USD/CAD: USD is corrected

06 June 2019, 10:21

| Scenario | |

|---|---|

| Timeframe | Intraday |

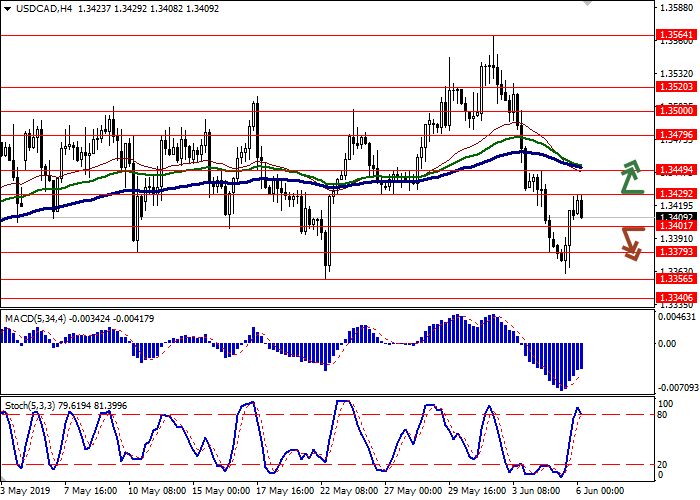

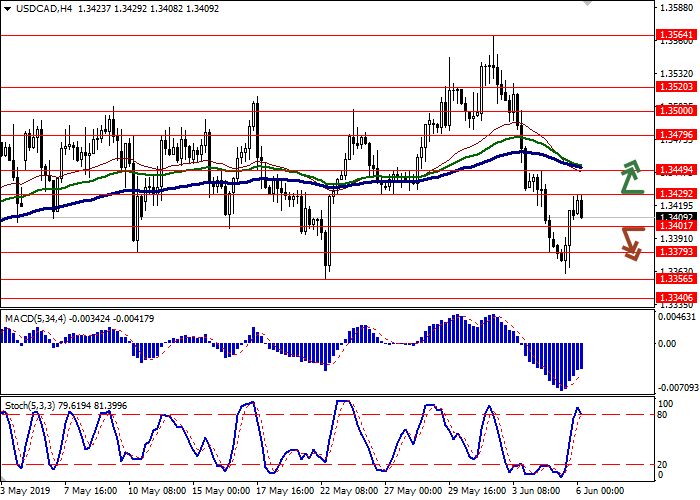

| Recommendation | BUY STOP |

| Entry Point | 1.3435 |

| Take Profit | 1.3500 |

| Stop Loss | 1.3401 |

| Key Levels | 1.3340, 1.3356, 1.3379, 1.3401, 1.3429, 1.3449, 1.3479, 1.3500 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.3395, 1.3370 |

| Take Profit | 1.3340, 1.3320 |

| Stop Loss | 1.3430 |

| Key Levels | 1.3340, 1.3356, 1.3379, 1.3401, 1.3429, 1.3449, 1.3479, 1.3500 |

Current trend

USD showed moderate growth against CAD on Wednesday, departing from the updated local lows of May 22. Correction of USD is largely due to technical factors, while the fundamental background remains very ambiguous. In particular, investors paid attention to the extremely weak ADP Employment Change report which reflected an increase in the private sector by only 27K new jobs in May after rising by 271K over the past month. The forecast assumed growth by 180K. Increased attention to the report is due to the upcoming publications on the US labor market on Friday.

Canadian statistics looks a little better for the time being. Labor Productivity indicator for Q1 2019 reflected an increase of 0.3% QoQ after a decline of 0.4% QoQ last month. Today, investors are waiting for the publication of statistics on imports and exports in Canada for April, as well as the PMI data from Ivey for May.

