GBP/USD: forming a broad consolidation

26 June 2019, 14:57

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL |

| Entry Point | 1.2678 |

| Take Profit | 1.2500 |

| Stop Loss | 1.2740 |

| Key Levels | 1.2330, 1.2400, 1.2550, 1.2500, 1.2570, 1.2655, 1.2760, 1.2785, 1.2830, 1.3000 |

Current trend

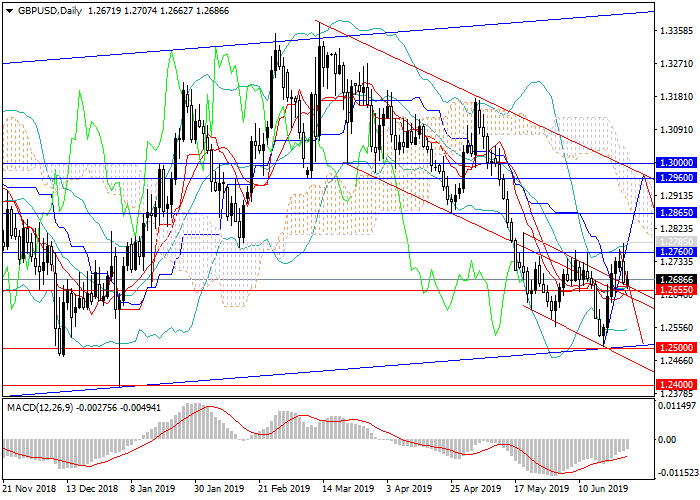

In June, GBP rose significantly against USD and reached the key resistance level of 1.2760. The pair tested the level unsuccessfully several times, after which it rebounded and began to decline. Yesterday, due to a change in trading sentiment from the key resistance level, the instrument fell by more than 100 points and almost returned within the medium-term downward channel, in which it has been trading for the past several months.

Today, USD may receive additional support and return the pair to a downward channel after the publication of US Durable Goods Orders data.

Support and resistance

In the medium term, the pair may go into a downward range and continue to fall to its lows. Now, GBP is under considerable pressure but USD is also weakening, which can form a broad sideways consolidation within 1.2760–1.2500. There are no drivers either for a significant recovery of GBP or to overcome the support levels and local lows of 1.2500, 1.2400.

On the 4-hour and daily charts, technical indicators confirm the transition to sideways movement. MACD volumes are decreasing, the signal line tends to the zero line, Bollinger bands are lined up horizontally.

Resistance levels: 1.2760, 1.2785, 1.2830, 1.3000.

Support levels: 1.2655, 1.2570, 1.2500, 1.2550, 1.2400, 1.2330.

Trading tips

Short positions can be opened from the current level with the target at 1.2500 and stop loss 1.2740.

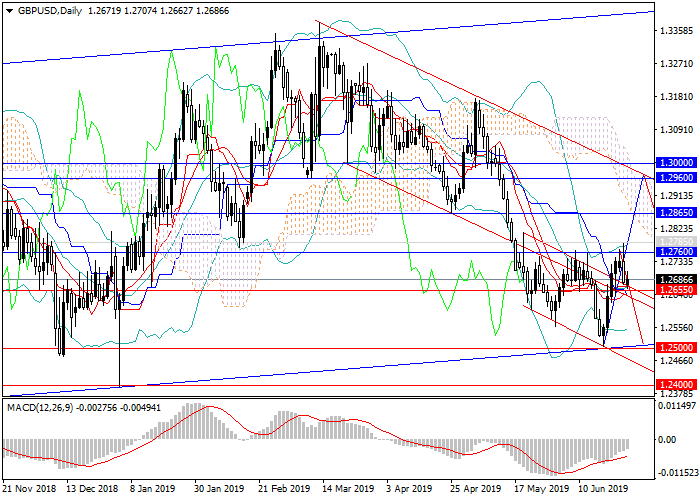

In June, GBP rose significantly against USD and reached the key resistance level of 1.2760. The pair tested the level unsuccessfully several times, after which it rebounded and began to decline. Yesterday, due to a change in trading sentiment from the key resistance level, the instrument fell by more than 100 points and almost returned within the medium-term downward channel, in which it has been trading for the past several months.

Today, USD may receive additional support and return the pair to a downward channel after the publication of US Durable Goods Orders data.

Support and resistance

In the medium term, the pair may go into a downward range and continue to fall to its lows. Now, GBP is under considerable pressure but USD is also weakening, which can form a broad sideways consolidation within 1.2760–1.2500. There are no drivers either for a significant recovery of GBP or to overcome the support levels and local lows of 1.2500, 1.2400.

On the 4-hour and daily charts, technical indicators confirm the transition to sideways movement. MACD volumes are decreasing, the signal line tends to the zero line, Bollinger bands are lined up horizontally.

Resistance levels: 1.2760, 1.2785, 1.2830, 1.3000.

Support levels: 1.2655, 1.2570, 1.2500, 1.2550, 1.2400, 1.2330.

Trading tips

Short positions can be opened from the current level with the target at 1.2500 and stop loss 1.2740.

No comments:

Write comments