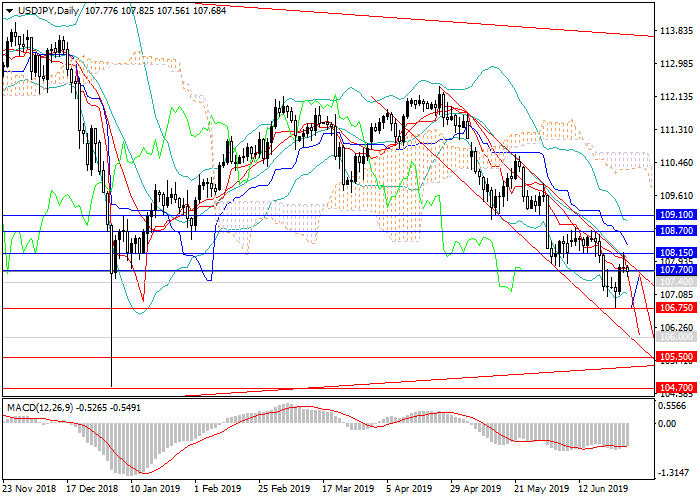

Over the past two months, the USD/JPY pair has maintained a downward trend. At the beginning of the current trading week, the price tested the local minimum and the key support level of 106.75, failed to break through it and began to grow. For two trading days, the instruments regained more than 150 points and reached the upper limit of the downwards channel but there was no change in direction and exit from the downwards channel. The course rebounded from strong resistance at 108.15 and went down again. At the end of the current trading week, USD was supported by favorable data on the growth rate of the US economy for the first quarter.

Today, JPY began to strengthen again against the background of favorable releases on industrial production, as well as due to a new wave of demand for the Japanese currency.

In early July, investors will pay attention to US publications on the labor market and key indices.

Support and resistance

Most likely, the pair will return to the local minimum at 106.75 and move to a wide sideways consolidation channel. Otherwise, the breakdown of the local minimum and testing of new lows within the current downward range is possible.

Technical indicators confirm the forecast for further decline. On the daily chart, MACD keeps high volumes of short positions, and Bollinger bands are directed downwards.

Resistance levels: 107.70, 108.15, 108.70, 109.10, 110.00.

Support levels: 107.40, 106.75, 106.00, 105.50, 104.70, 104.00.

Trading tips

Short positions can be opened from the current level with the targets at 106.75, 106.00 and stop loss 108.40.

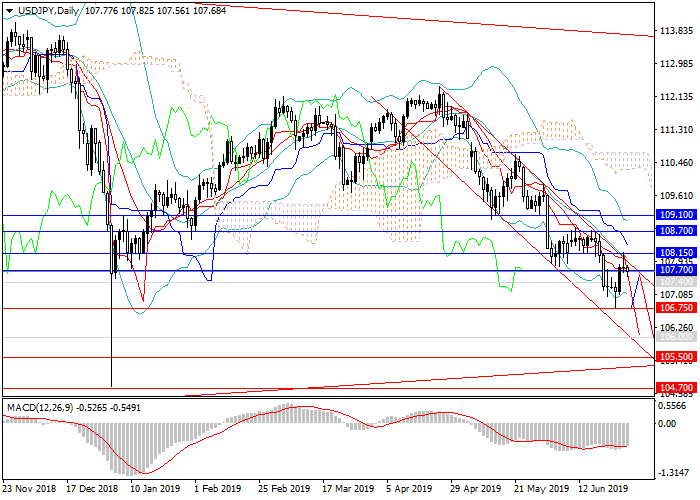

Over the past two months, the USD/JPY pair has maintained a downward trend. At the beginning of the current trading week, the price tested the local minimum and the key support level of 106.75, failed to break through it and began to grow. For two trading days, the instruments regained more than 150 points and reached the upper limit of the downwards channel but there was no change in direction and exit from the downwards channel. The course rebounded from strong resistance at 108.15 and went down again. At the end of the current trading week, USD was supported by favorable data on the growth rate of the US economy for the first quarter.

Today, JPY began to strengthen again against the background of favorable releases on industrial production, as well as due to a new wave of demand for the Japanese currency.

In early July, investors will pay attention to US publications on the labor market and key indices.

Support and resistance

Most likely, the pair will return to the local minimum at 106.75 and move to a wide sideways consolidation channel. Otherwise, the breakdown of the local minimum and testing of new lows within the current downward range is possible.

Technical indicators confirm the forecast for further decline. On the daily chart, MACD keeps high volumes of short positions, and Bollinger bands are directed downwards.

Resistance levels: 107.70, 108.15, 108.70, 109.10, 110.00.

Support levels: 107.40, 106.75, 106.00, 105.50, 104.70, 104.00.

Trading tips

Short positions can be opened from the current level with the targets at 106.75, 106.00 and stop loss 108.40.

No comments:

Write comments