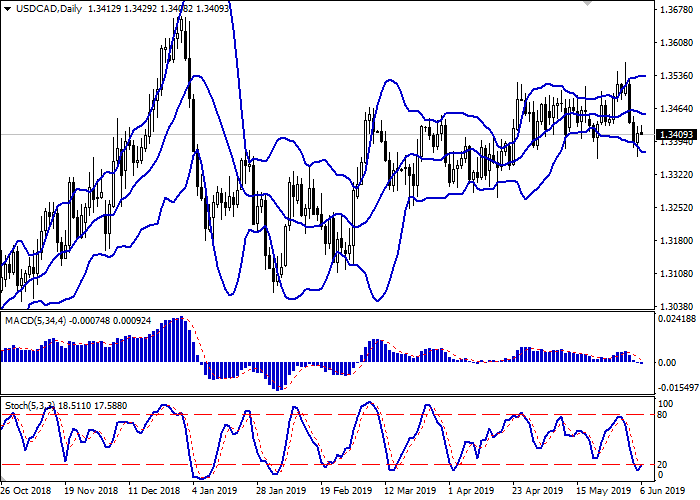

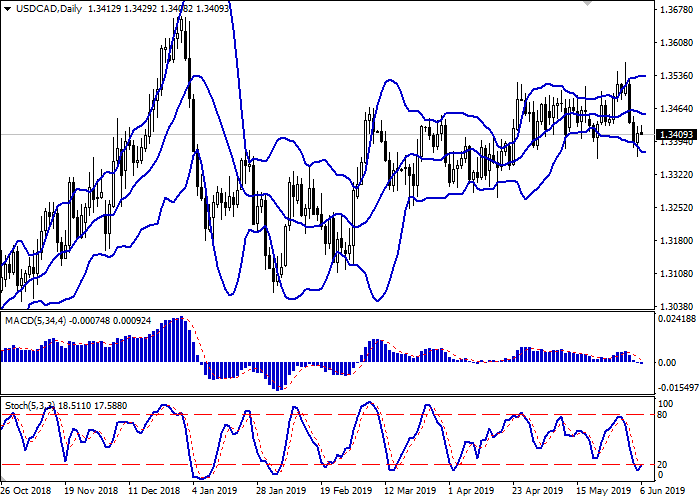

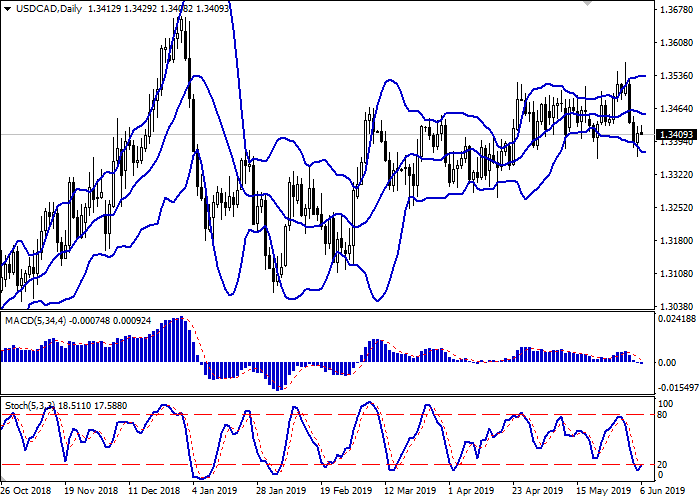

Support and resistance

Bollinger Bands in the D1 chart demonstrate flat dynamics. The price range expands slightly from below, indicating a strong "bearish" momentum, preserved in the short term. MACD is declining keeping a weak sell signal (located below the signal line). Stochastic approaching its minimum levels tends to reverse into an ascending plane, signaling oversold instrument in the ultra-short term.

It is worth looking into the possibility of the upward correction in the short and/or ultra-short term.

Resistance levels: 1.3429, 1.3449, 1.3479, 1.3500.

Support levels: 1.3401, 1.3379, 1.3356, 1.3340.

Trading tips

To open long positions, one can rely on the breakout of 1.3429. Take profit — 1.3500. Stop loss — 1.3401.

The return of "bearish" trend with the breakdown of 1.3401 or 1.3379 may become a signal for new sales with the target at 1.3340 or 1.3320. Stop loss — 1.3410–1.3430.

Implementation time: 2-3 days.

USD showed moderate growth against CAD on Wednesday, departing from the updated local lows of May 22. Correction of USD is largely due to technical factors, while the fundamental background remains very ambiguous. In particular, investors paid attention to the extremely weak ADP Employment Change report which reflected an increase in the private sector by only 27K new jobs in May after rising by 271K over the past month. The forecast assumed growth by 180K. Increased attention to the report is due to the upcoming publications on the US labor market on Friday.

Canadian statistics looks a little better for the time being. Labor Productivity indicator for Q1 2019 reflected an increase of 0.3% QoQ after a decline of 0.4% QoQ last month. Today, investors are waiting for the publication of statistics on imports and exports in Canada for April, as well as the PMI data from Ivey for May.

Support and resistance

Bollinger Bands in the D1 chart demonstrate flat dynamics. The price range expands slightly from below, indicating a strong "bearish" momentum, preserved in the short term. MACD is declining keeping a weak sell signal (located below the signal line). Stochastic approaching its minimum levels tends to reverse into an ascending plane, signaling oversold instrument in the ultra-short term.

It is worth looking into the possibility of the upward correction in the short and/or ultra-short term.

Resistance levels: 1.3429, 1.3449, 1.3479, 1.3500.

Support levels: 1.3401, 1.3379, 1.3356, 1.3340.

Trading tips

To open long positions, one can rely on the breakout of 1.3429. Take profit — 1.3500. Stop loss — 1.3401.

The return of "bearish" trend with the breakdown of 1.3401 or 1.3379 may become a signal for new sales with the target at 1.3340 or 1.3320. Stop loss — 1.3410–1.3430.

Implementation time: 2-3 days.

No comments:

Write comments