EUR/USD: general analysis

19 June 2019, 12:22

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 1.1180 |

| Take Profit | 1.1130 |

| Stop Loss | 1.1210 |

| Key Levels | 1.1106, 1.1128, 1.1159, 1.1180, 1.1203, 1.1219, 1.1246, 1.1264, 1.1303, 1.1325, 1.1347 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.1250 |

| Take Profit | 1.1400 |

| Stop Loss | 1.1220 |

| Key Levels | 1.1106, 1.1128, 1.1159, 1.1180, 1.1203, 1.1219, 1.1246, 1.1264, 1.1303, 1.1325, 1.1347 |

Current trend

Yesterday, EUR fell significantly against USD, renewing the lows of June 3, after the speech of the ECB President Mario Draghi, who did not exclude the broad incentives if the economic situation continues to deteriorate, meaning both additional interest rate cuts and expansion of the quantitative easing program. EU data releases did not support the instrument. Investors were disappointed by German ZEW Economic Sentiment. In June, the indicator collapsed from –2.1 to –21.1 points, with a forecast of a decline to –5.9 points. EU ZEW Economic Sentiment fell from –18.6 to –20.2 points. The Eurozone consumer price index in May rose by 0.1% MoM and 1.2% YoY, slowing down from the previous 0.7% MoM and 1.7% YoY. Tuesday’s US statistic was ambiguous and did not have a significant impact on the dynamics of the pair. Housing Starts in May decreased by 0.9% but Building Permits increased by 0.3% against the previous month.

Today, the market is awaiting a decision by the US Federal Reserve on the interest rate at 20:00 (GMT+2) and subsequent comments by the regulator. In recent statements by Fed Chairman Jerome Powell, investors have seen indirect hints of easing monetary policy. Although the rate cuts were not directly mentioned, the refusal of two rate hikes in 2019 causes investors to have well-founded concerns.

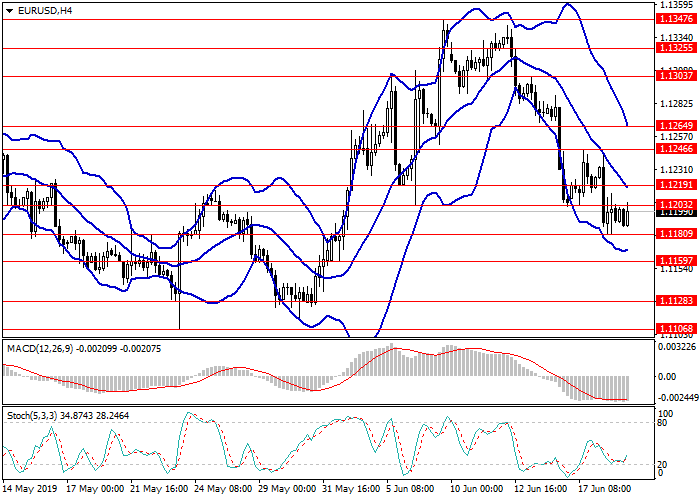

Support and resistance

Resistance levels: 1.1203, 1.1219, 1.1246, 1.1264, 1.1303, 1.1325, 1.1347.

Support levels: 1.1180, 1.1159, 1.1128, 1.1106.

Trading tips

Short positions can be opened from 1.1180 with the target at 1.1130 and stop loss 1.1210. Implementation period: 1–3 days.

Long positions can be opened from 1.1350 with the target at 1.1400 and stop loss 1.1320. Implementation period: 3–5 days.

Yesterday, EUR fell significantly against USD, renewing the lows of June 3, after the speech of the ECB President Mario Draghi, who did not exclude the broad incentives if the economic situation continues to deteriorate, meaning both additional interest rate cuts and expansion of the quantitative easing program. EU data releases did not support the instrument. Investors were disappointed by German ZEW Economic Sentiment. In June, the indicator collapsed from –2.1 to –21.1 points, with a forecast of a decline to –5.9 points. EU ZEW Economic Sentiment fell from –18.6 to –20.2 points. The Eurozone consumer price index in May rose by 0.1% MoM and 1.2% YoY, slowing down from the previous 0.7% MoM and 1.7% YoY. Tuesday’s US statistic was ambiguous and did not have a significant impact on the dynamics of the pair. Housing Starts in May decreased by 0.9% but Building Permits increased by 0.3% against the previous month.

Today, the market is awaiting a decision by the US Federal Reserve on the interest rate at 20:00 (GMT+2) and subsequent comments by the regulator. In recent statements by Fed Chairman Jerome Powell, investors have seen indirect hints of easing monetary policy. Although the rate cuts were not directly mentioned, the refusal of two rate hikes in 2019 causes investors to have well-founded concerns.

Support and resistance

Resistance levels: 1.1203, 1.1219, 1.1246, 1.1264, 1.1303, 1.1325, 1.1347.

Support levels: 1.1180, 1.1159, 1.1128, 1.1106.

Trading tips

Short positions can be opened from 1.1180 with the target at 1.1130 and stop loss 1.1210. Implementation period: 1–3 days.

Long positions can be opened from 1.1350 with the target at 1.1400 and stop loss 1.1320. Implementation period: 3–5 days.

No comments:

Write comments